Bitcoin ETF inflows reach $50B, fueling BTC’s climb and boosting Ethereum’s market momentum this July.

- 1 Introduction

- 2 What Does “Bitcoin ETF Inflows Reach $50B” Actually Mean?

- 3 Why Are Institutions Pouring In Now?

- 4 Bitcoin’s Price Reaction to $50B ETF Inflows

- 5 Ethereum: A Beneficiary of the Bitcoin ETF Momentum

- 6 Market Signals: What the Smart Money Is Doing

- 7 Long-Term Impact: Beyond July

- 8 Conclusion

- 9 Frequently Asked Questions (FAQs)

Introduction

July opens with a market-moving milestone: Bitcoin ETF inflows reach $50B, sending fresh shockwaves across the crypto space.

It’s not just a big number—it’s a bold statement from institutional investors doubling down on digital assets despite macro headwinds.

As Wall Street pours billions into Bitcoin, Ethereum is also riding the momentum, posting double-digit gains and renewed bullish sentiment.

Why does this matter? ETF inflows act as a confidence barometer. When large funds move into Bitcoin exchange-traded funds, it signals long-term conviction, often triggering a ripple effect across altcoins and on-chain metrics.

The fact that Bitcoin ETF inflows reach $50B in mid-2025 tells us something deeper: institutional adoption is not just back—it’s accelerating.

In this post, we’ll break down what’s fueling this ETF flood, how it’s impacting Bitcoin and Ethereum prices in July 2025, and what it might signal for the rest of Q3.

Whether you’re HODLing or hedging, understanding why Bitcoin ETF inflows reach $50B today could shape your portfolio tomorrow.

What Does “Bitcoin ETF Inflows Reach $50B” Actually Mean?

When we say “Bitcoin ETF inflows reach $50B,” we’re referring to the total amount of investor capital that has flowed into Bitcoin exchange-traded funds—financial vehicles that let people gain exposure to BTC without directly holding the asset.

In the crypto space, ETF inflows are a key metric of institutional sentiment. They show whether major players—pension funds, hedge funds, even retail investors—are increasing their exposure to Bitcoin.

To understand the weight of this $50 billion figure, it’s important to know how these ETFs function.

There are two primary types: spot ETFs and futures ETFs. Spot Bitcoin ETFs buy actual BTC on behalf of investors and hold it in cold storage.

These directly impact market supply and are generally seen as more bullish. Futures ETFs, on the other hand, track the price of Bitcoin via derivatives contracts. While useful, they don’t move physical BTC and often carry rollover costs.

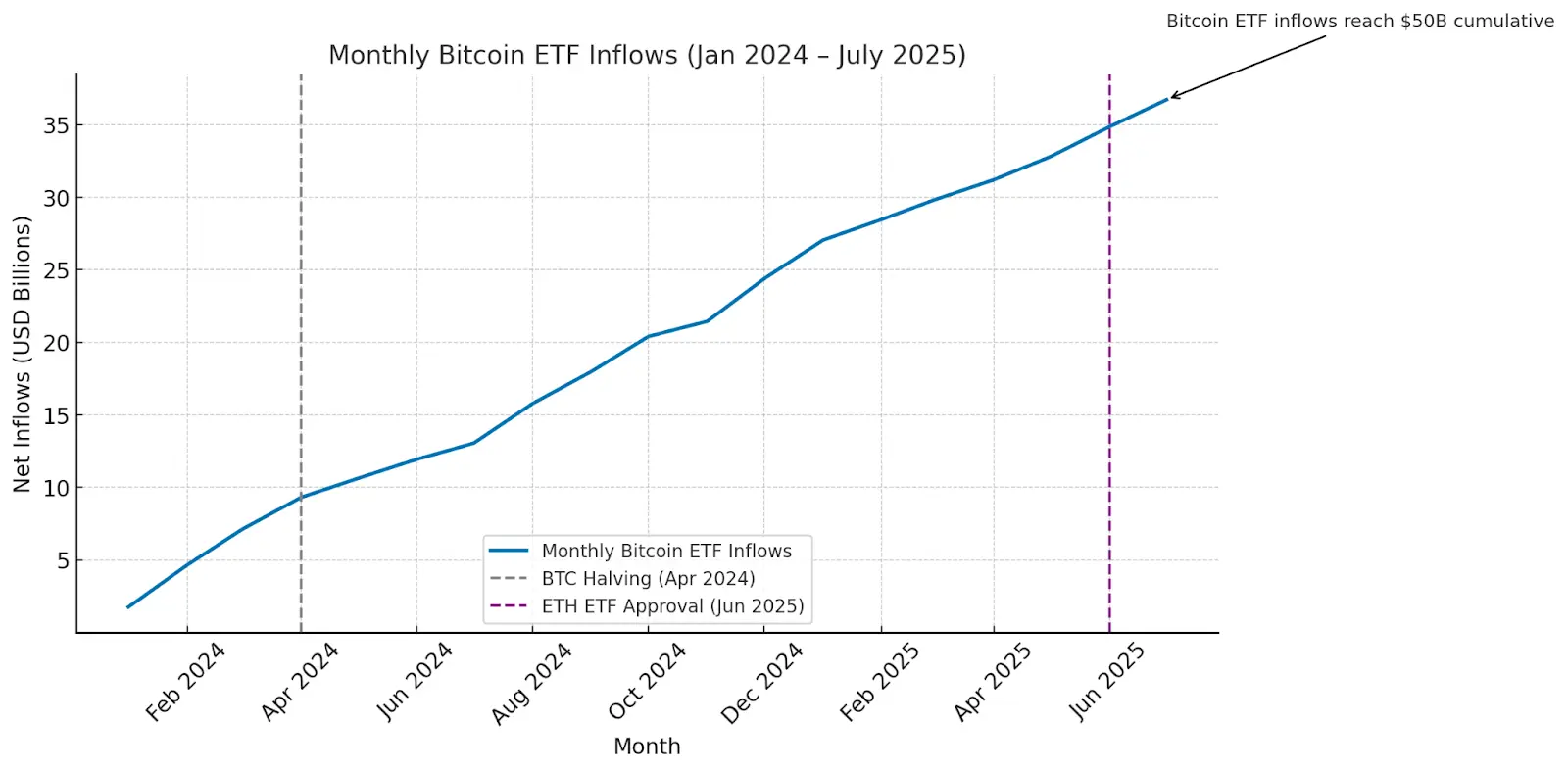

In July 2025 alone, Bitcoin ETF inflows reach $50B in cumulative terms, with nearly $4.2 billion added just this month.

BlackRock’s iShares Bitcoin Trust led the charge with over $1.6 billion in net inflows, followed closely by Fidelity’s Wise Origin Bitcoin Fund and Ark Invest’s 21Shares Bitcoin ETF.

Combined, these three have accounted for over 65% of July’s inflow surge, reinforcing the dominance of well-established issuers.

So when headlines scream “Bitcoin ETF inflows reach $50B,” they’re not just throwing around numbers. This influx represents real money, real market moves, and real investor conviction.

The flow of funds into spot Bitcoin ETFs, in particular, continues to exert upward pressure on BTC prices—and by extension, helps drive Ethereum and other correlated assets higher.

Why Are Institutions Pouring In Now?

The surge we’re seeing—where Bitcoin ETF inflows reach $50B—isn’t happening in a vacuum. Several converging macro and regulatory tailwinds are fueling this institutional gold rush into crypto.

First, the macro backdrop is unusually favorable. The Federal Reserve has held rates steady for three consecutive quarters, signaling a pause in tightening. Inflation continues to soften, with June’s CPI print coming in at just 2.1%, restoring investor appetite for risk assets.

Post-halving optimism is also playing a role—Bitcoin’s April 2024 halving tightened supply, and historically, such cycles have led to price acceleration in the months that follow.

Next, the risk-on appetite is fully back. Hedge funds and family offices are no longer just testing the crypto waters—they’re diving in. Many are treating Bitcoin as an alternative asset class, not unlike gold or real estate.

This diversification strategy is showing up in the numbers: as Bitcoin ETF inflows reach $50B, hedge fund allocations to digital assets have risen by over 30% compared to the same period last year. Multi-strategy funds are using ETFs to avoid custody headaches while gaining exposure to BTC’s asymmetric upside.

The third and perhaps most powerful catalyst? Regulatory clarity. The SEC’s recent approval of Ethereum spot ETFs in late June has removed a significant overhang. It’s a signal to the market that digital assets are no longer in regulatory limbo.

That comfort is rippling across institutional desks. Asset managers who were previously sidelined are now allocating capital. As a result, Bitcoin ETF inflows reach $50B and counting, driven by both fresh entries and scaled-up commitments from existing players.

This trifecta—macro stability, risk-on sentiment, and regulatory green lights explains why July 2025 is seeing record-setting ETF activity. Institutions aren’t just buying the dip; they’re buying the thesis.

Bitcoin’s Price Reaction to $50B ETF Inflows

The statement “Bitcoin ETF inflows reach $50B” isn’t just impressive—it’s market-moving. Bitcoin’s price surged past $75,000 in the first week of July, reclaiming levels last seen in late Q1.

This rally wasn’t built on hype alone. It came with strong technical confirmation and deeper structural support.

From a technical perspective, BTC broke out of its $68K–$72K consolidation range on high volume, flipping former resistance into support. Momentum indicators like RSI and MACD flashed bullish divergence in late June, preceding the breakout.

The breakout was clean, and daily candles have consistently closed above the 100-day moving average, suggesting institutional conviction rather than retail FOMO.

On-chain data backs this up. Dormant Bitcoin wallets—some inactive for over three years—have begun to stir. July has also seen a notable decline in BTC balances held on centralized exchanges, down nearly 5% compared to June.

This drop suggests reduced sell-side pressure, as investors move coins into cold storage—a behavior often associated with long-term confidence.

Again, this trend aligns with the broader context where Bitcoin ETF inflows reach $50B and institutions appear to be accumulating rather than flipping.

Derivatives markets are showing their own kind of excitement. Funding rates for perpetual futures have surged across major exchanges, indicating a strong long bias.

Open interest on CME Bitcoin futures hit a new year-to-date high, with institutional traders accounting for over 60% of total positions.

CME’s dominance in futures volume reflects growing preference for regulated crypto exposure, especially as Bitcoin ETF inflows reach $50B and institutions seek both spot and leveraged plays.

The combined picture is clear: price, behavior, and positioning are all pointing in the same direction. Bitcoin isn’t just reacting to ETF inflows—it’s being re-priced by them.

Ethereum: A Beneficiary of the Bitcoin ETF Momentum

While Bitcoin dominates the headlines, especially as Bitcoin ETF inflows reach $50B, Ethereum is quietly enjoying its own resurgence.

As capital flows into BTC spot ETFs reach historic levels, some of that liquidity is naturally spilling over into ETH, lifting its price above $4,000 for the first time since March.

The key catalyst? Spot ETH ETF approvals in late June. Their arrival brought long-anticipated clarity to Ethereum’s regulatory status.

In just two weeks, ETH spot ETFs have collectively drawn in over $870 million in net inflows. While that’s a fraction of what Bitcoin has pulled in, the pace and breadth of participation are significant.

Institutional desks that missed the early BTC wave are now rotating into ETH as the next best “blue chip” digital asset.

This growing confidence is stabilizing Ethereum’s standing in the market. The ETH/BTC ratio, which had been declining since February, has rebounded and is holding firm around 0.053.

That may seem technical, but it’s telling: Ethereum is regaining ground as the go-to altcoin for smart money, not just a beta trade on Bitcoin, but a foundational layer for tokenized finance, DeFi, and real-world asset protocols.

The broader narrative is clear. As Bitcoin ETF inflows reach $50B, they create a rising tide. And Ethereum, thanks to its own spot ETF tailwinds, is rising with it.

ETH may not yet be the institutional darling that BTC is, but July’s activity suggests it’s rapidly becoming a necessary part of the crypto allocation playbook.

Market Signals: What the Smart Money Is Doing

As Bitcoin ETF inflows reach $50B, the real story is in the behavior of the smart money. Wallet activity, rebalancing trends, and portfolio shifts all reveal one thing: institutions aren’t just testing crypto, they’re building around it.

First, let’s talk wallets. Blockchain analysts tracking Grayscale and BlackRock-linked addresses have observed notable activity since early July.

Grayscale’s primary custodian wallets have transferred over 8,000 BTC to cold storage vaults in the past two weeks, a strong signal that redemptions are low and holdings are being preserved long-term.

Meanwhile, BlackRock’s ETF-related wallets have added more than 3,400 BTC since July 1st, as demand surges.

This kind of accumulation confirms that when Bitcoin ETF inflows reach $50B, it’s not just churn—it’s strategic positioning.

Next, consider ETF rebalancing cycles. Most issuers operate on bi-weekly or monthly rebalancing schedules.

These periodic inflows and adjustments directly influence BTC and ETH liquidity on both spot and derivatives markets.

During July’s first rebalance window, BTC saw an injection of over $1.1 billion into spot ETFs, prompting sharp upward price action and tightening spreads. Ethereum benefited as well, with ETH ETFs absorbing $420 million in tandem.

When Bitcoin ETF inflows reach $50B, their ripple effect amplifies through scheduled portfolio adjustments, turning market-neutral strategies into directional tailwinds.

Perhaps most telling is the evolution in institutional portfolios. What was once a cautious 1% allocation to BTC is now trending toward 3–5% in diversified crypto exposure.

Sovereign wealth funds, insurance giants, and endowments are blending BTC and ETH into broader alternative asset strategies, treating them like digital versions of gold and tech stocks combined.

July’s allocation reports show a noticeable uptick in ETH allocations following the SEC’s green light, reinforcing the thesis that crypto is becoming a strategic, not speculative, play.

So, as Bitcoin ETF inflows reach $50B, the smart money isn’t waiting for the next dip—they’re already in position, building for a longer horizon.

Long-Term Impact: Beyond July

As Bitcoin ETF inflows reach $50B and counting, the big question is: what comes next? Are we witnessing a peak in institutional appetite, or just the beginning of a broader capital shift into crypto?

Forecasts from leading asset managers suggest momentum will continue.

Analysts at major firms expect Bitcoin ETF inflows to surpass $65B by the end of Q3 2025, driven by global pension funds, sovereign wealth entities, and private banks finally allocating to crypto.

Fidelity has hinted at expanding crypto coverage in its retirement products, while Bloomberg models show potential BTC price targets crossing $100,000 if current flows sustain into October.

These projections underscore a thesis gaining traction: that we’re entering a new regime of structured, long-term crypto exposure.

Ethereum, too, is part of that vision. With spot ETH ETFs now live and attracting steady inflows, ETH at $6,000 doesn’t seem far-fetched. If Bitcoin ETF inflows reach $50B and continue to climb, capital rotation into Ethereum and high-cap altcoins becomes a logical next step for portfolio diversification. Institutions increasingly see BTC as the digital store of value, and ETH as the programmable layer—both playing complementary roles in next-gen financial ecosystems.

But it’s not all smooth sailing. The very force that lifted prices—massive inflows—can also introduce volatility. Rebalancing events may trigger sharp short-term moves.

If price expectations run too hot, ETF overexposure could result in crowded trades or liquidity gaps.

Market fatigue is another concern: if Bitcoin ETF inflows reach $50B but fail to translate into new highs, some investors might reassess their positioning or pivot to AI and tech equities.

Still, the net effect is undeniable. Institutional crypto is no longer a fringe narrative; it’s a dominant trend.

July 2025 may be remembered as the moment when ETFs stopped being entry vehicles and started becoming the foundation of crypto’s next bull cycle.

Conclusion

As Bitcoin ETF inflows reach $50B, it’s clear we’re witnessing more than just a market headline—we’re watching a structural shift in how capital flows into crypto. This isn’t 2021’s meme-fueled mania. It’s measured, regulated, and capitalized by the world’s largest asset managers.

What makes this moment different is who’s buying. Retail may be cautiously optimistic, but institutions are allocating with conviction.

The FOMO now comes not from TikTok traders, but from CFOs and portfolio managers afraid of underperforming peers who already added crypto to their models. While retail may chase pumps, the smart money is steadily building positions, often through ETFs that quietly accumulate day by day.

So what’s next? If Bitcoin ETF inflows reach $50B today, tracking that figure tomorrow could be your edge. Whether you’re dollar-cost averaging or actively trading, it pays to follow the smart money.

Use tools like IntoTheBlock, Glassnode, or TradingView to monitor on-chain flows, ETF wallet movements, and liquidity metrics. Watch the trendlines, not just the headlines.

This may very well be Institutional Bull Phase 2.0, and those watching closely now could be the ones telling the story later.

Frequently Asked Questions (FAQs)

What are Bitcoin ETF inflows?

Bitcoin ETF inflows refer to the amount of capital entering Bitcoin exchange-traded funds, signaling investor demand and institutional confidence.

How do ETF inflows impact Bitcoin’s price?

High inflows reduce BTC supply on exchanges and increase demand, often leading to price appreciation, especially when Bitcoin ETF inflows reach $50B or more.

Which Bitcoin ETFs are leading in July 2025?

BlackRock, Fidelity, and Ark Invest lead July 2025, accounting for over 70% of total ETF inflows.

How are Ethereum ETFs performing after launch?

Ethereum ETFs have attracted over $870 million since their June launch, boosting ETH’s price above $4,000.

Will Bitcoin ETFs push BTC to $100K?

If inflows continue rising and macro conditions hold, Bitcoin ETF-driven demand could help BTC break $100,000 in Q3 or Q4 2025.