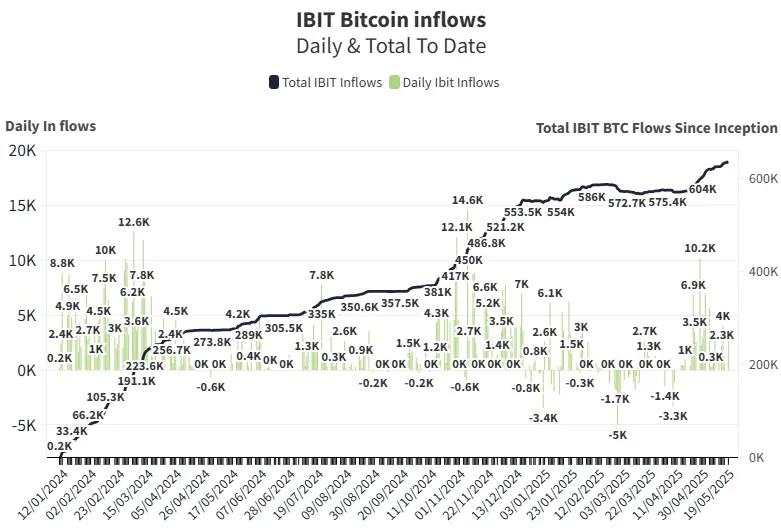

Spot Bitcoin ETFs saw $667M inflows Monday, with BlackRock’s IBIT adding 2,910 BTC, signaling rising investor confidence.

On Monday, the dollar volume of inflows into spot Bitcoin ETFs increased once more, reaching $667 million.

The inflow was primarily driven by BlackRock’s iShares Bitcoin Trust (IBIT), with substantial contributions from Ark Invest’s ARKB and Fidelity’s FBTC.

Today, the price of Bitcoin has experienced a significant 3% rebound, trading above the $105,565 mark.

Additionally, the ‘golden cross’ pattern formation is evident in technical charts, contributing to a robust bullish sentiment.

Again, BlackRock Leads Spot Bitcoin ETF Inflows

BlackRock’s IBIT contributed $306 million in inflows to BTC ETFs on Monday, recording net inflows of $667 million.

A market analyst, Nate Geraci, reported that IBIT has accounted for a significant portion of the inflows recorded on 23 of the last 24 trading days.

The ETF has attracted approximately $6.5 billion in new investments, which indicates the high confidence level in Bitcoin’s future.

The fund has received an additional $1.1 billion in the last four trading days.

BlackRock Bitcoin ETF IBIT acquired 2910 Bitcoin on Monday, bringing its total holdings to 636,000 BTC.

However, data from Farside Investors indicates that Fidelity Bitcoin ETF (FBTC) and Ark Invest’s ARKB also made substantial contributions on Monday, with $188 million and $155 million in inflows, respectively.

The recent ETF inflows have occurred in the context of a robust increase in the price of Bitcoin, which is currently trading at an additional 3% higher level today.

Bulls are pursuing new all-time highs.

Bitcoin Eyes Golden Cross For Bullish Breakout

Bitcoin’s price has resumed its upward trajectory, surpassing $105,000 and gaining 3% after a week of consolidation.

Furthermore, the Coinglass data indicates that the open interest has increased by 7% to $73 billion, and 24-hour short liquidations have increased to $45 million.

Benjamin Cowen, a renowned crypto analyst, has emphasized the imminent “golden cross” for Bitcoin, which is anticipated to occur shortly.

This underscores the potential for a robust bullish rally shortly.

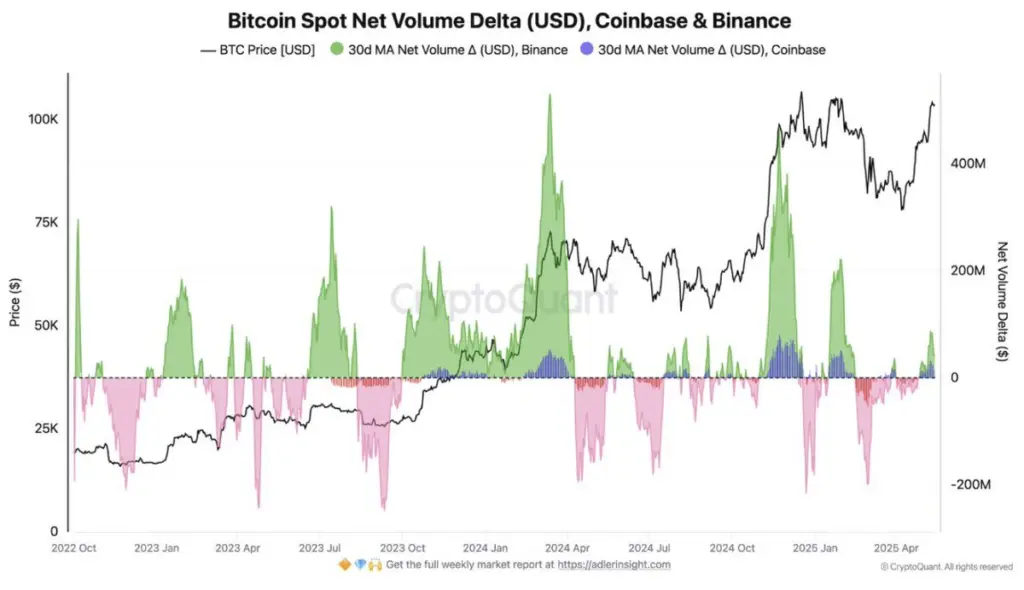

Additionally, the Bitcoin spot net volume delta (USD) on Binance has experienced a positive shift, as the data analytics firm CryptoQuant reported.

This shift suggests a resurgence in purchasing activity in the spot markets.

This development is indicative of a decrease in the amount of selling pressure, as per CryptoQuant.

The prospective bullish indicator for Bitcoin’s short-term price movement is the renewed interest in spot purchases.

Moody’s last week downgraded the U.S. credit rating, underscoring the nation’s economic vulnerabilities and escalating debt obligations.

Consequently, Bitcoin is demonstrating greater resilience.