Bitcoin ETFs have experienced substantial outflows totaling $228.2 million, with BlackRock’s IBIT ETF as an exception.

Yesterday, Farside Investors’ most recent monitoring data indicated a substantial net outflow of US$226.2 million from the US Bitcoin spot ETF market. This considerable change suggests that investors’ perspectives are evolving.

BlackRock’s IBIT ETF was the sole fund to garner new investments, reporting a net inflow of US$18.2 million even though most funds experienced outflows. This development demonstrates the diverse investor sentiments toward various Bitcoin ETFs in a tumultuous market, emphasizing that investors view not all funds equally.

Detailed ETF Performance and Regulatory Insights

Yesterday, there were substantial fluctuations in the cryptocurrency market concerning bitcoin exchange-traded funds (ETFs) in the United States. In total, 11 spot bitcoin ETFs reported substantial outflows aggregating $226.21 million.

According to data from Farside Investors, Fidelity’s FBTC, I experienced its second-largest single-day outflow since its inception, valued at an astounding $106.4 million. This was one of the most significant losses. Net outflows of $61.5 million were also observed in Grayscale’s well-known GBTC fund.

Ark Invest and 21Shares’ ARKB were among the other significant players that experienced pressure, with $52.7 million exiting the market. Bitwise and VanEck experienced approximately $10 million in losses in their respective funds. Invesco and Galaxy Digital’s BTCO experienced smaller outflows, totaling $2.7 million.

BlackRock’s IBIT, the most prominent spot bitcoin fund by net asset value, defied the trend. In reality, it generated $18.2 million in new investments. Despite yesterday’s outflows, these 11 funds have collectively accumulated $15.30 billion in net inflows since their inception in January.

Bitcoin Price Trends and Market Dynamics

Bitcoin has been experiencing a recent period of volatility. It appeared to be on the brink of surpassing $72,000 just last week; however, it could not exceed that threshold. Instead, the price has been declining, with a nearly 6.5% decrease in the past seven days.

Nevertheless, the situation could be more manageable. The data analysts at Santiment have observed a significant increase in customer interest following Bitcoin’s decline below $67,000 on Thursday.

This is the second-largest surge in purchasing interest in the past two months. Conversely, there does not appear to be significant selling pressure accumulating.

The significant actors also continue to accumulate assets. The number of whales possessing over 1,000 BTC has reached an all-time high as institutional investors continue to invest even though the miners have been cashing out in more significant quantities to fund their operating expenses following the halving event.

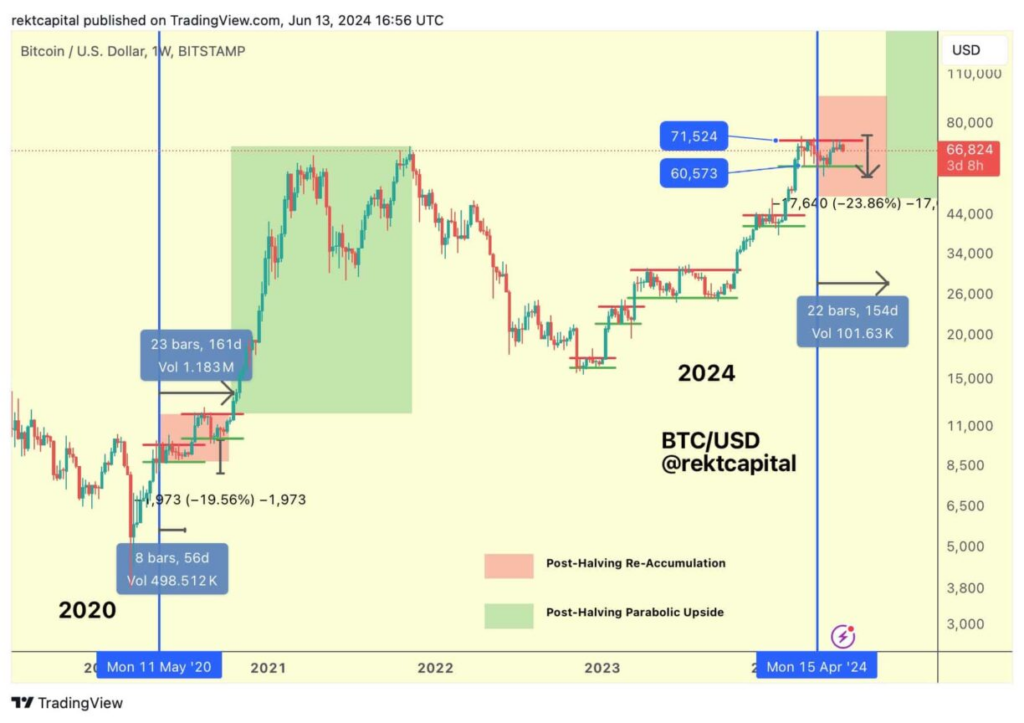

According to the analysis specialist Rekt Capital, this period of Bitcoin’s failure to decisively break out could benefit the longer market cycle. After a halving, Bitcoin has never made such a significant move so early in history, according to him.

Bitcoin is currently trading at approximately $67,059. In the previous 24 hours, the cryptocurrency has been exchanged for more than $26 billion. It has generally decreased by approximately 0.77% daily, fluctuating between $67,141 and $66,539.

With a market capitalization that remains at $1.3 trillion. Despite recent turbulence, some promising signals for Bitcoin’s long-term trajectory have emerged based on historical patterns and whale accumulation.