Bitcoin’s price rally near $90K in early November drove major inflows into U.S. Bitcoin ETFs, with investors boosting their exposure.

A huge inflow of money into spot Bitcoin exchange-traded funds (ETFs) occurred in the United States as a result of Bitcoin’s price spike to almost $90,000 in early November.

Bitcoin started a bull run on November 6 that saw its price skyrocketing from $69,000 to almost $90,000 in only seven days.

Both individual and institutional investors increased their exposure to Bitcoin as a result of the price boom, which was fueled by good market mood and FOMO.

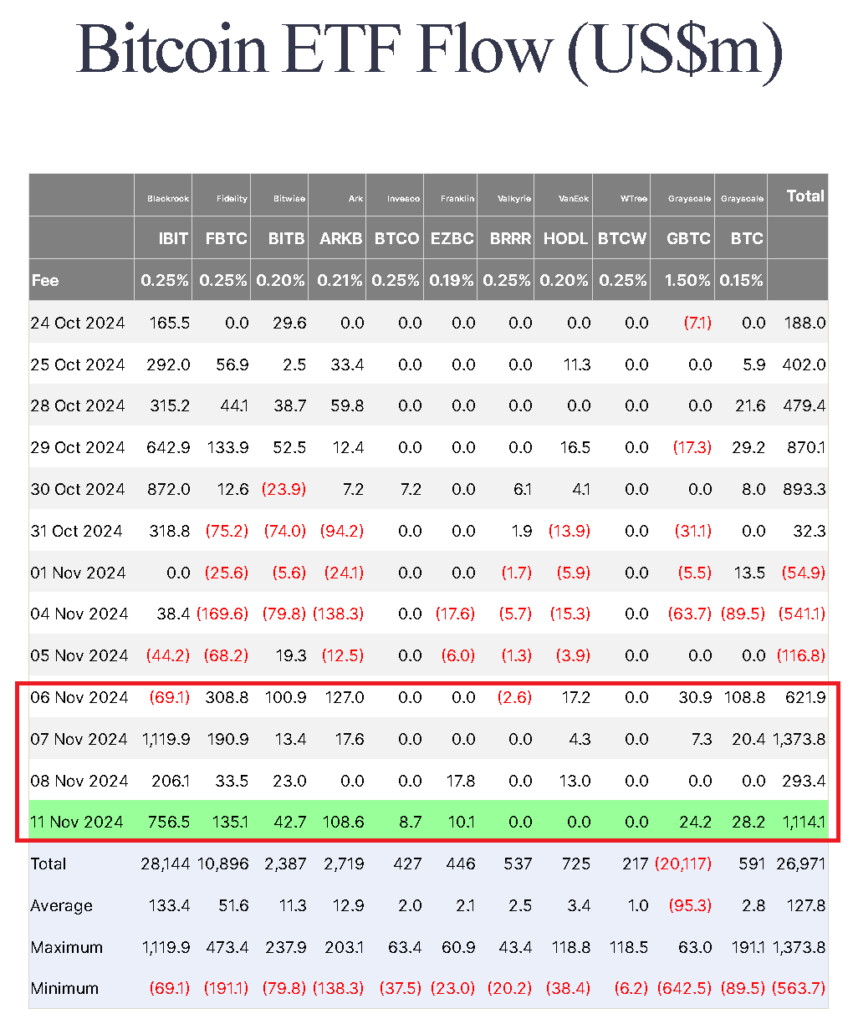

According to statistics gathered by Farside Investors, investments into spot Bitcoin ETFs in the US for the week of November 6–11 totaled $2.6 billion.

Bitcoin Bull Run Attracted Investors From All ETF Providers

BlackRock’s iShares Bitcoin Trust attracted the largest investments throughout the period, totaling over $2 billion, out of the 11 top Bitcoin ETFs in the US.

With inflows of $668.3 million, $180 million, and $253.2 million, respectively, the Bitwise Bitcoin ETF, ARK 21Shares Bitcoin ETF, and Fidelity’s Wise Origin Bitcoin Fund are other well-known ETFs that helped drive the weekly inflows.

Grayscale Captures Uncommon String of Positive Input

Furthermore, during the Bitcoin boom, the Grayscale Bitcoin Trust—which is notorious for having contributed $20 billion in withdrawals from the ETF ecosystem—saw net positive inflows.

Farside Investors reports that since November 6, Grayscale’s Bitcoin ETFs, GBTC and BTC, have generated a total of $219.8 million.

Positive investor optimism permeated the ecosystem of spot Ether ETFs. The US spot Ether ETFs saw their largest daily inflows since their July inception on November 11.

On November 11, the spot Ether ETFs saw inflows of $294.9 million, shattering the previous record of $106.6 million on the day of introduction.

In a message to Cointelegraph, cryptocurrency analyst Rachael Lucas of BTC Markets stated, “Ethereum is beginning to catch a bid after being a laggard for the majority of this cycle.”