The approval of Bitcoin ETFs has boosted the capital inflow from TradFi, as traditional investors view Bitcoin as a retirement investment product.

Establishing spot Bitcoin exchange-traded funds (ETFs) in the United States has furnished a crucial means for conventional finance to transfer capital.

According to David Princay, president of Binance France, the U.S. Spots Bitcoin ETFs are the first vehicles enabling institutions to engage in Bitcoin easily.

Exclusively to Cointelegraph, Princay stated:

“Before [ETFs] institutions had an excuse: we want to expose our retail investors to Bitcoin but we don’t know how which products and there’s not enough trust etc. The arrival of ETFs created a vehicle for institutions to integrate those kinds of products into traditional offers.”

Large financial institutions in Europe were unable to invest in Bitcoin before the approval of ETFs; this has since changed, per Princay:

“Before, it was impossible for a bank in France to invest in Bitcoin…”

During the initial quarter of 2024, BNP Paribas, the second-largest European bank, invested in BlackRock’s spot Bitcoin ETF. While the initial investment amounted to a mere $41,684, equivalent to a single Bitcoin, Princay characterized the investment predominantly as “symbolic.”

ETFs made Bitcoin a tool for retirement

The introduction of spot Bitcoin ETFs has led to a growing perception among mainstream investors that Bitcoin can be a viable retirement investment.

Prince of Binance France elaborated:

“Before it was only the early adopters that considered that Bitcoin would be a tool for their retirement. And now everyone is considering having 1%, 2%, or maybe 5% of their 401(k) in Bitcoin.”

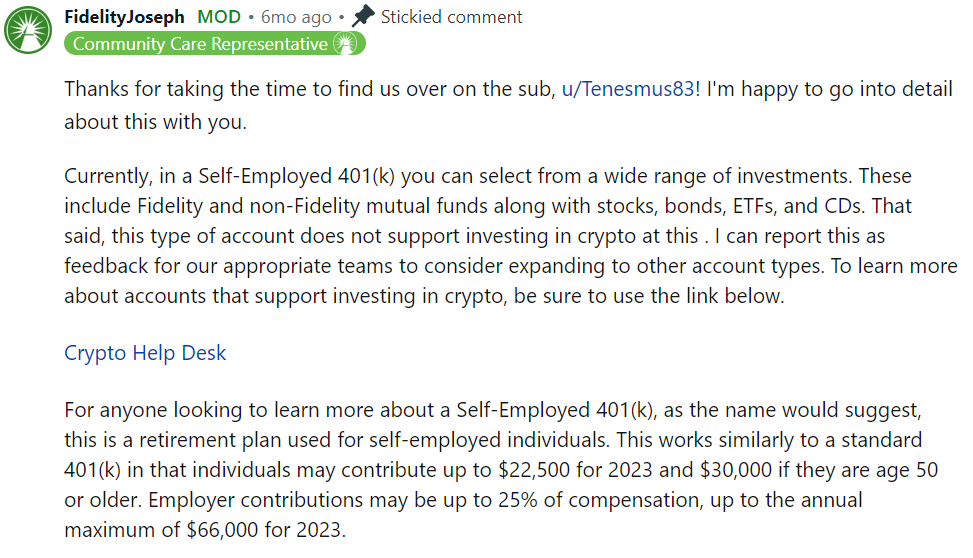

Certain prominent financial institutions, such as Fidelity, provide 401(k) retirement plans through which investors can acquire direct exposure to Bitcoin ETFs. Additionally, it is the largest 401(k) plan provider in the United States.

Additionally, these investments provide Princay with long-term capital, which has the potential to mitigate volatility.

“401k is not the traditional trading like buying and selling every day. It’s not a daily trading activity. It’s a long-term activity… Bitcoin may become one of the preferred assets inside the 401(k) in terms of safety.”

Fortunately, the majority of Bitcoin ETF holders are still retail investors.

Despite assurances that it will attract more senior boomers to Bitcoin, retail investors hold more than 85 percent of the underlying BTC, while hedge funds have only 10 percent.

Nevertheless, this is consistent with the expected progression of recently introduced trading products, given that retail investors hold the majority of global capital.

Furthermore, this includes TradFi retail investors as well as crypto retail investors who previously held BTC in a cold wallet, according to Princay:

“It’s retail, but at the same time, it’s not the retail that we are used to speaking about. This means that ETF went into a lot of traditional finance products owned by retail people… So the 401(k)is a retail product, but to have access to Bitcoin inside 401(K), you have to have the institutions that open the door.”

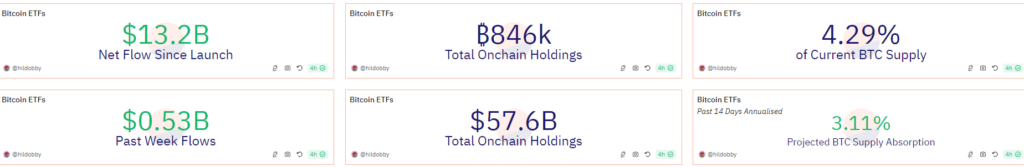

Since their inception, U.S. spot Bitcoin ETFs have assimilated 4.29 percent of Bitcoin’s supply, per Dune.