CoinShares data reveals that spot Bitcoin ETFs saw $3.12 billion in inflows between Nov. 18 and 22.

Weekly inflows into US-based spot Bitcoin exchange-traded funds (ETFs) have hit a new high, indicating sustained investor fervor during Bitcoin’s meteoric rise.

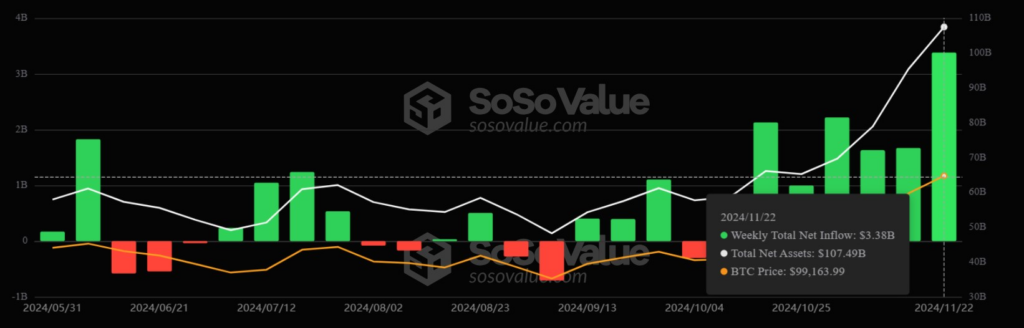

According to cryptocurrency tracking site SoSoValue, net inflows into spot Bitcoin ETFs for the week of November 18–22 totaled $3.38 billion, a 102% rise over the $1.67 billion inflow the week before.

The number reflects the biggest weekly inflows for spot Bitcoin ETFs that have been documented.

According to SoSoValue, it is also the eighth week in a row that flows have been positive.

With net assets of $48.95 billion as of November 22 and cumulative inflows of $31.33 billion, BlackRock’s iShares Bitcoin Trust (IBIT) continues to lead the field.

In the meantime, since its inception, the Grayscale Bitcoin Trust ETF has experienced withdrawals totaling more than $20 billion, even though it has $21.61 billion in net assets.

To Date, Digital Asset Products Have Generated $37 Billion

Data from CoinShares, a cryptocurrency investing firm, shows that digital asset investment products have already generated $37 billion in inflows so far this year.

The Bitcoin ETFs were the main source of ETF inflows, which had already surpassed the initial influx of gold ETFs, which only brought in $309 million during their first year of operation.

According to CoinShares, outflows from nations like Germany, Sweden, and Switzerland counterbalanced the inflows into the US.

CoinShares claims that rather than doubling down on bets, the recent peak in the price of bitcoin was viewed as an opportunity to take profits.

According to CoinShares data, weekly inflows into Bitcoin ETFs total $3.12 billion.

Additionally, $10 million was invested in short-bitcoin products, suggesting that some investors are protecting themselves against possible downside risk.

The combined confidence of the Australian, Canadian, and Hong Kong markets resulted in inflows of about $70 million.

Bitcoin Reaches Record High Of $99,655

The rise in weekly inflows coincides with Bitcoin setting a new record high before a minor drop.

According to data from Cointelegraph Markets Pro, Bitcoin reached a new price high of $99,655.50 on November 22.

Despite this, the cryptocurrency asset failed to reach $100,000, a highly anticipated milestone for the community.

At the moment, the asset is worth $98,459.95.