Bitcoin ETFs have seen outflows of $1.3 Bitcoin in the last two weeks of trading, but analysts expect markets to rally higher in the coming months.

The price of Bitcoin has continued to decline, resulting in outflows of $1.3 billion from United States spot Bitcoin exchange-traded funds (ETFs) over the past two weeks.

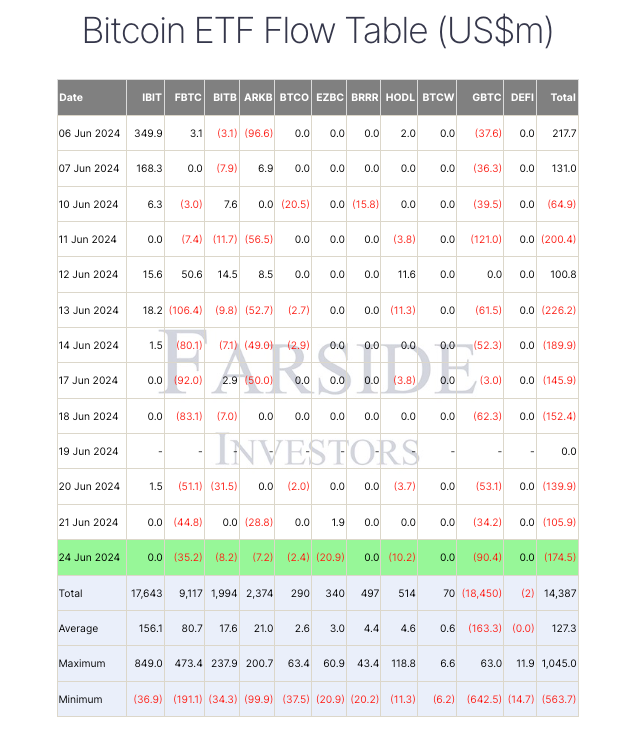

The total outflow for Bitcoin ETFs over the last two trading weeks was $1.298 billion. According to data from Farside Investors, Grayscale led the way with $517.3 million in outflows during the same period.

It is worth noting that BlackRock’s Bitcoin ETF has been the sole fund to generate positive results in the past two weeks, receiving $43.1 million in inflows.

During the same period, the price of Bitcoin fluctuated.

As per TradingView data, the value has decreased by 11.6%, from $69,476 on June 10 to $61,359 at the time of publication.

The most severe outflows in the spot Bitcoin ETFs have occurred since April, when the BTC investment vehicles experienced total net outflows eclipsing $1.2 billion from April 24 to the beginning of May.

Jonathan de Wet, the chief investment officer at ZeroCap, stated to Cointelegraph that the price of Bitcoin is expected to decline to its “key support” level of approximately $57,000 in the coming weeks as a result of the ongoing creditor repayments at Mt. Gox. He also stated that the bleed across the broader crypto market is continuing.

“BTC and ETH are actually maintaining a surprisingly strong performance in comparison to the rest of the market, with key support at 63,000 and 3,400, respectively, and are still clearly within the price range that has been in place for the past few months,” de Wet stated.

Numerous market analysts have expressed their apprehension regarding the impending substantial downward pressure. This results from Bitcoin sales by the German government and nearly $9 billion in BTC Mt. Gox creditor repayments anticipated to be released in July.

De Wet maintains an optimistic outlook for the long term, even though Bitcoin and other cryptocurrencies are expected to experience further declines in the upcoming week due to selling pressure from Mt. Gox creditor repayments.

“Medium to long-term we are constructive given the ETH ETF launch expected easing bias toward the end of 2024 […] before actual easing in 2025.”

According to numerous analysts, the impact of the Mt. Gox creditor repayments may be milder than initially thought.

Farhan Badami, a market analyst at eToro, stated to Cointelegraph that Bitcoin is frequently priced in response to significant market events and can be regarded as “forward-looking.”

Badami is anticipating that the price of Bitcoin will stabilize in the upcoming weeks and subsequently rise to new all-time highs in the coming months.

“Within the next few weeks, it’s possible we will be range-bound between $60-70K USD.”