CEO of Bianco Research, Jim Bianco, said increased adoption of ETFs will require the next Bitcoin halving in 2028 and substantial on-chain tool development.

Before becoming an “instrument of adoption” rather than a “small tourist tool,” bitcoin exchange-traded funds (ETFs), which debuted in the US early this year, would require additional time, according to a former Wall Street analyst.

Spot Bitcoin ETFs (BTC$54,863ETFs) have not lived up to the pre-approval hoopla since they opened for trading in January, according to Jim Bianco, CEO of analytics firm Bianco Research, who made this statement in a Sept. 8 X post.

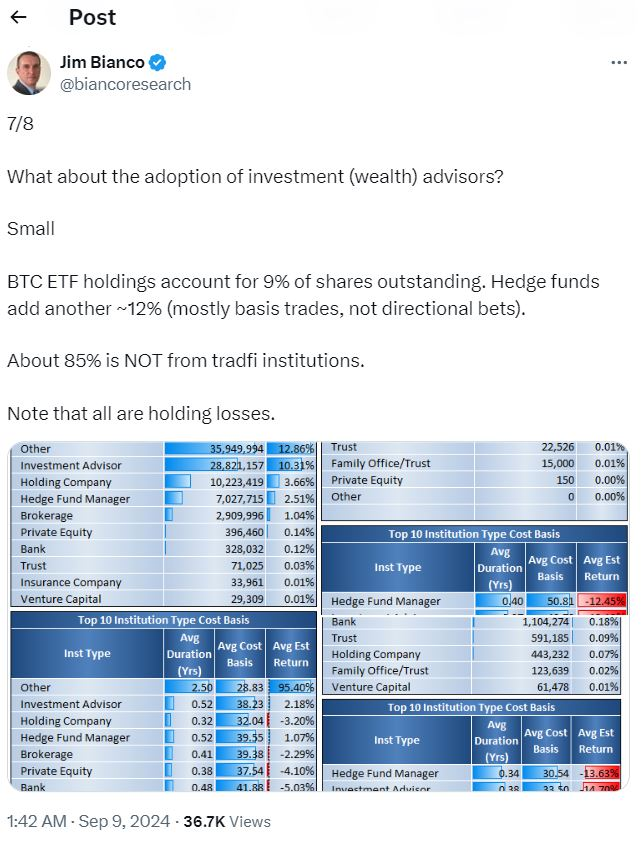

According to him, the Bitcoin ETF market may require more time to develop because of recent outflows, individuals losing money on their holdings, and a shortage of significant institutional participation.

“Build it, and the boomer will come was never a thing,'” he stated, citing the first eight months of Spot BTC trading as evidence.

Data from Farside Investors indicates that there have been net withdrawals of more than $1 billion in the last eight trading days from the 11 US BTC ETFs. The assets under management in the spot Bitcoin ETF market are currently at about $48 billion, having peaked in March at $61 billion.

According to Bianco, most ETF inflows were from “onchain holders moving back to Trad-fi accounts,” meaning that “very little new money has entered the crypto space.”

About 80% of Bitcoin ETF purchases have probably been made through self-directed online accounts, according to Samara Cohen, chief investment officer of BlackRock’s ETF and Index Investments. Cohen made this statement in June.

According to Bianco, before the market takes off, there will probably need to be another Bitcoin halving in 2028 and a “significant development of onchain tools.”

“First, we need development breakthroughs and patience throughout a few more seasons, including one or two winters,” he continued.

Other commentators

Only some people concur with Bianco’s evaluation. After eight months, the BTC ETFs had billions of assets under management, according to a Sept. 8 X post by Eric Balchunas, senior ETF analyst at Bloomberg.

What term should characterize an ETF with assets of $7 million if IBIT, with its roughly $20 billion in assets, is deemed a failure? He stated.

BlackRock’s iShares Bitcoin Trust (IBIT), which has received inflows totaling over $20 billion, is the most popular of the top four Bitcoin ETFs in the US.

With about $10 billion, there is the Fidelity Wise Origin Bitcoin Fund (FBTC). The net inflows for Bitwise BTC ETF Trust (BITB) and ARK 21Shares Bitcoin ETF (ARKB) total almost $2 billion.

In contrast, another cryptocurrency analyst, Bryan Ross, stated, “If most ETF trades are NOT institutional, this means institutions aren’t even here yet, and we could see massive institutional inflows next time FOMO and greed show up.” Ross disagreed with Bianco.