Bitcoin and Ether options worth $2.4 Billion expire on May 3rd and may lead to volatility.

The expiration of Bitcoin and Ether options contracts on May 3rd is valued at a combined $2.4 billion, potentially resulting in heightened market volatility.

By utilizing Bitcoin options contracts, which are derivatives, investors can speculate on Bitcoin’s price movements without actually holding Bitcoin.

Options can be classified as either call or put. Call options grant purchasers the privilege to acquire a cryptocurrency at a designated price before a specified date. Conversely, put options allow investors to divest a cryptocurrency at a specified price before the option expires.

Investors frequently employ the put-to-call ratio to gauge the market’s overall condition. Traders’ purchases of puts over calls are regarded as a bearish indicator, whereas purchasing calls over puts indicates favorable market sentiment.

A put-to-call ratio falling below 0.7 indicates bullish sentiment, whereas a ratio exceeding 1 signifies adverse sentiment.

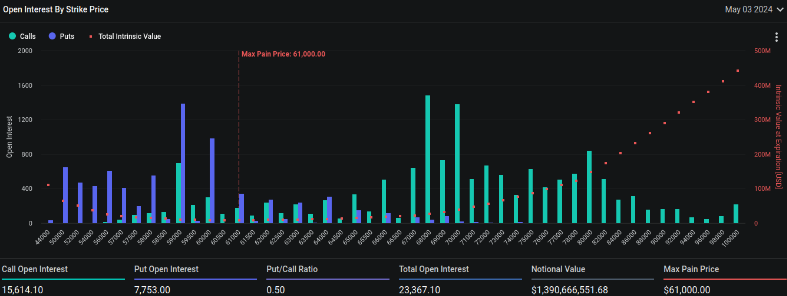

The expiration of 23,367 Bitcoin contracts, valued at $1.39 billion, is scheduled for May 3. The present put-to-call ratio for Bitcoin options contracts is 0.5, with a maximum pain point of $61,000, according to data from the Deribit exchange. The price at which the most significant number of holders will incur financial losses is the utmost pain point.

On Friday, an equivalent number of 334,248 Ether contracts, valued at a notional sum of $1 billion, are anticipated to reach their expiration. At $3,000, these expiring contracts have a maximal pain point and a put-to-call ratio of 0.37.

The current cryptocurrency market has traditionally experienced brief price volatility after the expiration of options contracts. Bearish pressure has been exerted on Bitcoin and Ether over the past few weeks.

The price of Bitcoin fell below $60,000, signifying a weekly correction of nearly 20% following the halving. Likewise, the price of Ether dipped below $2,900. Frequently, the cryptocurrency market recovers from volatility caused by options within days of expiration.