Institutional interest in Bitcoin, Ethereum, and XRP has decreased, according to CoinShares. Inflows have declined from $2.2 billion to $1.9 billion.

Institutional interest in Bitcoin, Ethereum, and XRP has experienced a substantial decline. The community is left to ponder what lies ahead as US President Donald Trump has reiterated his commitment to establishing the United States as the global crypto capital. This sentiment is reflected in the prices of these assets. Additionally, BlackRock’s iShares ETFs have experienced consistent growth, with inflows reaching $1.45 billion within a week.

Bitcoin, Ethereum, and XRP Experience a Decline in Institutional Interest

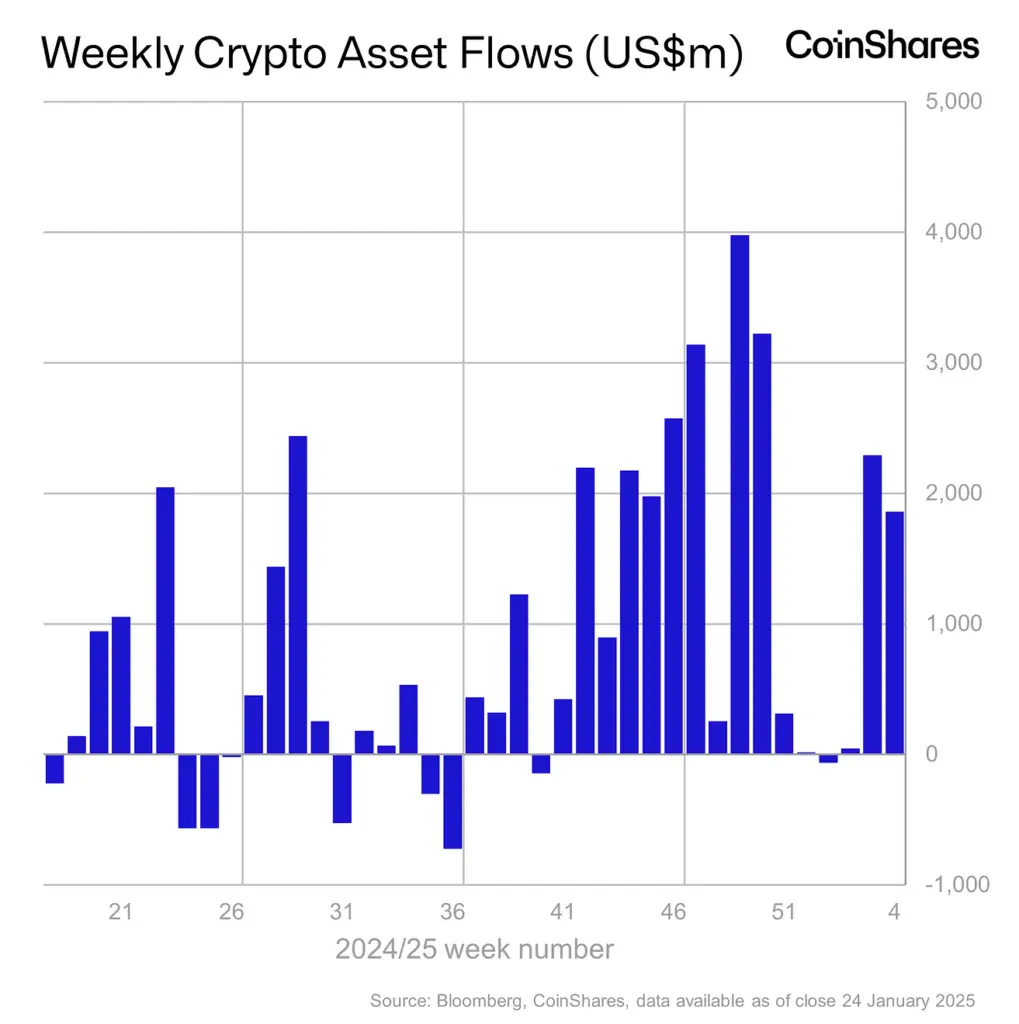

Bitcoin, Ethereum, and XRP experienced a substantial decline in inflows last week, as indicated by a report from CoinShares. It suggests a decrease in institutional investors’ interest. Inflows into digital assets have decreased from $2.2 billion in the previous week to $1.9 billion.

Nevertheless, the transaction volume remained consistently high, with $25 billion recorded during the week. The quantity is believed to have fluctuated in response to the Presidential executive order establishing a strategic digital asset stockpile in the United States. AltcoinsAltcoins, including Ethereum (ETH), XRP, and Hedera (HBAR), may be included.

A boost rooted in the proposal of an executive order that seeks to develop a National Digital Asset Stockpile is the $4.8 billion Year-to-Date inflow. It has incited bullish sentiments in the crypto market and is gathering additional momentum as Donald Trump has reiterated his dedication to establishing the United States as a crypto capital.

Over a week, Bitcoin’s inflows have decreased from $1.9 billion to $1.6 billion. Similarly, Ethereum’s inflows have declined from $246 million to $205 million. Inflows into XRP have decreased from $31 million to $18.5 million.

Inflows of Digital Assets by Provider

The iShares ETFs are currently at the top of the chart, with an inflow of $1.4 billion, bringing their year-to-date flows to $2.9 billion and an AUM of $64.6 billion. It was succeeded by Ark 21 Shares and Fidelity ETFs, which received inflows of $173 million and $202 million, respectively. Four providers recorded a weekly outflow.

- Grayscale Investments documented an outflow of $124 million.

- An outflow of $19 million was observed in Bitwise ETFs.

- An outflow of $14 million was observed in CoinShares XBT.

- The Volatility Shares Trust registered an outflow of $17 million.

The MTD flows of other providers reached $92 million, with an AUM of over $33 billion due to a weekly inflow of $180 million. Additionally, the United States experienced the highest inflows among significant countries, with an inward movement of $1.7 billion. Sweden is the sole region to have experienced an outflow of $5.7 million.

Price Decline of Bitcoin, Ethereum, and XRP

The global crypto market has experienced a significant decline today due to various factors, such as the FOMC Meeting, China’s DeepSeek AI model, and other concerns.

In the past 24 hours, the price of Bitcoin (BTC) has declined by 5.66%, resulting in a decline below the $100,000 threshold. Bitcoin is currently trading at $98,738.10. BitMEX co-founder Arthur Hayes anticipated a decline to $75K, followed by a subsequent rebound to a new all-time high.

In the interim, the price of XRP has declined by 11.15% to $2.77, and it may decrease to $2. Ripple’s native token is not expected to experience such a significant decline, according to industry experts.

ETH has experienced a 7.55% decline in the past 24 hours and is currently trading at $3,050. Additionally, it discloses a decrease of 9.44% in the previous seven days and 8.60% in the last month.