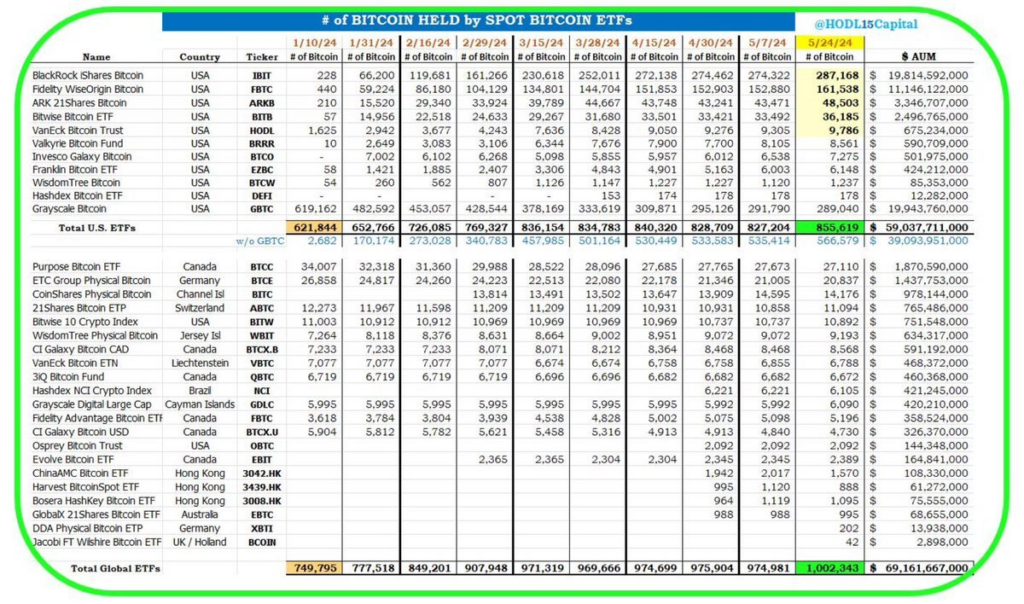

The collective total held by all Bitcoin ETFs globally is now over 1 million BTC, which is worth almost $68 billion.

Global holdings of Bitcoin BTC tickers down $67,804 have surpassed one million in exchange-traded products—investment vehicles that track the price or provide exposure to BTC.

Eleven spot Bitcoin ETFs have absorbed 855,619 since their introduction in the United States in mid-January, accumulating an average of 6,200 BTC daily.

Twenty-one additional Bitcoin exchange-traded products, available in Canada, Germany, Brazil, and other nations, bring the total amount of Bitcoin held to 1,002,343 BTC, which is estimated to be worth $68 billion, according to data shared by HODL15Capital.

According to CoinGecko, this represents 5.08% of the current circulating supply of coins, which is 19,704,484.

At the time, GBTC from Grayscale remained the largest fund holding the asset, with 289,040 coins valued at approximately $19.9 billion.

BlackRock’s iShares Bitcoin Trust (IBIT), which has 287,168 BTC worth approximately $19.8 billion and may surpass it this week if inflows remain consistent and GBTC continues to outflow, is gaining ground swiftly.

Grayscale has lost approximately 330,960 BTC, or 53% of its previous holdings, since mid-January, when GBTC was converted into a spot ETF.

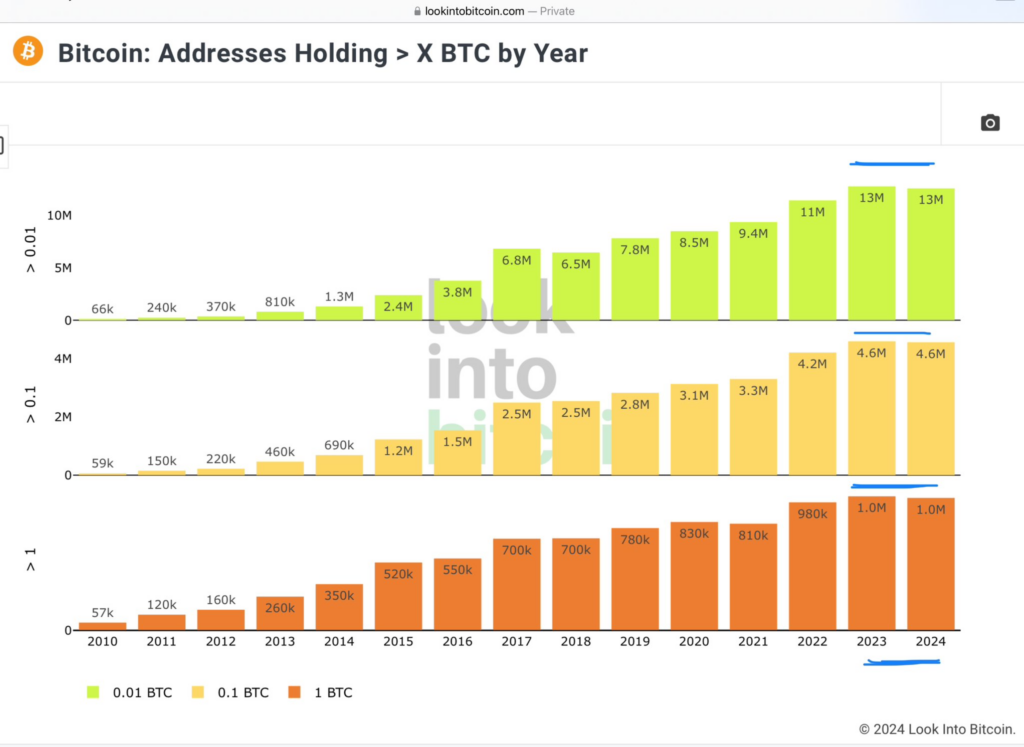

HODL15Capital raised the inquiry on X on May 28th regarding whether the ETFs were impeding the development of Bitcoin held in self-custody.

A chart illustrating the quantity of Bitcoin (BTC) held at different addresses indicates that self-custody stayed the same between 2023 and 2024.

The chart indicates no growth between 2017 and 2018, nonetheless.

It is considered one million addresses contain one BTC or more, as reported by LookIntoBitcoin.