Bitcoin exchanges have hit historic lows, indicating a supply crunch as on-chain data shows rapid inventory depletion.

As on-chain data indicates a rapid depletion of available inventory, bitcoin balances on crypto exchanges have reached historic lows.

The trend was recently underscored by a significant decrease in the quantity of Bitcoin available for purchase, as noted in a note from 10X Research on Sunday.

According to the report, this is in stark contrast to the trends that were observed in late summer, when an abrupt inflow temporarily replenished exchange reserves.

However, the supply shortage has been further exacerbated by the absence of such an inventory boost this time.

According to analysts, the broader crypto market and Bitcoin have been supported by favorable catalysts that indicate that growth will continue in the upcoming year.

President-elect Donald Trump has pledged to safeguard crypto mining interests and develop favorable industry policies, in addition to establishing a Bitcoin reserve in the United States.

This has contributed to the asset’s transformation into a store of value in the minds of investors and has driven Bitcoin’s price to record highs just below $100,000.

The on-chain analytics indicate that long-term holders, who are frequently perceived as a stabilizing factor in the market, are firmly maintaining their positions, thereby restricting the flow of Bitcoin into exchanges and decreasing liquidity.

Bitcoin Exchange Charts

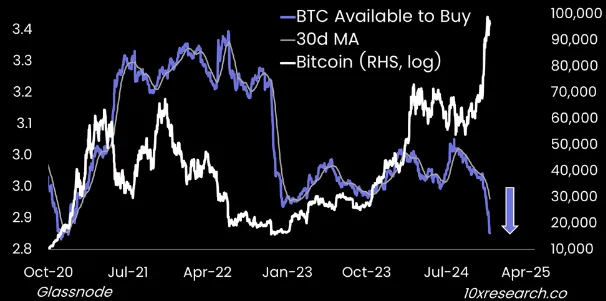

The chart appended from 10X Research, which utilizes Glassnode data, illustrates a distinct discrepancy between the price of Bitcoin and its available supply on exchanges.

The 30-day moving average of Bitcoin available for purchase, denoted by the blue line, has experienced a significant decline.

In the latter half of 2024, Bitcoin’s price experienced a significant increase, with the price recently approaching $100,000, as indicated by a logarithmic scale.

At present, only three main exchanges—Bitfinex, Binance, and Coinbase—report adequate Bitcoin reserves to satisfy buyer demand, according to 10X.

The maintenance of liquidity is becoming increasingly difficult for smaller exchanges, which may result in increased price volatility.

Institutional interest in Bitcoin-driven financial products, such as spot ETFs, is correlated with a tightening supply, which is a result of broader macroeconomic trends.

As demand from both retail and institutional participants increases, the upward price pressure may be further exacerbated by the shrinking exchange inventory, as Decrypt was previously informed.