Analysts say that despite a potential supply shock rally, Bitcoin currently lacks the trading volume needed to break the $100,000 resistance.

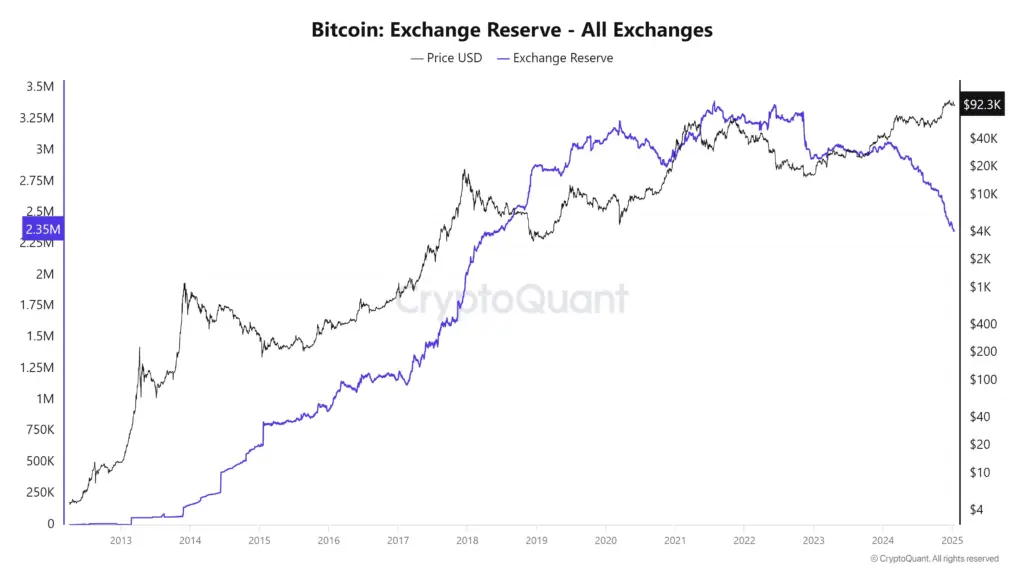

The continued institutional buying of Bitcoin has resulted in a near seven-year low in Bitcoin reserves, which is causing crypto investors to anticipate a potential supply disruption.

As of January 13, the total number of bitcoin reserves across all cryptocurrency exchanges decreased to 2.35 million BTC, a level that has not been observed in nearly seven years.

This low was last observed in June 2018, when BTC was trading above $7,000, according to CryptoQuant data.

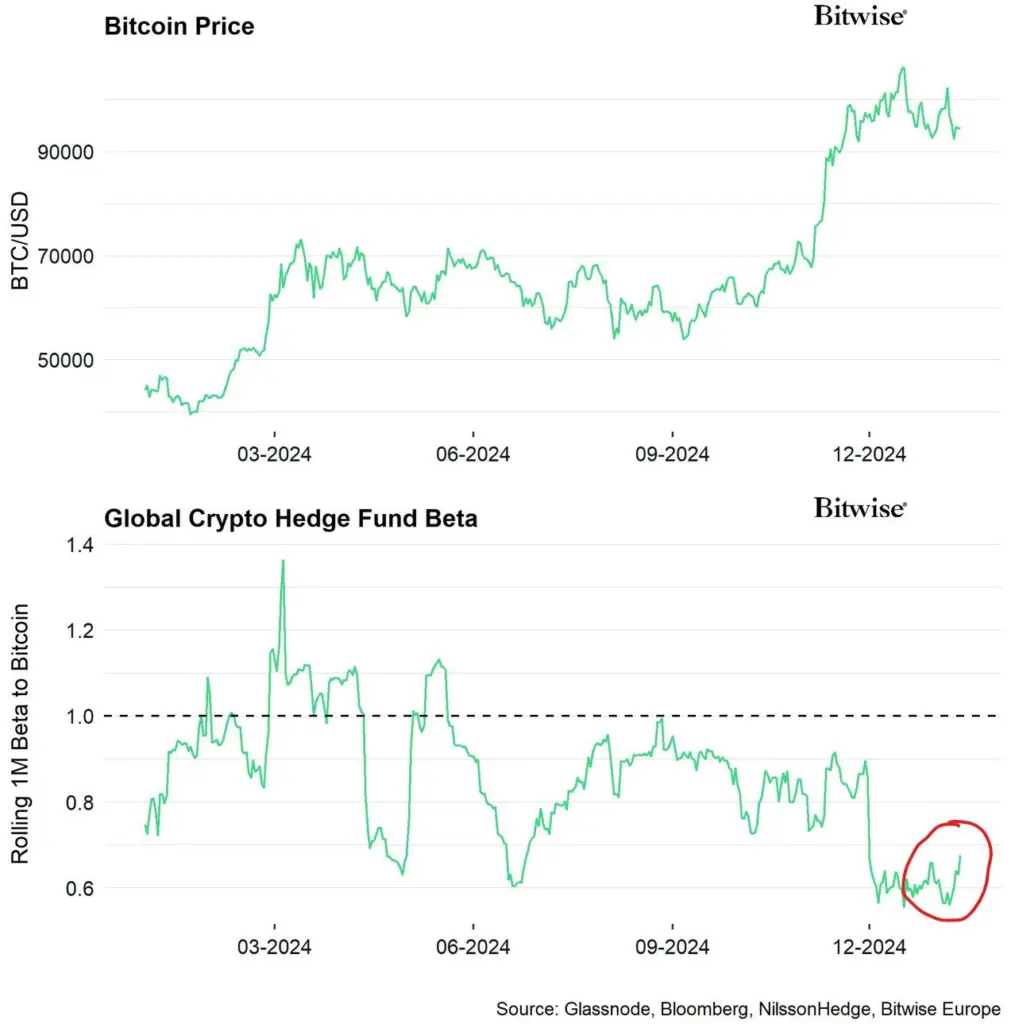

According to André Dragosch, the director of research at Bitwise, the diminishing BTC supply on exchanges is most likely due to the ongoing discount buying by institutional participants.

The researcher wrote in a Jan. 13 X post that crypto hedge funds are purchasing the current BTC decline.

“1 million beta of global hedge funds’ performance to BTC has increased from its recent cycle lows signaling increasing market exposure to Bitcoin & other crypto assets.”

The upcoming price rally could be triggered by a “supply shock,” which is the result of a decrease in the supply of Bitcoin on exchanges, resulting in increased price appreciation because of high buyer demand.

As Bitcoin reached a new all-time high of $108,300 on December 17, US spot Bitcoin exchange-traded funds (ETFs) purchased nearly three times the nearly 14,000 coins produced by miners, according to data from Cointelegraph Markets Pro.

Trading Activity Is Absent During Bitcoin Recovery To $100,000

While the trajectory of Bitcoin for 2025 remains optimistic, analysts continue to view the $100,000 psychological threshold as a significant obstacle before further potential upside.

Although a recovery above $100,000 may be imminent, Ryan Lee, principal analyst at Bitget Research, contends that the crypto market is devoid of trading activity to support a substantial rally.

The analyst informed Cointelegraph that market sentiment appears to be stabilizing, as reduced selling pressure indicates the possibility of consolidation or an upward trajectory if the resistance is surmounted.

“However, technical analysis indicates that the daily timeframe has low trading volume, which suggests that there is a lack of decisive momentum to overcome the current resistance or support levels,” he continued.

In addition to Bitcoin, the broader crypto market is also plagued by a dearth of trading activity.

According to the Jan. 13 X post of market intelligence platform Santiment, the trading volume surrounding several of the most prominent cryptocurrencies has plummeted to a level that has not been observed in over two months, a level that has not been observed since prior to the United States elections.

“Crypto trading volume has sunk as ‘trading paralysis’ has swept markets. Top projects across Layer 1’s, Layer 2’s, meme coins, and AI last saw this low level of trading on November 4th. The lack of excitement is a sign of FUD, which increases the probability of rebounds.”

Nevertheless, analysts are optimistic about the trajectory of Bitcoin, with some anticipating a cycle top above $150,000 in late 2025.

This anticipation is fueled by a projected $20 trillion increase in the global money supply, which could entice $2 trillion of investment into BTC.