Bitcoin is currently experiencing significant selling pressure at spot rates as it continues to decline from the critical resistance level of $66,000

Some analysts are optimistic despite the possibility that BTC may fall below the psychological line at $60,000 and reach lows of $56,500 in May 2024.

Bitcoin’s subsequent decline is expected following its halving: Analyst

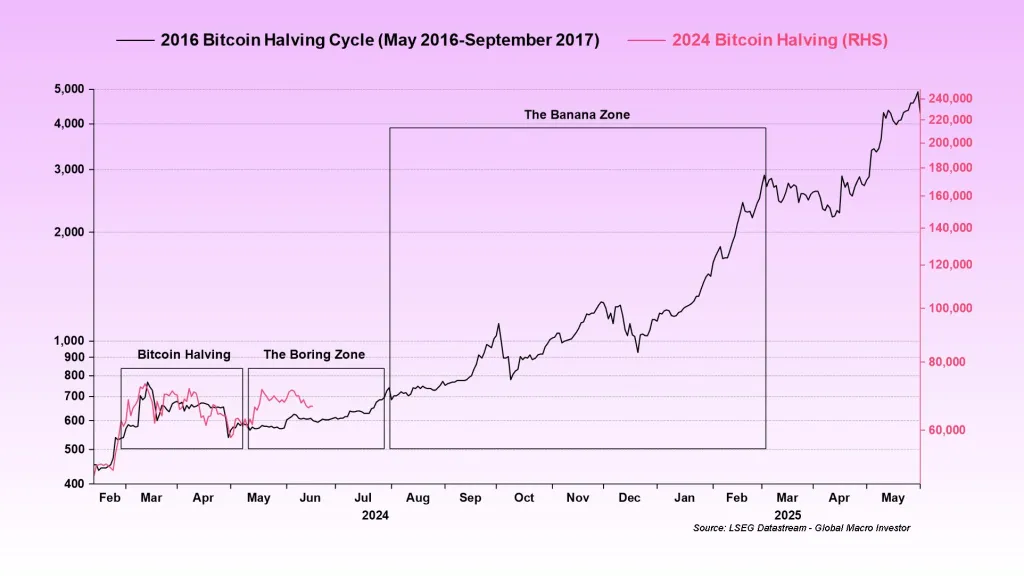

One analyst elucidated that the current correction is a typical aspect of the cyclic market cycle of X. If anything, astute traders should persist in their accumulation on declines, with an eye toward the all-time highs of Q1 2024. They should anticipate that prices will explore new territories.

After examining the formation in the daily chart, the analyst maintained that the current Bitcoin price action is consistent with historical trends, particularly in the weeks following the network’s halving of miners’ rewards.

Bitcoin is in the fifth epoch, following the halving of miner rewards on April 20. This reduction from 6.25 BTC to 3.125 BTC has substantially impacted miner revenue streams.

Despite the 12% correction from the all-time peak of $73,800, BTC is currently in a recognizable pattern. The analyst asserts that Bitcoin prices typically experience a surge before their halving.

Prices experienced a significant increase from October 2023 to March 2024, rising from a minimum of $25,000 to record-breaking highs. Nevertheless, the surge in demand was also exacerbated by the anticipation that the United States Securities and Exchange Commission (SEC) would authorize a spot BTC exchange-traded fund (ETF). The trading of the product commenced in January 2024.

The “Boring Zone” is where BTC is located as a whale dump.

BTC experienced a 25% decline to as low as $56,500 in May following the pre-halving rally, swiftly followed by a sharp correction.

After this phase concludes, prices typically exhibit minimal volatility and move sideways until a final downward push is implemented to clear out traders.

Before rising prices in the “Banana Zone,” prices undergo an additional prolonged consolidation phase characterized by price stagnation. Due to the current decline within the $56,500 and $73,800 range, it is uncertain whether BTC is in the “Boring Zone.”

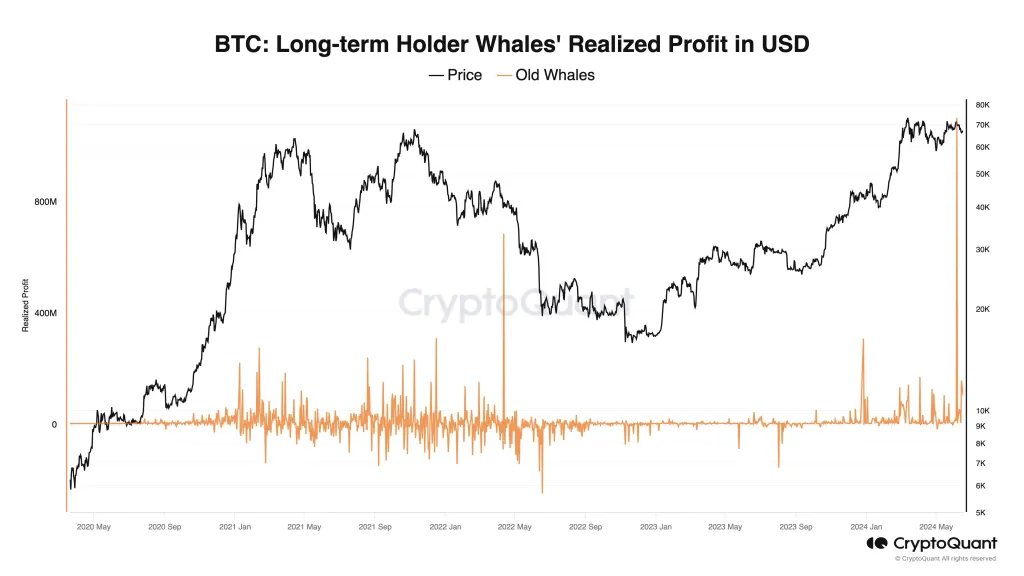

Ki Young Ju, the proprietor of CryptoQuant, a blockchain analytics platform, has stated that whales have been disposing of their BTC for the past two weeks.

As on-chain data indicates, these long-term holders have likely sold approximately $1.2 billion worth of the coin through brokers, thereby suppressing prices. The uptrend has also been slowed by the expanding outflows from spot Bitcoin ETFs.