Bitcoin is testing multi-month lows and now runs the risk of breaking the support that has held up the price of BTC over its whole bull run.

As the most enormous liquidation cascade in years is sparked by Mt. Gox payouts, BTC is fighting to maintain its bull market.

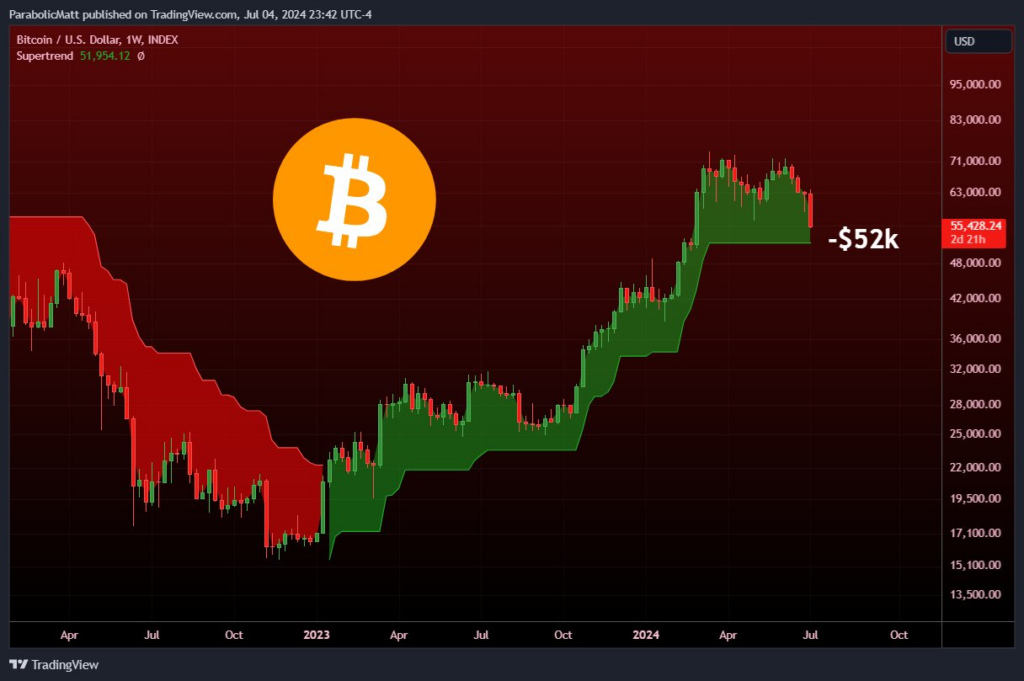

Bitcoin’s supertrend support is getting closer to its first test since 2022.

According to statistics from Cointelegraph Markets Pro and TradingView, the price decline of BTC$54,509 fell by 5% on July 5 alone. As a result, traders are now focusing on boundaries that bulls need to maintain.

Support near the $52,000 level is the first thing well-known trader Matthew Hyland watches.

This creates the weekly timeframe floor of Bitcoin’s super trend indicator, which has supported the price since the all-time high of $73,800 in mid-March.

Supertrend uses the average true range to draw a “Supertend line” that indicates the best times to purchase and sell BTC/USD. Since the conclusion of Bitcoin’s most recent bear market at the end of 2022, the pair has been above the supertrend line.

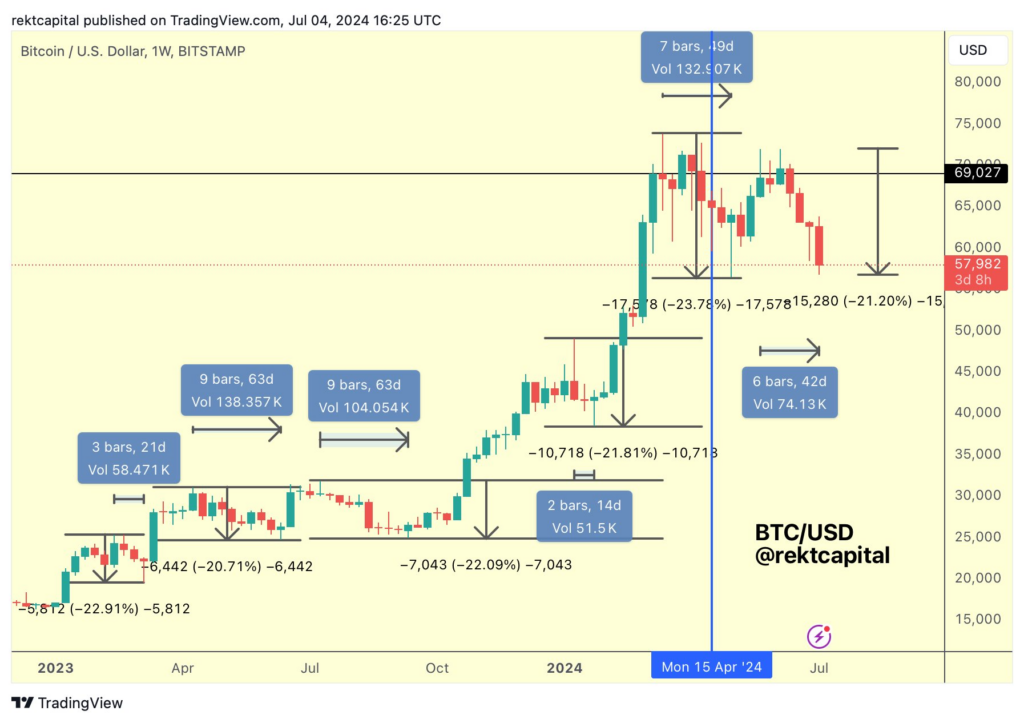

Looking back at previous Bitcoin bull markets, the current decline from the peak is minimal.

BTC/USD has dropped by 38% several times since 2016, with $45,750 being the capitulation objective.

Blockstream CEO and creator Adam Back addressed the problem by criticizing erratic market sentiment. Instead, he maintained that holders should broaden their exposure to MicroStrategy’s shares, which has the most significant Bitcoin treasury of any publicly traded business, and to Bitcoin itself.

“Just in case, shut up. Past bull markets have seen six drawdowns of 30% or more. He wrote on X, “We’re at about -26% (-27% earlier).”

“In fact if anything, recent draw-downs seem to be less deep, but people forget the normal bull market pattern. Don’t panic, buy the dip. or buy a bit of $CMSTR with BTC.”

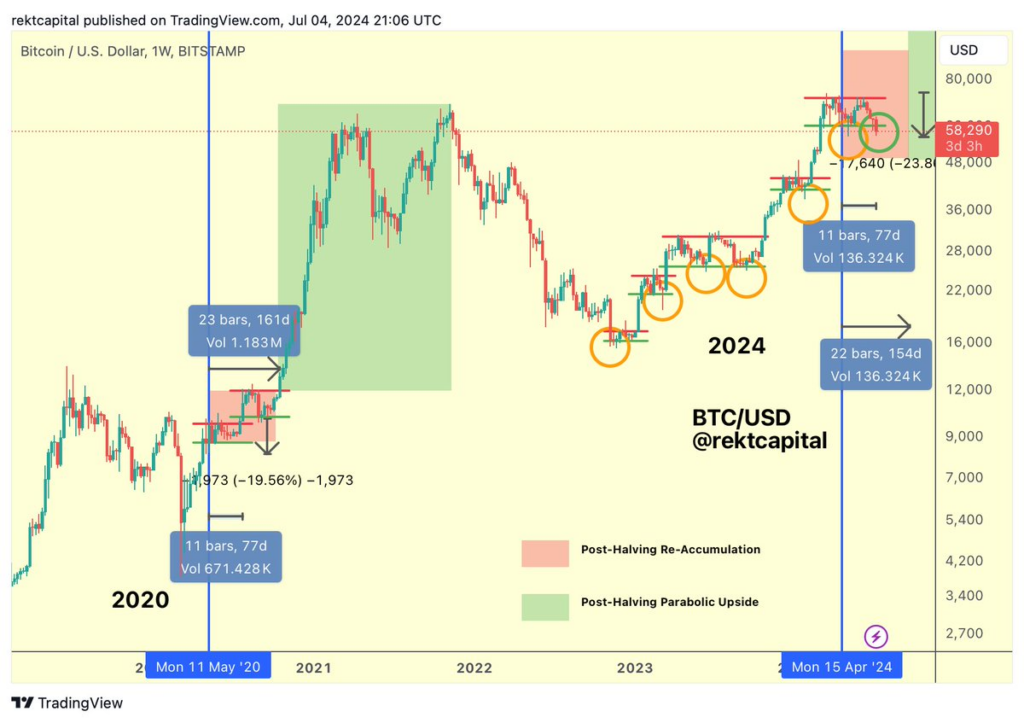

Analyst: The history of Bitcoin is “repeating as we speak.”

Not too concerned about how far the market is south, says well-known trader and analyst Rekt Capital.

“This 45-day pullback is -21% deep. He found that the average retrace depth in this cycle is -22%, and the average retrace period is 42 days.

“In terms of retrace depth, this is almost an average retrace. In terms of retrace duration, this is an above-average pullback.”

Long-term Bitcoin price history is “repeating as we speak,” he continued in a subsequent X post that included a comparison chart.