At the August 16 Wall Street open, Bitcoin (BTC$57,964) underwhelmed as rangebound BTC price behavior contrasted with new record highs for gold.

As bitcoin prices continue to rise laterally and reach all-time highs, it scarcely looks like gold.

Analyst: Upside “telling” of the Price of Bitcoin.

According to TradingView and Cointelegraph Markets Pro data, the price of Bitcoin/USD was between $1,500 and $1,500 per day.

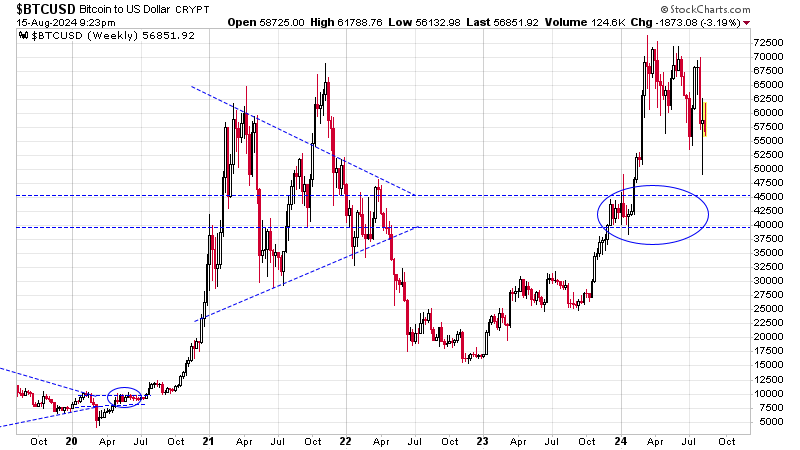

While Bitcoin avoided testing the $56,000 lows from the day before, market watchers must be addressed.

Co-founder of trading platform DecenTrader Filbfilb said on X, “It’s probably more telling than people want to admit that BTC won’t rise on good news.”

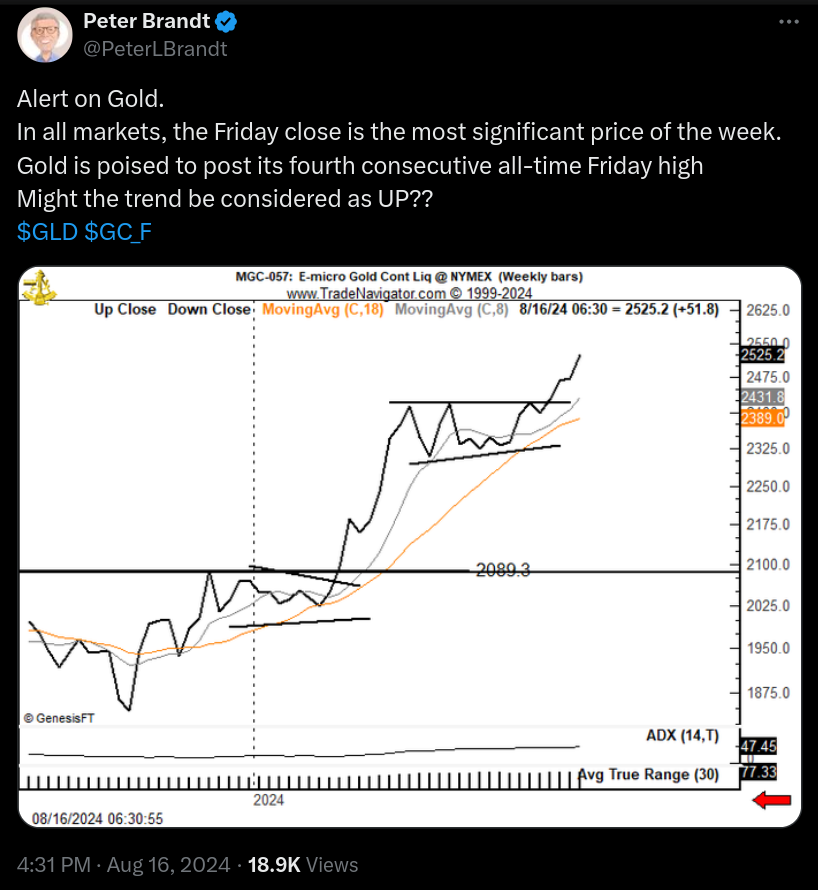

According to Filbfilb, stocks and gold outperform BTC, reaching fresh all-time highs of $2,500 on the day.

XAU/USD has gained 21% so far this year. However, it is still less than Bitcoin’s 38% gain.

Charles Edwards, the creator of Capriole Investments, a digital asset fund that invests in Bitcoin quantitatively, responded in a more upbeat manner, urging “patience” but conceding that Bitcoin’s recovery from the lows at the beginning of August had lagged “behind other asset classes.”

However, Edwards argued that considering historical history, BTC should eventually trail gold upward. He demonstrated that there is around a three-month lag between a gold and Bitcoin advance.

The Association between 2025 returns on Bitcoin stocks

While Benjamin Cowen, the founder and CEO of the analytics resource Into the Cryptoverse, compared the price motion of BTC to equities, he also made analogies to past market cycles.

“Remind yourself that BTC diverged from SPX in 2019, the same year the Fed cut rates,” he wrote in an X post that included an S&P 500 chart.

Cowen was alluding to the US Federal Reserve’s anticipated path for this year, which the markets anticipate will involve a reduction in interest rates starting next month.

The exact same thing happened last cycle, but so many people keep pretending like this is unprecedented and hard to believe, Cowen continued.

He then provided a date for resuming the positive correlation between the two assets, stating that it will happen by 2025.

Bitcoin’s similarly lackluster movements compared to Japanese stocks, which reversed their record decline from two weeks ago.

However, seasoned BTC expert Tuur Demeester stated that a new downturn may quickly hit the markets again.

He cautioned that day, “To be clear: the bleeding likely isn’t over!”

“A pullback to $45k isn’t unthinkable, e.g. if we see a big selloff in the stock markets. Be sure to keep your seatbelts fastened.”