Bitcoin price falls after halving, eyeing about $62,000. Some investors are hopeful it will rise again.

On May 8, Bitcoin anticipated a test of range lows as analysts lamented “boredom” following the halving.

Bitcoin Falls Toward the Range Bottom

According to TradingView and Cointelegraph Markets Pro data, BTC price momentum was directed toward $62,000 during the Asia session.

Bitcoin had surpassed $65,500 a few days prior, and its subsequent 5% retracement placed the BTC/USD pair within a range that had remained unchanged since before the weekend.

With a daily close of approximately $62,300, the BTC/USD pair grew more susceptible to a further retreat from its recent gains.

In part of market coverage on X the day before, J. A. Maartunn, a contributor to the on-chain analytics platform CryptoQuant, cautioned, “Any daily close below $62,100 or prolonged inactivity constitutes a stop-loss.”

Michael van de Poppe, the founder and chief executive officer of MNTrading, lamented the absence of a unified trajectory following the halving of Bitcoin’s block subsidy in mid-April.

He wrote that day, “Bitcoin gradually approaches the range’s lower limits in preparation for a test of support.”

“After that, it seems likely we’ll continue the upwards grind. Boredom has started since the Bitcoin halving took place.”

A supplementary chart illustrated critical levels to monitor in the event of a downward correction.

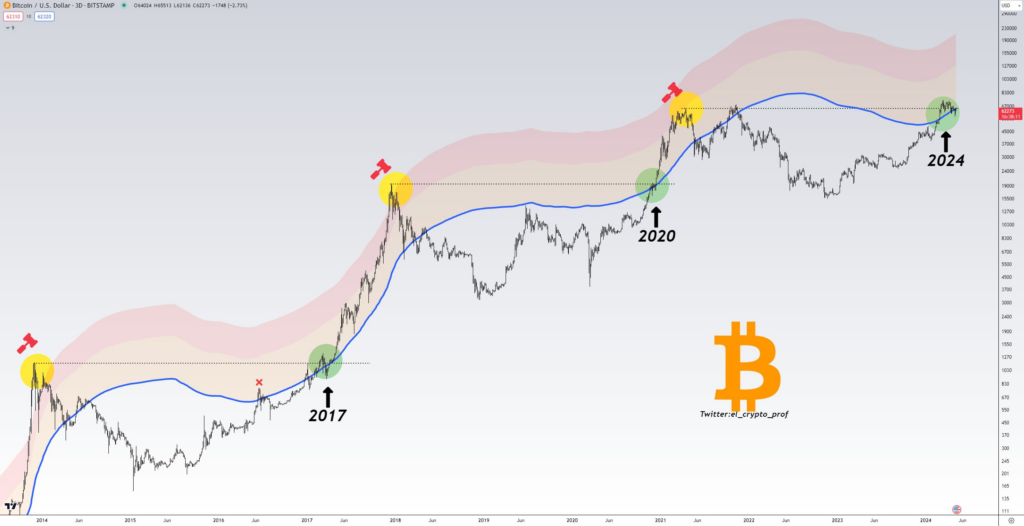

Conversely, fellow trader Moustache maintained an upbeat outlook, contending that the ongoing actions should lead to a more enduring upward trend similar to those observed in previous configurations following the halving.

“The final dips before Bitcoin begins its next leg,” he advised X followers.

“The situation has never been different throughout history. It is either 2017 or 2020 at this time.”

Ethereum ETFs abandon the inflow trend

Amid the turmoil in the crypto exchange-traded fund (ETF) industry, opinions regarding the outlook were divided.

According to Cointelegraph, Grayscale, one of the administrators of the new spot Bitcoin ETFs in the United States, has reportedly canceled preparations for an Ether futures ETF product.

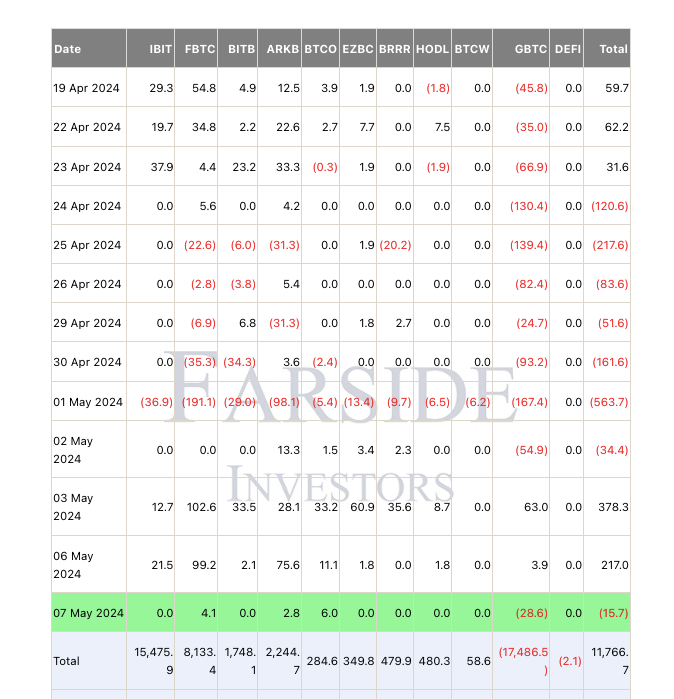

On May 7, the U.S.-based Bitcoin ETFs experienced an additional day of net outflows, starkly contrasting to the inflows of over $500 million on the previous two days.

Information sources, including the investment firm Farside of the United Kingdom, validated outflows amounting to $15.7 million.

Concurrently, the investment firm Susquehanna disclosed a $1.3 billion ETF portfolio.