According to Bitfinex’s head of derivatives, a Federal Reserve interest rate cut could help Bitcoin close the year at “record-breaking levels.”

According to a report from Matrixport, a crypto services provider, the price of Bitcoin may increase to $160,000 in 2025 as a result of the relaxation of global monetary policies and the improvement of macroeconomic conditions.

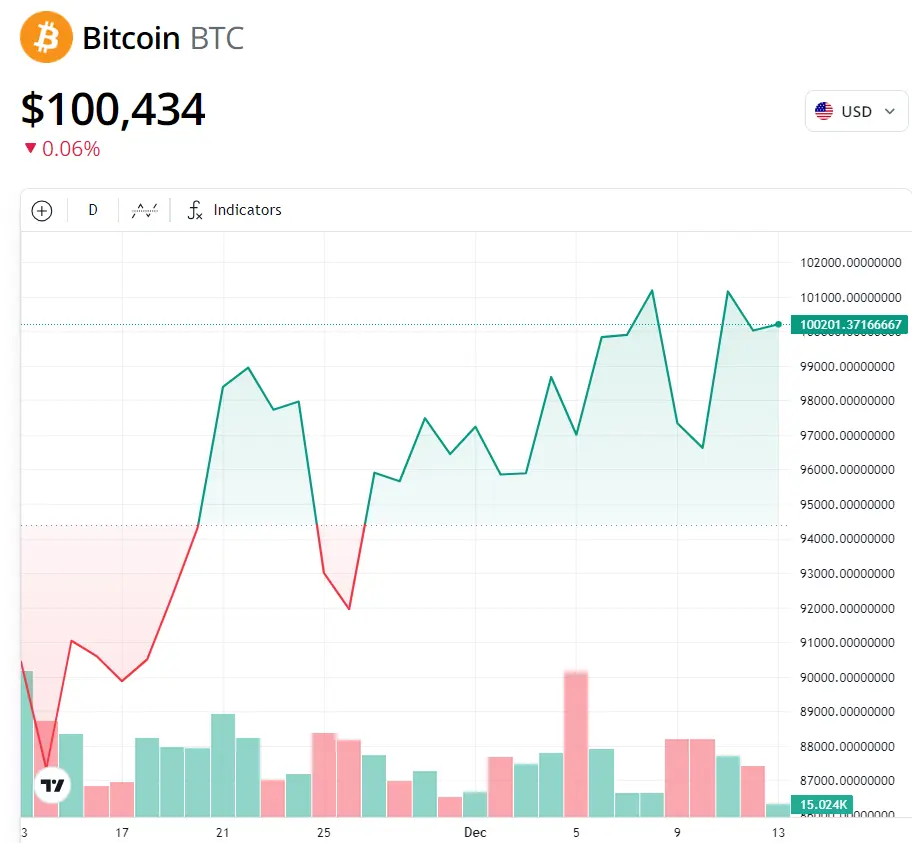

On December 6, BTC achieved a long-awaited milestone in the annals of the cryptocurrency industry by surpassing the $100,000 high.

In an effort to stimulate economic activity and investment in the region, the European Central Bank (ECB) decreased its key interest rates by 25 basis points to 3% on Dec. 12, sending a bullish signal for the Bitcoin price.

On November 21, the People’s Bank of China decided to reduce its benchmark one-year lending rate by 40 basis points to 5.6 percent.

The economy has experienced a slowdown, resulting in the first rate cut in over two years.

The global trend of easing interest rates, as noted by Jag Kooner, director of derivatives at Bitfinex, may encourage investors to pursue risk-on assets such as Bitcoin.

“This dual easing could spur capital flows into risk-on markets, including crypto. Combined with the traditional optimism seen in December markets, this may fuel a potential “Santa rally,” driving Bitcoin and other cryptocurrencies higher as investors allocate more capital into the space.

Nevertheless, the price trajectory of BTC until the end of 2024 could be substantially influenced by the Federal Reserve’s upcoming monetary decision on Dec. 18.

Matrixport in a Dec. 13 X post shared a report that suggests this dynamic could increase the price of Bitcoin to over $160,000 in 2025. Matrixport declared:

“Our projections indicate that Bitcoin could reach $160,000 in 2025, representing a +60% upside. This target aligns with the sustained demand for Bitcoin ETFs, the evolution of the macroeconomic environment and the expanding global liquidity pool.”

Bitfinex Has Completed Deleveraging Of Cryptocurrency Market In Preparation For Subsequent Upward Trajectory

The United States Federal Reserve’s ultimate monetary policy decision for 2024 is eagerly anticipated by bitcoin investors on December 18.

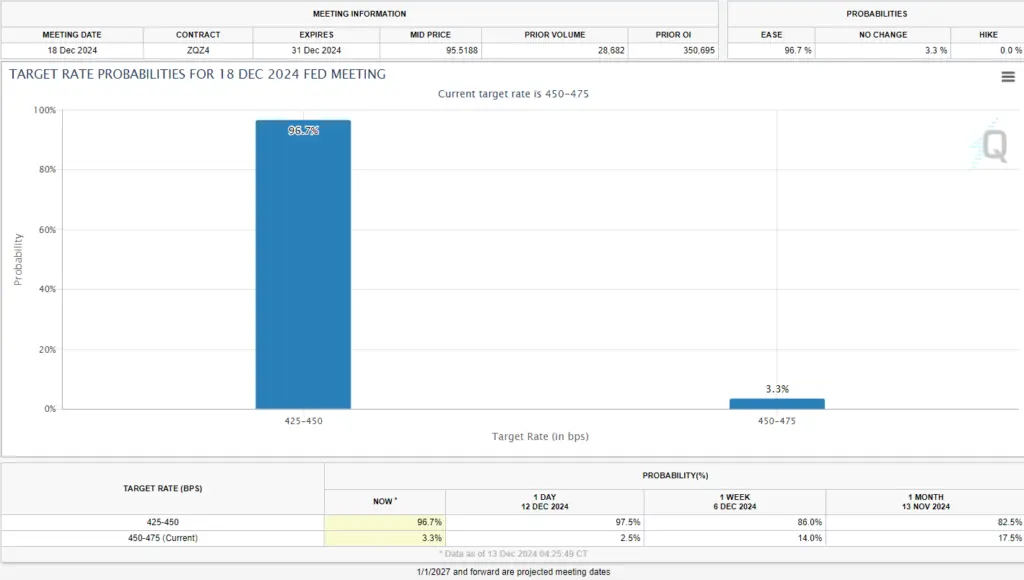

The most recent data from the CME FedWatch tool indicates that the probability of a 25 basis-point rate cut has increased from 82.5% a month ago to 96.7% now.

Kooner stated that Bitcoin would conclude the year at “record-breaking levels” if the Federal Reserve reduced its interest rates.

“Investors are generally more inclined to take risks when interest rates are lower, as they incur lower borrowing costs.”

Cryptocurrencies, which are classified as high-risk assets, frequently experience inflows during periods of elevated liquidity.

Furthermore, the psychological benefit of a dovish monetary policy can enhance investor sentiment.

Bitcoin’s price is expected to experience additional gains in the wake of a $1.7 billion decrease in leveraged trading positions on December 9.

Kooner stated that this deleveraging establishes the groundwork for the subsequent market rally, stating, “Excessive leveraged long positioning has been eliminated, thereby establishing a solid foundation for the subsequent upward movement in Bitcoin’s price.”

Leverage is the term used to describe the quantity of borrowed funds that are utilized to establish trading positions in the cryptocurrency market.

Kris Marszalek, the co-founder and CEO of Crypto.com, issued a warning on Nov. 12 that the crypto market would require deleveraging before Bitcoin could surpass $100,000.

This warning was issued nearly a month prior to BTC surpassing the six-figure price mark for the first time.