According to Bitcoin analyst Will Woo, Bitcoin’s future market demand will rise as BTC price shows strong signs of consolidation.

Bitcoin (BTC), the largest cryptocurrency in the world, has been hovering around $68,000 since last week when it was severely rejected at $70,000.

Although the price of Bitcoin has been exhibiting clear indications of consolidation, the on-chain metrics of Bitcoin indicate promising progress in the future.

Bitcoin Futures Demand Bounces Back

Bitcoin analyst Willy Woo has analyzed Bitcoin’s recent market behavior, indicating that the cryptocurrency has benefited from the 2.5 months of consolidation fueled by optimistic demand.

According to Woo, this consolidation period signifies that Bitcoin’s price has additional ascent potential before reaching its zenith.

According to Woo, net capital inflows into the Bitcoin network reached their lowest point during the consolidation phase and have risen consistently since the beginning of May.

Inflows into spot Bitcoin ETFs have rebounded significantly over the past two weeks, with BlackRock recently surpassing Grayscale, as we have seen. Daily demand from spot Bitcoin ETFs is a factor of a million greater than daily BTC mining.

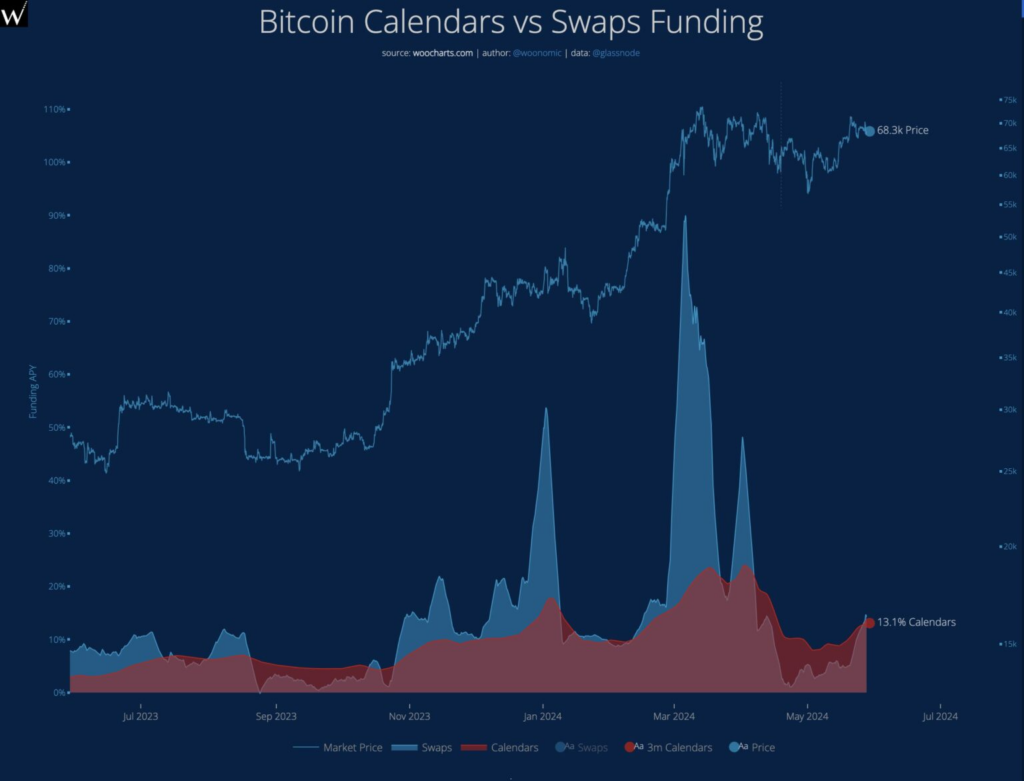

Furthermore, Woo observed a resurgence in future markets, specifically retail traders exhibiting long demand.

In examining the funding rate for perpetual swaps, Woo identified a resurgence in interest from retail traders, as illustrated by the blue-shaded area. He further underscored that this increased demand does not signify the emergence of perilously high fear of missing out (FOMO).

Substantial BTC whale accumulation has caused many Bitcoins to leave exchanges during this consolidation phase. This may result in a subsequent BTC supply disruption, which will exert upward pressure on the price of Bitcoin.

Zones of Baht Resistance and Demand

Recently, Bitcoin analyst Willy Woo commented on the price dynamics of the cryptocurrency, highlighting the $73,000 level of significant resistance. The price, as mentioned earlier, remains a substantial barrier to the ascent of Bitcoin, in the opinion of Woo.

Nevertheless, Woo noted that if the price exceeds $72,000, significant liquidations may incite a short squeeze. According to Woo’s analysis, this situation can cause Bitcoin’s price to surpass $75,000 and ultimately surpass its all-time highs.

According to Woo, fundamental demand factors will likely influence the Bitcoin market and cause a price compression.