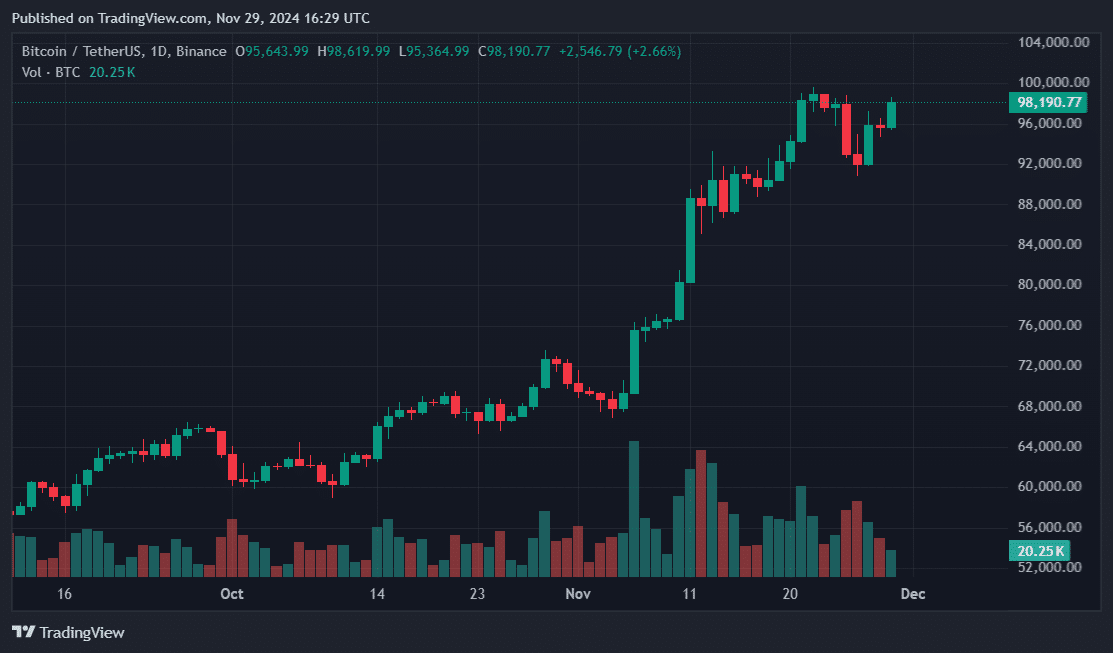

On the CME Futures market, Bitcoin’s spot price got close to $100,000, but it stayed a little lower over Thanksgiving

The biggest cryptocurrency went over $100,085 on the derivatives market in the late morning hours of November 29. This was confirmed by TradingView data tracking Bitcoin CME Futures.

BTC’s spot price stayed at $98,285 after hitting an all-time high of $99,645 on November 22. When prices dropped to $91,000 after hitting ATH, experts talked about a “BTC cool-down.”

According to data from CME Futures, Bitcoin may hit new highs more quickly than expected. Coinglass research supported this, revealing that open interest in BTC Futures had surged to $61 billion at the time of writing.

In just over a month, open interest increased by 50%, which added to the arguments about whether the market will fix itself or keep going up.

No matter what the reason was, institutions and national governments rushed to buy Bitcoin for government and business reserves. MicroStrategy, a private company group, held approximately $35 billion in Bitcoin. Companies like SOS Limited and Metaplanet did the same thing and put millions of dollars into buying Bitcoin.

Even though the U.S. had the most Bitcoin held by a national government, the country could build up its crypto war chest under President Trump. Trump’s transition team looked at potential members of a crypto group that could help him keep his promise to hold a large amount of bitcoin.

As Bitcoin became more important in geopolitical talks, Senator Cynthia Lummis from Wyoming also put forward a bill to buy one million Bitcoin over five years. El Salvador was the first country to buy Bitcoin, and since then, other countries and cities in Canada, like Vancouver, have tried to follow suit. El Salvador now has about $500 million in Bitcoin. The Swiss government also passed a law to investigate how Bitcoin could improve its power grid.