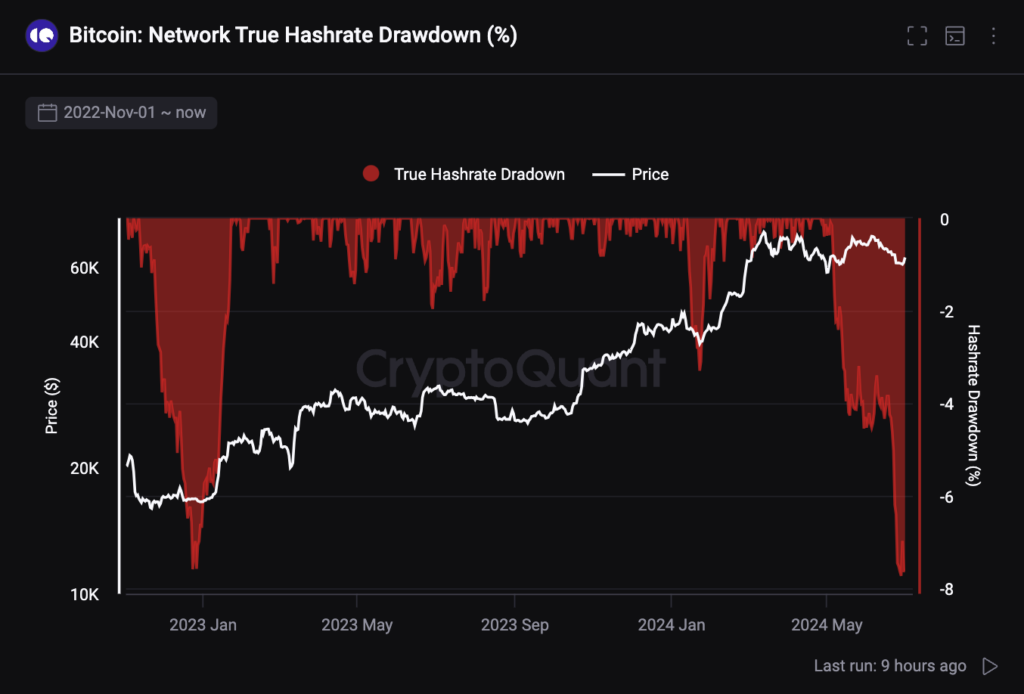

The Bitcoin hashrate drawdown metric can be employed to identify relative bottom points in the market price of Bitcoin and to indicate potential opportunities.

The Bitcoin hashrate drawdown, a metric that quantifies fluctuations in the relative computing power of the Bitcoin network, has plummeted to levels that have yet to be observed since December 2022.

This decline occurred immediately following the collapse of FTX during the previous bear market.

The True Bitcoin Hashrate Drawdown is currently at -7.6%, as data from CryptoQuant suggests that the decentralized asset may be approaching a price low.

The case for a market bottom is substantiated by additional metrics, including the Bitcoin Exchange Reserve, the Miners Position Index (MPI), and the Bitcoin Miner Reserve, which all indicate minimal selling pressure.

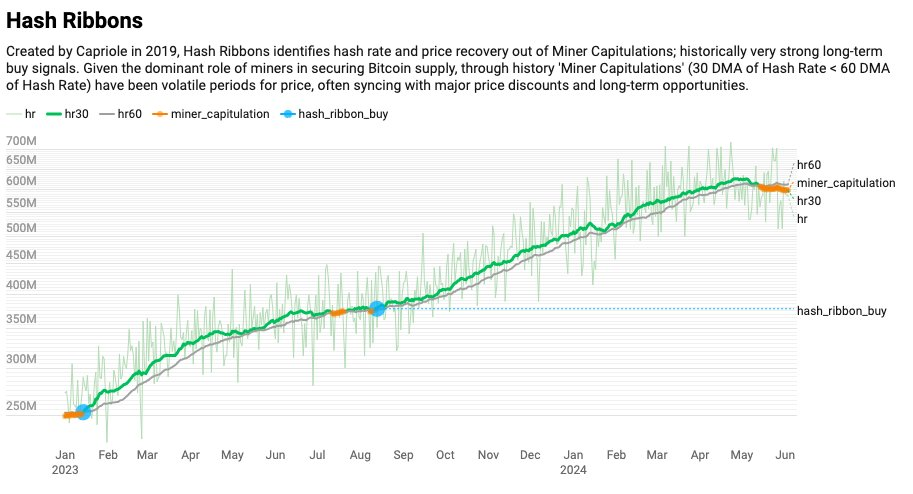

Miner capitulation and the current cycle

Several indicators have suggested in recent weeks that miners are starting to capitulate, which could indicate potential buying opportunities for Bitcoin.

Charles Edwards, the inventor of the crypto hedge fund Capriole, contended that the Bitcoin Hash Ribbons indicator, which his firm had developed, was emitting a buy signal at the outset of June, indicative of the relative decrease in network computational power.

The network’s hashrate is determined by comparing the 60-day moving average of the Bitcoin hashrate to a 30-day average using hash ribbons. A relative decrease in hash power is indicated when the 30-day average falls below the 60-day average.

Will Woo, a market analyst, concurred with Edwards’ assertion that the market will only reach new highs once feeble miners are compelled to cease operations. This phenomenon has historically occurred in the weeks following a halving event but is lingering during the current cycle.

In the aftermath of the halving, Bitcoin miners’ withdrawals experienced a significant decline of up to 90%, suggesting that the selling pressure from miners has been reduced and that the price of Bitcoin will continue to increase.

The Bitcoin mining industry and the post-halving realities

Financial services firm Cantor Fitzgerald published a report anticipating the April 2024 halving event, which detailed the obstacles miners would encounter due to the reduced block subsidy.

Eleven mining companies, such as Marathon Digital, Hut8, and Argo Blockchain, were identified in the report as potentially unsustainable due to high mining costs and reduced rewards.

The report emphasizes the predicament of the mining industry post-halving by predicting that if the market price of Bitcoin plummets to $40,000, some of the world’s largest mining companies would be compelled to capitulate.