Bitcoin price hits ATH of $124.4K, boosting the value of holdings for SpaceX, MicroStrategy, and other major corporate buyers.

Bitcoin is steadily reaching new highs, hitting a new all-time high of $124.4k today and impacting the holdings of SpaceX, MicroStrategy (Strategy), and other buyers.

Notably, the cryptocurrency market has recently seen a notable increase, and institutional and ordinary purchasers are seizing the opportunity.

This corporate strategy and the growing demand for Bitcoin spark curiosity regarding their recent investment results.

Let’s talk.

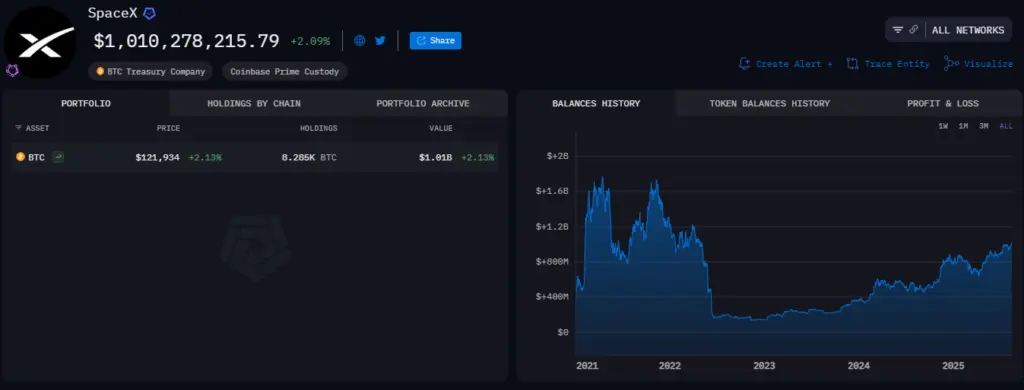

As Price Reaches $124.4k, SpaceX’s Bitcoin Holdings Reach $1.02 Billion

One of the first few businesses to use the BTC purchasing approach was Elon Musk’s SpaceX.

According to Arkham Intelligence, the company has acquired 8,285 Bitcoin since its initial buy on December 31, 2020, and its most recent acquisition on June 10, 2022.

This is valued at $1.0 billion today, as the price of BTCreaches a new high.

Although the number was notably greater (28,000 BTC), they cut their holdings by about 70% during the market turbulence 2022, which included the FTX catastrophe and the Terra-Luna collapse.

It’s interesting that Musk’s Tesla company also has a sizeable quantity of Bitcoin—11,509, or $1.42 billion.

These two have $2.4 billion in BTC holdings between them.

Leading Bitcoin Purchasers, Their Assets

Satoshi Nakamoto, the creator of BTC, is the largest holder globally.

Nakamoto is one of the wealthiest guys on the planet, with an estimated 1.1 million BTC in his possession.

SATOSHI NAKAMOTO IS NOW RICHER THAN BILL GATES

SATOSHI NET WORTH: $133.5B

BILL GATES NET WORTH: $118.7B pic.twitter.com/ysBQclDyCw

— Arkham (@arkham) August 13, 2025

Among the most oversized BTC holders are SpaceX and Tesla, but there are others.

Over 951k BTC is held by the top 100 publicly traded corporations, which increases their market demand and valuation.

Experts point out that the BTC price surge to a new all-time high of $124.4 has been chiefly attributed to MicroStrategy and other institutional buyers.

According to a study by Bitcoin Treasury, Strategy is the largest institutional buyer of Bitcoin, holding 628.946 ($77.2B), with a recent purchase of 155 BTC made just three days ago.

With 50,639 and 43,514 holdings, respectively, MARA Holding and XXI come next.

Trump Media and Technology Group is in second place with 15,000 tokens, followed by Metaplanet Inc. in sixth place with 18,113 BTC.

In light of the recent BTC milestone, Tesla ranks tenth, with hundreds more waiting in line.

Interestingly, BTC ($2.45T) surpassed Google ($2.448T) to become the fifth largest global asset.

Demand is driven by SpaceX, institutional purchasers’ HODL strategy, and the September Fed rate cuts that followed the July U.S. CPI data.