As soon as the US Federal Reserve clarifies that it will cut interest rates, bitcoin bulls surge past significant price resistance.

Following the August 23 Wall Street open, Bitcoin BTC $61,518 surged beyond $62,000 in response to the US Federal Reserve’s announcement of the first interest rate reductions since 2019.

The volatile price of Bitcoin as Powell, the Fed, says policy should “adjust.”

According to TradingView Markets Pro data, new local Bitcoin price highs of $62,323 were recorded on Bitstamp.

Investors responded favorably when Fed Chair Jerome Powell confirmed that interest rates will likely decline.

At the annual Jackson Hole summit, he declared, “The time has come for policy to adjust.”

A dovish Powell announced an “appropriate dialing back of policy restraint” during the event, which the markets had been closely monitoring for signs of policy relaxation. However, Powell did not provide a specific start date for the reduction.

“We have enough room to respond to any risks we may face, including the risk of an unwanted further weakening in labor market conditions, given the current level of our policy rate,” he said.

The week’s main conversation subject was employment after a snap reduction resulted in 818,000 fewer job vacancies for the year ending in March 2024.

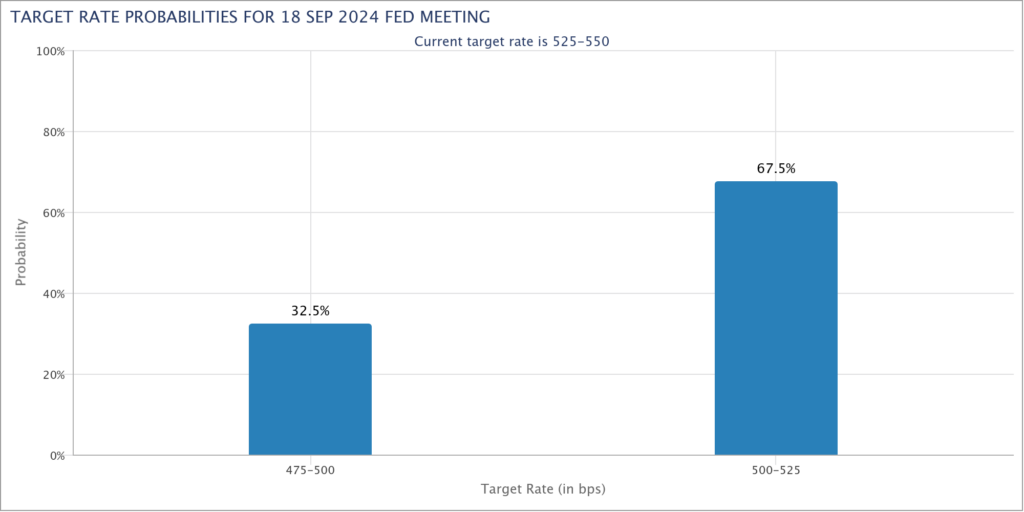

In the meantime, markets were banking for a 0.25% rate drop at the Fed’s upcoming meeting at the end of September, according to the most recent data from CME Group’s FedWatch Tool.

Commentators on the Bitcoin market were optimistic in their response.

The “Wolf of All Streets,” trader, analyst, and podcast presenter Scott Melker, summed up Powell’s remarks in a post on X, saying, “Powell goes full dove.”

The former CEO of BitMEX, Arthur Hayes, forecast that cryptocurrency will “up only time.”

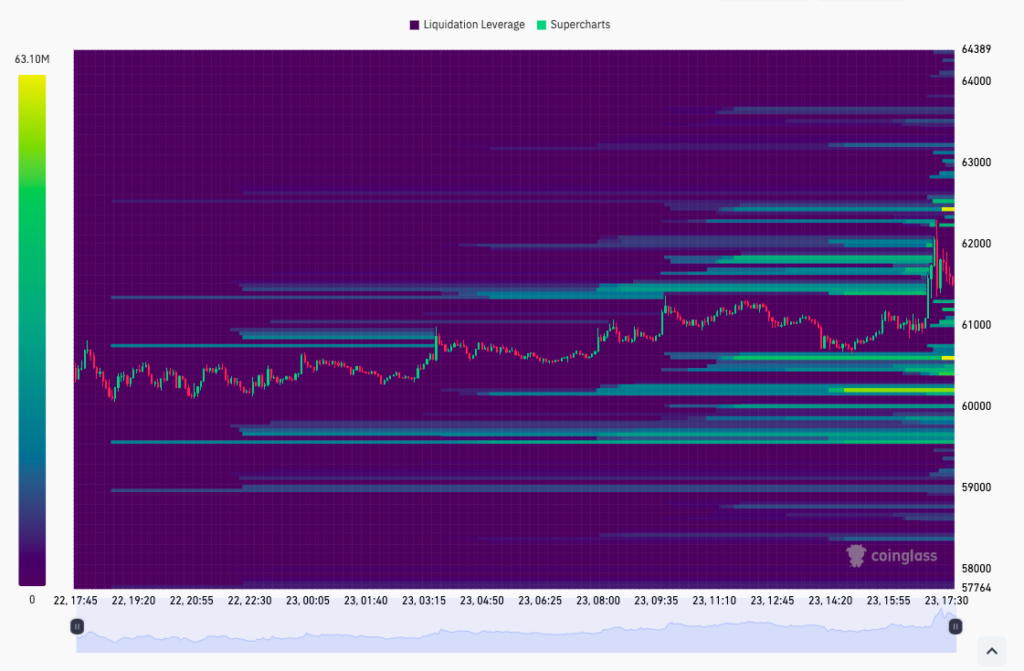

Famous trader CrypNuevo tweeted, “$BTC liquidations to the upside getting hit and a long wick forming,” as he examined short-term market movements.

Bitcoin dealers increase games of liquidity.

The most recent information on resource CoinGlass monitoring recorded changes in liquidity throughout exchange order books. It showed that a fresh block of ask liquidity had been introduced at $62,450, preventing the price from rising further as of this writing.

On daily timescales, however, $62,000 continued to be the critical breakout level that bulls may turn to support.

“Bitcoin still needs to make a breakthrough. According to Michaël van de Poppe, the founder and CEO of MNTrading, “if it breaks through $62K, that would be a sign for the markets to continue rallying this week” in his most recent X analysis.

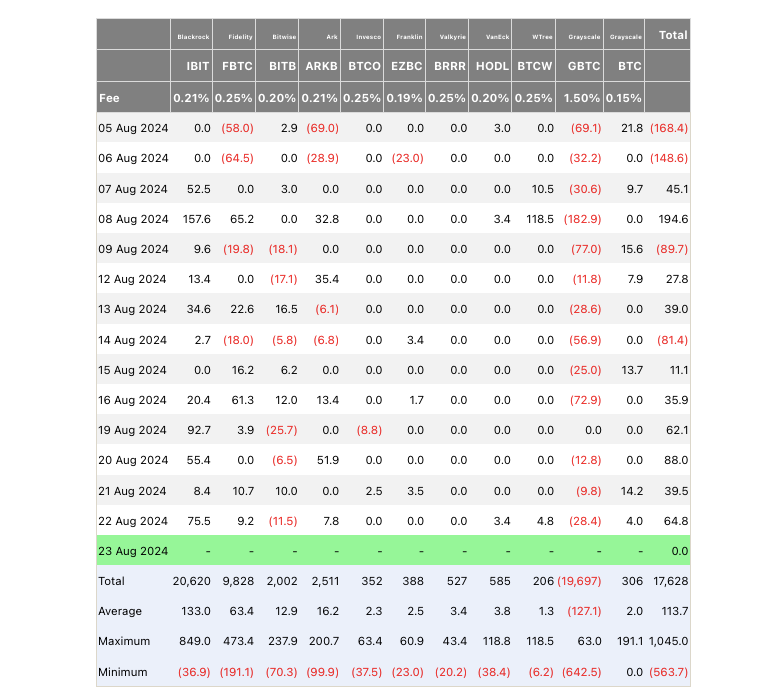

According to Van de Poppe, this could happen because of the capital inflows into US spot Bitcoin exchange-traded funds (ETFs) during the previous week.

“Considering the enormous inflow we’ve seen in the ETF over the last week, we’ll probably have that breakout,” he added.

Net ETF inflows during the first four days of the week were estimated by sources, including Farside Investors, an investment firm based in the United Kingdom, to have been slightly over $250 million.