Donald Trump’s strategic BTC reserve has prompted the Bitcoin price to reach a new all-time high of over $106,000.

As investors anticipate the Christmas rally, the Bitcoin price surged by an additional 6% to reach a new all-time high of $106,498 today. Donald Trump’s strategic Bitcoin Reserve developments and the inclusion of MicroStrategy in the Nasdaq 100 index were the catalysts for today’s BTC surge.

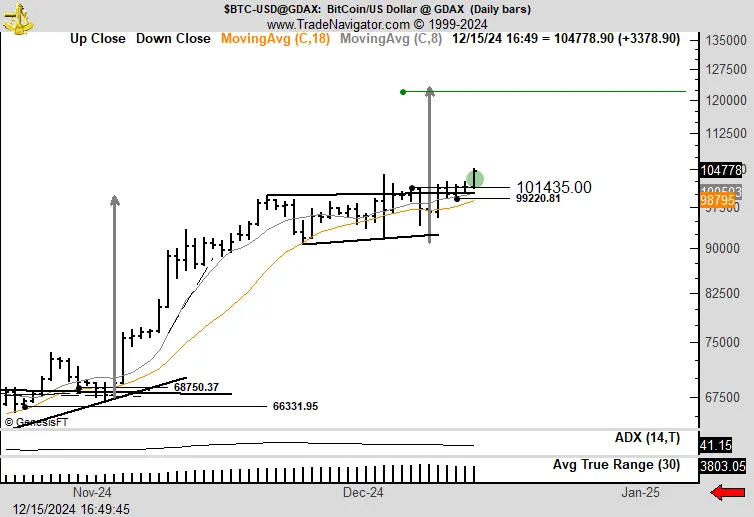

Peter Brandt, a renowned trader, predicted that Bitcoin would surpass $120,000 by the end of the year. This Bitcoin price target appears feasible in light of Trump’s pro-crypto statements.

Could Trump rally in support of a further increase in Bitcoin?

Analysts are optimistic about the prospect of a regulatory environment that is more favorable to cryptocurrency, as Donald Trump is expected to assume the presidency of the United States next month. Furthermore, the Trump administration will likely establish a strategic Bitcoin reserve in the United States. While addressing the New York Stock Exchange (NYSE) last week, Donald Trump disclosed his intentions regarding cryptocurrency without providing additional information.

Michael Saylor’s MicroStrategy achieved a significant milestone last week by becoming a member of the Nasdaq 100 Index. MicroStrategy, a business intelligence software company, has evolved into a leveraged Bitcoin investment vehicle over the past four years by raising billions of dollars through its MSTR stock sale and purchasing additional Bitcoins. Sean McNulty, director of trading at liquidity provider Arbelos Markets, commented on the development:

“Now that MicroStrategy is in Nasdaq, index funds may buy its shares, and that will help the company to raise more equity to buy more Bitcoin”.

Michael Saylor hinted on Sunday that his company’s Bitcoin buying spree could persist, even at new all-time highs. As of the current Bitcoin price, MicroStrategy has 423,650 BTC on its balance sheet, which is valued at $44.58 billion, according to the Saylor Tracker data.

Saylor has been purchasing Bitcoin for his organization on Mondays for the past five weeks. MicroStrategy will announce its sixth announcement on December 16, and investors eagerly anticipate it. Peter Brandt, a prominent economist and Bitcoin critic, stated:

“Bitcoin is at a new all-time high again tonight. Most likely, we will find out tomorrow that Michael Saylor was the buyer. That seems to be the trend, as it’s happened the last five Mondays in a row”.

A seven-week winning streak was achieved by Bitcoin, which extended its rally through Sunday, the longest since 2021. The decision was precipitated by the expectation of establishing a strategic reserve of Bitcoin in January.

Analysts anticipate that Bitcoin will reach a price of $120,000

A renowned trader, Peter Brandt, recently shared a chart depicting a Bitcoin price breakout above the $101,435 level. He also suggested that the next Bitcoin all-time high could be above $120,000. He anticipates this milestone will be achieved between Christmas and New Year 2025.

Conversely, the Bitcoin whale accumulation has maintained steady over the past few weeks. Following Donald Trump’s victory in the U.S. presidential elections, crypto analyst Ali Martinez noted a significant rise in the number of Bitcoin whales on the network.

Nevertheless, the forthcoming FOMC meeting on Wednesday may hinder the subsequent Bitcoin price increase. The Federal Reserve is anticipated to reduce the interest rate by 25 basis points to 4.25%. Additionally, traders must monitor the Bank of Japan and the Bank of England’s rate reduction decisions.

At the time of publication, the BTC price was trading at $105,193.04, a 6.2% increase, and its market capitalization had surpassed $2.08 trillion. The daily trading volume has also increased by 64% to $63.2 billion. The 24-hour BTC liquidations have increased to $119 million, with $103 million of that amount being in short liquidations, according to the Coinglass data.