Federal Reserve anticipated a December rate cut and speculation that President Trump may designate Bitcoin as a US reserve asset from the outset.

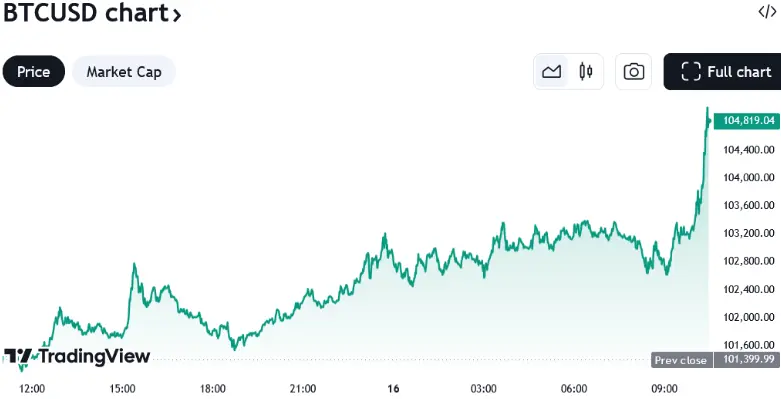

On December 15, Bitcoin’s price surged by nearly 5% in a single day, surpassing $106,000, amid increasing rumors that it may serve as a reserve asset for the United States.

Bitcoin’s peak was $106,554, but it has since declined slightly to $106,000, according to TradingView data. Previously, it reached a high of $104,000 on December 5.

According to CK Zheng, the chief investment officer of ZK Square, Bitcoin has likely entered “Santa Claus mode” due to the fear of missing out and the desire to allocate additional capital into the asset class, as reported by Cointelegraph.

He anticipates that Bitcoin will be priced at $125,000 in early 2025; however, he cautions that a potential 30% correction may occur, as most of the bullish news from the incoming Trump administration has already been “priced in.”

In a 30% correction from $125,000, Bitcoin would retrace to approximately $87,500.

It coincides with Strike founder and CEO Jack Mallers’ assertion that US President-Elect Donald Trump may issue an executive order designating Bitcoin as a reserve asset on his first day in office on January 20.

“There is potential to utilize a day-one executive order to acquire Bitcoin,” Mallers stated, adding:

“It wouldn’t be the size and scale of 1 million coins but it would be a significant position.”

In the interim, Dennis Porter, CEO of the Satoshi Action Fund, has disclosed that a third Bitcoin reserve bill is currently being developed at the state level. However, he needed to specify which state would follow the example of Texas and Pennsylvania.

“We had Pennsylvania and Texas.” Additionally, we have an additional state that is soon to join. The draft was also sent to me. Consequently, I am confident that it is authentic,” he stated at an X Spaces event on December 15.

Porter also anticipates that a minimum of ten states will introduce a combined Bitcoin reserve bill.

“Its not going to stop. We’re going to see more and more of these bills come. At least 10, in my opinion.”

Financial analysts also anticipate that the US Federal Reserve will reduce its interest rate by 0.25% on December 18, which could further increase the price of Bitcoin in the months ahead.

Another potential factor contributing to the recent increase in Bitcoin’s price is the implementation of new regulations by the Financial Accounting Standards Board. These regulations allow institutions to record the value of their crypto assets more accurately. The regulation will apply to fiscal years commencing after December 15.

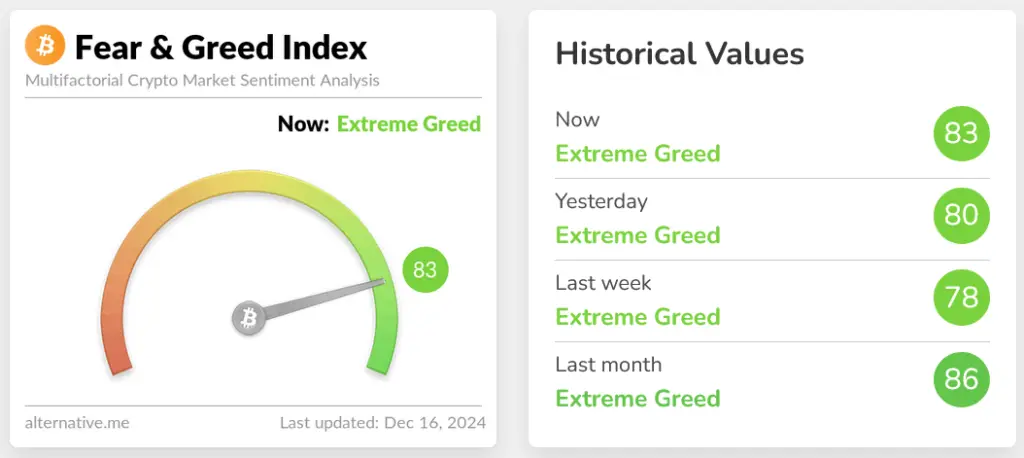

According to the Crypto Fear and Greed Index, Bitcoin’s market sentiment is currently scored at 83 out of 100, placing it in the “Extreme Greed” category.

It has remained unchanged since December 5, when Bitcoin surpassed the $100,000 threshold.