After the most recent halving, Bitcoin L2s continue to be vital to the Asian crypto ecosystem by providing miners with fresh sources of income.

The rise of Bitcoin layer-2 (L2) solutions is one crypto narrative that has gained much traction in the Asian technology environment.

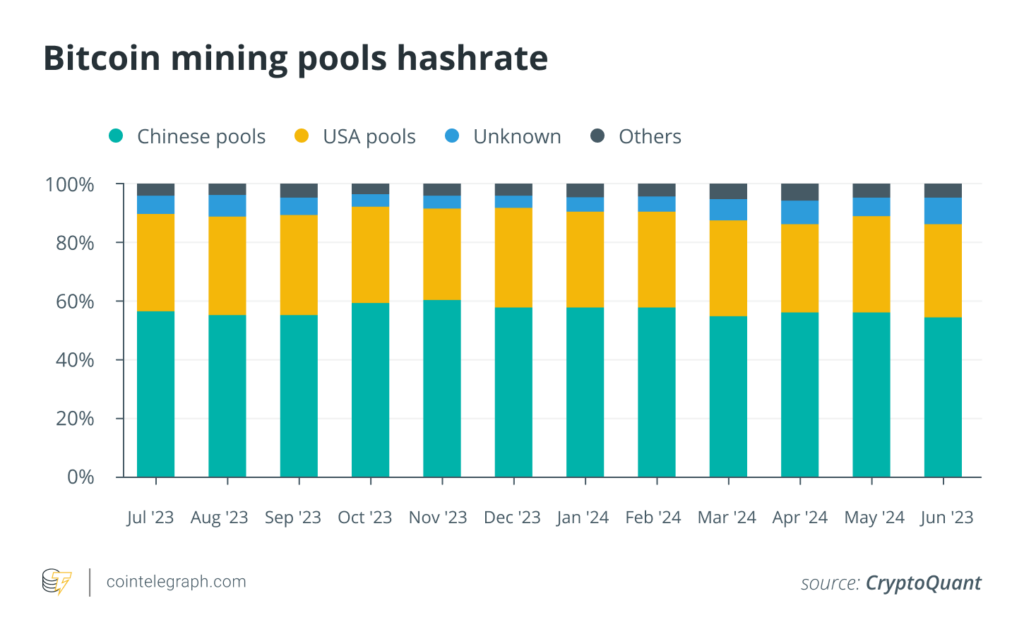

Chinese miners play a significant role in the BTC$ 64,914 mining ecosystem, reportedly contributing over 50% of the network’s hashrate. The emergence of these solutions appears to be supported by miners looking to diversify their sources of income, particularly in the wake of the recent BTC halving.

For miners, the Bitcoin halving—a planned occurrence that cuts mining payouts in half—has always been difficult. The reward ratio for digital assets was lowered by the most recent halving, which ended on April 19, from 6.25 BTC to 3.125 BTC, making it more difficult for miners to maintain a profit.

However, the quick development of Bitcoin L2 technologies is providing these vital network users with a lifeline. Robbie Liu, the CEO of Polyhedra Network’s Asia division for blockchain protocol, said:

“Bitcoin L2s are not just an innovation; they’re a necessity for the evolving crypto ecosystem in Asia. With the recent halving, miners are looking for ways to maintain profitability, and L2 solutions offer just that.”

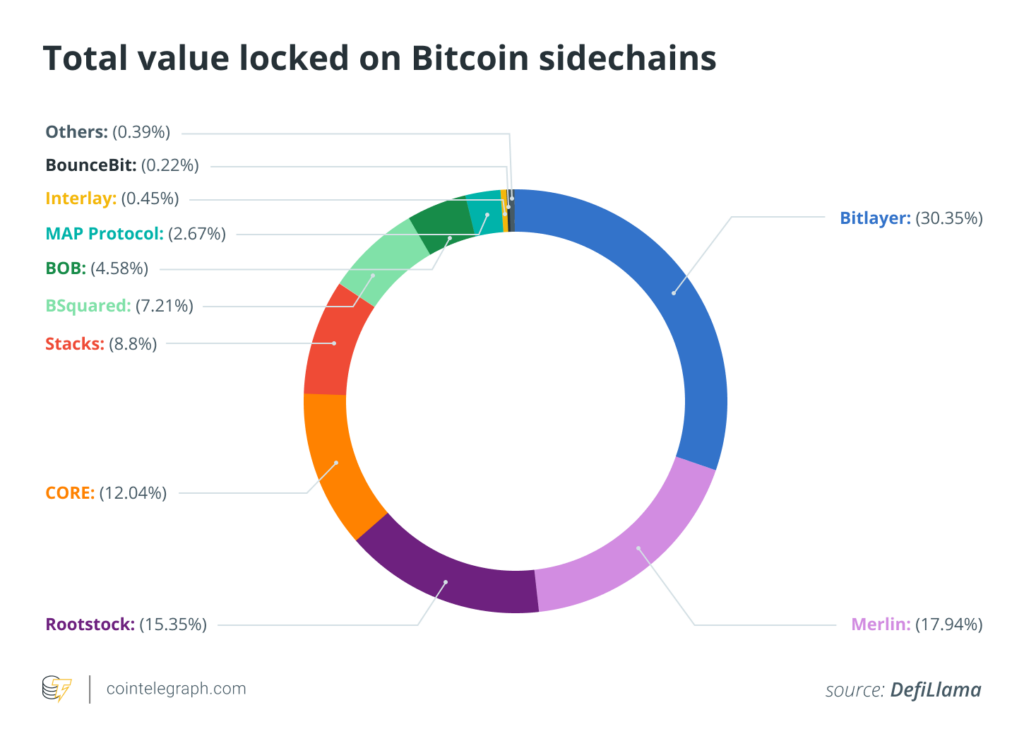

Liu went into further detail on the prevalence of Asian initiatives in the Bitcoin L2 market, emphasizing that many of the region’s L2 products, such as Bitlayer, based in Singapore, are industry leaders in total value locked (TVL).

He continued, “We are also seeing the rise of some noteworthy Western projects like Stacks, BOB, and Anduro.”

Chinese miners have been incredibly resilient and adaptable in the face of numerous regulatory obstacles and frequent crackdowns. By offering additional revenue streams through staking, Bitcoin L2s have further assisted them in maintaining their profitability.

Staking, restaking, and inflows of capital

The advent of various staking and restaking mechanisms, which enable Bitcoin holders (including miners) to earn extra income streams without selling their holdings, has been one of the most significant developments in the Bitcoin L2 sector during the past year or so.

Staking projects are creating new opportunities for capital efficiency, according to Yongjin Kim, CEO of cryptocurrency futures exchange Flipster, who told Cointelegraph that protocols like Babylon are one example.

According to him, the platform enables stakers to acquire rewards in a self-custodial and trustless way. Kim continued by saying the following regarding the significance of employing Bitcoin’s latent capital:

“In recent years, there has been a market trend in maximizing capital efficiency, where the rise of real-world assets (RWA), security token offerings and restaking protocols are all part of the boat. Asia has followed this lead, and the regional Bitcoin community has begun to think about how to maximize capital efficiency on Bitcoin, which has led to the emergence of these L2s.”

Investors have noted the possibility of expanding the use of Bitcoin in domains like RWAs. The ecosystem has seen a notable increase in financial inflow recently, which has sped up infrastructure development throughout Asia.

This flood of capital has the potential to spur more significant advancements in the field and draw in other developers and entrepreneurs. Vice president of Cobo, a cryptocurrency asset management platform located in Singapore, Alex Zuo, said:

“The surge of capital into the Bitcoin L2 ecosystem has accelerated infrastructure development in Asia, attracting more developers to Bitcoin L2 projects and expanding the ecosystem beyond peer-to-peer transactions.”

According to him, this growth is essential to Bitcoin’s long-term survival as a platform for various financial applications. Zuo emphasized the Bitcoin L2 Merlin Chain, claiming that after only 30 days of mainnet activation in February, the project has amassed over $3.5 billion in TVL.

According to Zuo, the accomplishment of such undertakings may establish the fundamental proof-of-concept for subsequent L2s.

There are many innovations, yet there is still work to be done.

Despite the excitement surrounding it, Bitcoin’s L2 ecosystem still needs to be solved, especially with its current asset and security management protocols.

Particular security problems arise from the high stakes associated with managing significant quantities of Bitcoin and the complexity of these systems.

These difficulties are mainly brought on by the dangers and complexity of running decentralized systems, according to Alvin Kan, chief operating officer of Bitget Wallet.

He cited initiatives like the Liquid Network, Rootstock, and Lightning Network as examples of addressing these problems using various strategies, including federated sidechains, innovative contract platforms, and off-chain transactions.

For instance, the Lightning Network leverages off-chain transactions to increase scalability and lower transaction costs. Users can complete transactions quickly and effectively by utilizing a network of bi-directional payment channels.

Micropayments and other high-frequency, low-value transactions impractical on the main Bitcoin blockchain could be made possible using this technology, which is very promising.

Rootstock expands the potential for decentralized applications and intricate financial instruments built on top of Bitcoin by introducing Ethereum-compatible intelligent contracts to the network. The platform addresses one of the main issues facing the L2 domain, which emphasizes security through formal verification and contract audits.

Blockstream’s Liquid Network adopts an additional strategy. As a federated sidechain solution, it solves inter-exchange settlement and liquidity management problems while improving privacy and transaction speed. Institutional investors and big Bitcoin holders searching for more effective ways to manage their holdings may find this especially helpful.

Growth in the use of Bitcoin L2s

With an increasing number of developers and projects in Asia concentrating on Bitcoin L2s, the ecosystem appears ready for substantial expansion and development.

According to Kan, several trends could influence this industry in the future. These include the broad adoption of solutions like the Lightning Network, particularly in nations with significant remittance inflows, and the considerable expansion of decentralized finance applications constructed on Bitcoin L2 platforms.

The growth of cross-chain interoperability solutions is another trend. The capacity to transfer assets between networks effortlessly will be more and more important as the diversity of the blockchain ecosystem grows. Bitcoin L2s that enable this interoperability may be crucial components of the more extensive blockchain network.

As more Asian nations simultaneously present themselves as crypto-friendly jurisdictions—including Vietnam, Thailand, Singapore, and Hong Kong—L2s appear to be part of a more significant trend.

The laws in these nations that favor cryptocurrencies are designed to draw in top-notch investors and talent from across the globe while also creating an environment that fosters the growth of enterprises.

In the long run, China’s hegemony in the Bitcoin mining industry is paving the way for Asia to take the lead in L2 innovation.

The Bitcoin network and the Asian financial environment could undergo significant changes as miners adjust to the new reality of a post-halving world and developers rush to build on these new platforms.