Bitcoin miner Marathon (MARA) fuels speculation with its $130M BTC purchase as whale accumulation surges.

Marathon Digital (MARA), the foremost Bitcoin miner, has once more captivated the attention of investors with its most recent acquisition of Bitcoin (BTC).

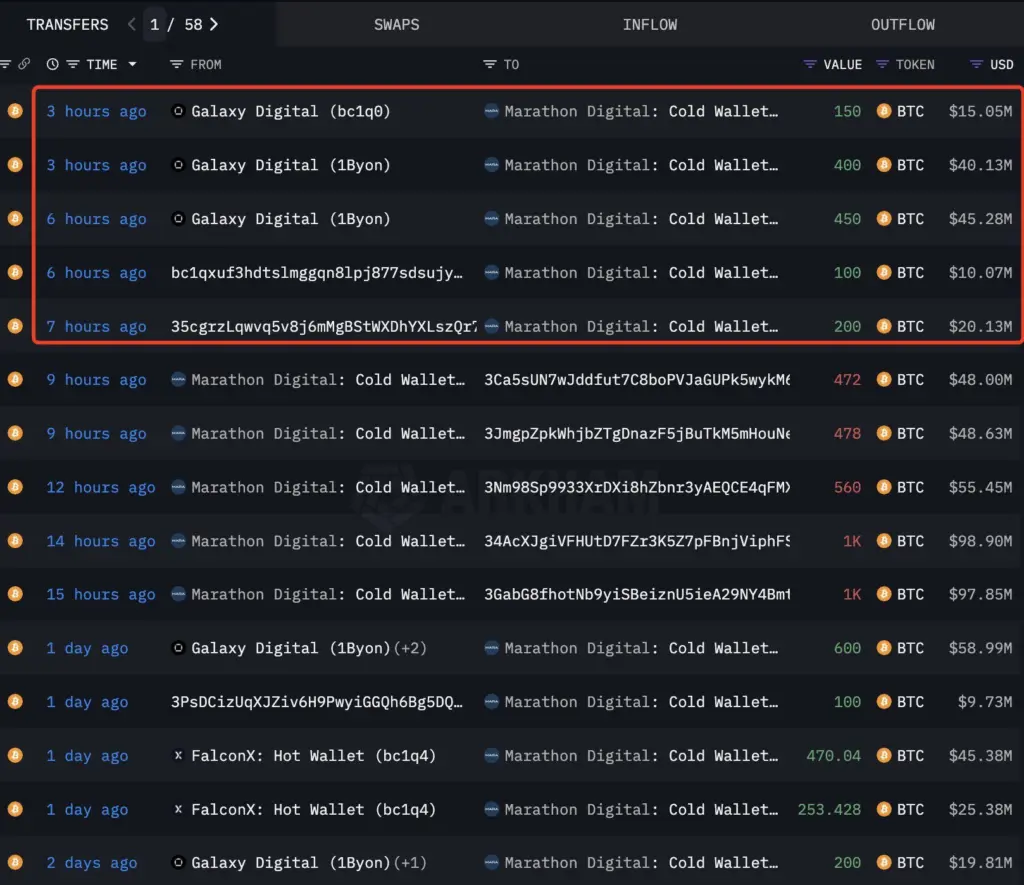

The miner has recently accumulated 1300 BTC, as indicated by the most recent data.

This follows a similar transaction of 1,423 Bitcoin earlier this week.

This is particularly noteworthy because the company recently announced the completion of its second $850 million convertible note offering, which was intended to augment its Bitcoin acquisition strategy.

Bitcoin Miner Marathon (MARA) Is Continuing Its BTC Purchasing Spree

The recent massive purchases of the players by the leading Wall Street players are indicative of their recent transition in focus to the digital assets space.

The institutional interest in the premier crypto appears to have remained unaffected, despite BTC reaching $100K.

Marathon (MARA), a Bitcoin miner, has expedited its BTC acquisition strategy, as indicated by the most recent transactions, according to recent data.

Arkham data indicated that Bitcoin Miner Marathon acquired 1300 Bitcoin, valued at approximately $130.66 million, yesterday, which prompted market optimism.

Furthermore, investors have been further intrigued by the organization’s acquisition of comparable assets earlier this week.

To provide context, the Bitcoin Miner Marathon acquired an additional 1423 Bitcoin earlier this week, which is estimated to be worth approximately $139.5 million.

The BTC miner’s announcement of the effective closure of its second $850 million convertible note offering is particularly noteworthy, as this substantial purchasing activity occurs shortly thereafter.

The primary objective of this strategic move, as stated by the organization, was to expedite its Bitcoin acquisition strategy, in addition to partially repurchasing existing notes that are scheduled to mature in 2026.

Will Bitcoin Keep Rising?

Today, the price of Bitcoin (BTC) increased by more than 1% and traded at $99,531, a return to the 24-hour low of $97,629. Nevertheless, the trading volume of the cryptocurrency decreased by 32% to $93,57 billion at the same time.

The flagship cryptocurrency has reached a 24-hour high of $102,039.88, which suggests that there is significant market interest in the event of Marathon’s purchasing spree.

BTC Futures Open Interest decreased by 0.5% to $61.25 billion within a 24-hour period, as indicated by CoinGlass data. However, there was a modest rebound in the short term.

Given this, it seems that investors are resuming their participation in the BTC market following a brief hiatus.

Furthermore, Bitcoin whales are also engaged in a purchasing frenzy in conjunction with the institutions.

The whales have amassed 20,000 BTC, which is approximately $2 billion, since yesterday, according to Ali Martinez.

This accumulation indicates a high level of confidence in the asset. However, BTC will probably surpass its all-time high of $103,900, which was achieved on December 5.