In a mere seven months, the market capitalization of publicly traded bitcoin miners has doubled, approaching $40 billion.

Bitcoin miners are on the cusp of a significant milestone as they approach an aggregate market capitalization of $40 billion. Although miners were hovering around a $20 billion market cap just seven months ago, the recent Bitcoin price explosions have significantly altered financial projections. The farside data has revealed an extraordinary trajectory that has captivated the attention of industry experts and investors.

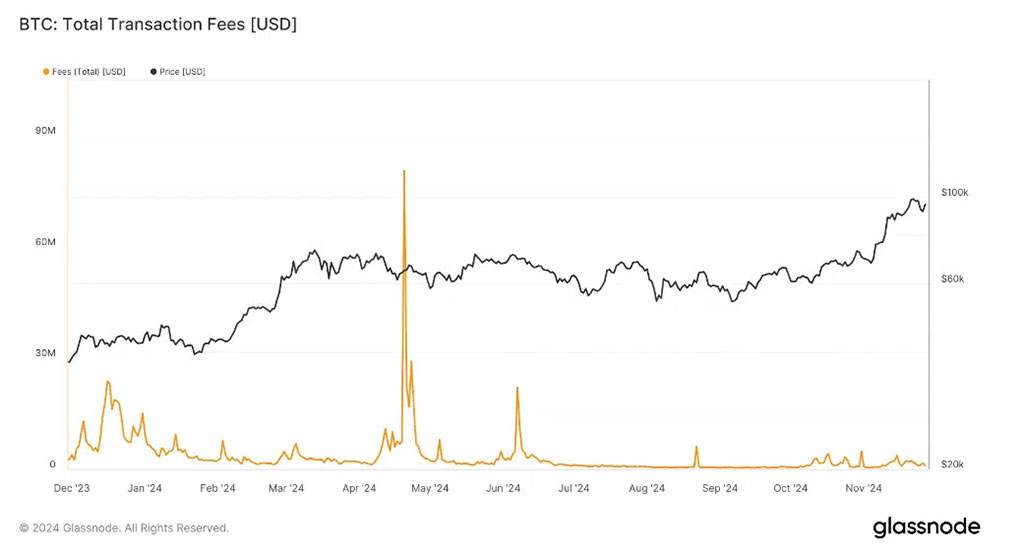

Miners face the intricate challenge of maintaining profitability amid a volatile financial environment. The pressure on industry participants was exacerbated by the April blockchain halving event, which reduced block rewards by half. The daily yield of bitcoin mining is 450 coins as of November 27, and transaction fees are still below $946,000. Miners must demonstrate strategic flexibility to maintain viability in light of these constraints.

Exploring alternative revenue streams or optimizing production costs below Bitcoin’s current spot price of approximately $96,000 is necessary for survival, which compels miners to pursue innovation. The traditional mining approaches are being fundamentally reevaluated due to market dynamics.

The complexity of Bitcoin mining is on the rise, and resilience is a critical factor

The mining difficulty is expected to continue its relentless ascent, with an additional 3% increase anticipated in the coming days. The complexity of blockchains is becoming an increasingly formidable obstacle for miners, as they have already surpassed the trillion-dollar threshold. Operational resilience is tested as each modification increases block generation’s cost and technical complexity.

For over a month, the hashrate, the computational power that drives blockchain transactions, has maintained a consistent level of over 700 exahashes per second. The computational momentum has been sustained since mid-2024, as evidenced by the current seven-day moving averages of approximately 726 EH/s—an increase in computational power results in more intricate mining conditions.

Miners are expanding their operations beyond conventional cryptocurrency mining. Many are shifting their focus to the high-performance computing and AI industries, where they have identified lucrative opportunities in the hosting of computing infrastructure. Companies such as IREN have experienced up to 30% stock surges, which indicates that the market is enthusiastic about innovative strategies.

MARA’s Intelligent Investment Strategy

Marathon Digital Holdings (MARA) exemplifies an adaptive corporate strategy. Following the acquisition of a $1 billion convertible note, researchers observed that MARA added 703 BTC to its balance sheet on November 27. Their current total bitcoin holdings are an impressive 34,794 BTC, which indicates their strategic long-term investment strategies.

Investment vehicles like the CoinShares Valkyrie Bitcoin Miners ETF offer a more comprehensive market understanding. The year-to-date performance indicates a 60% increase even though it is still following Bitcoin’s extraordinary 113% surge. Market observers interpret these figures as indicators of the potential and transformation of the underlying industry.

The unfolding narrative represents a complex ecosystem of technological innovation, financial strategy, and computational evolution, which is not solely about cryptocurrency mining. Miners are no longer merely simple blockchain transaction processors; they are now emerging as sophisticated technology infrastructure providers.