Bitcoin Miners’ Position Index sparks fears of a miner-led selloff as BTC dips below $120K, raising concerns of increased selling pressure this week.

There were worries about possible selling pressure from Bitcoin miners after the Miners’ Position Index (MPI) spiked sharply earlier this week.

On-chain data, however, provides a more thorough understanding of miner behavior.

Could the change in miner activity indicate that the bottom of Bitcoin is near?

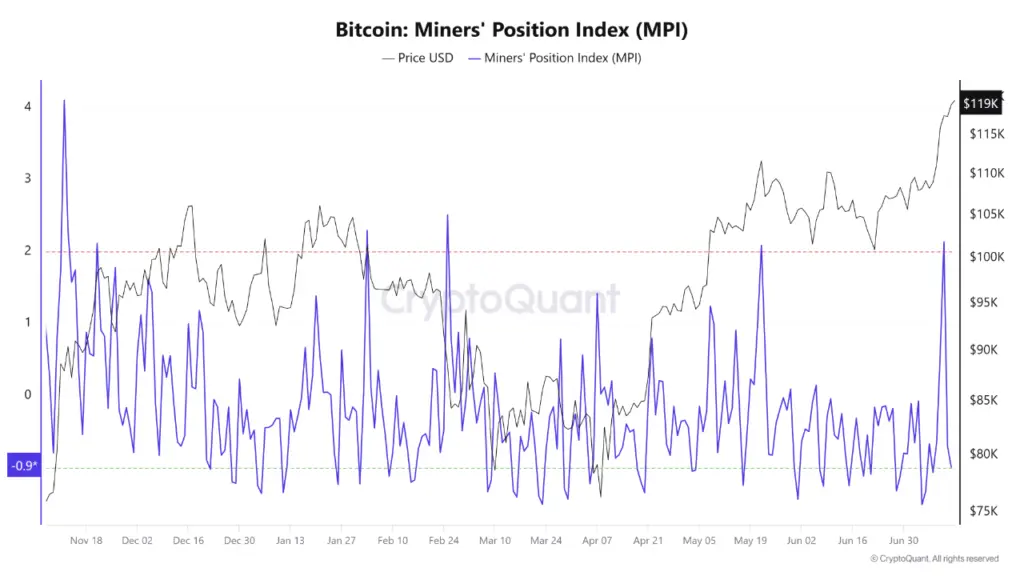

MPI Surge Initiates Speculation About Profit-Taking

In mid-July 2025, the MPI measured the ratio of miner outflows to their one-year moving average momentarily crossed 2.

When the price of Bitcoin reached new highs, miners sold their holdings, as shown by a value greater than 2.

Large-scale Bitcoin miners selling has historically caused such circumstances to occur before market corrections.

Bitcoin miners frequently prepare to sell to lock in profits when prices are high, especially when they transfer more Bitcoin to exchanges at levels higher than their historical average.

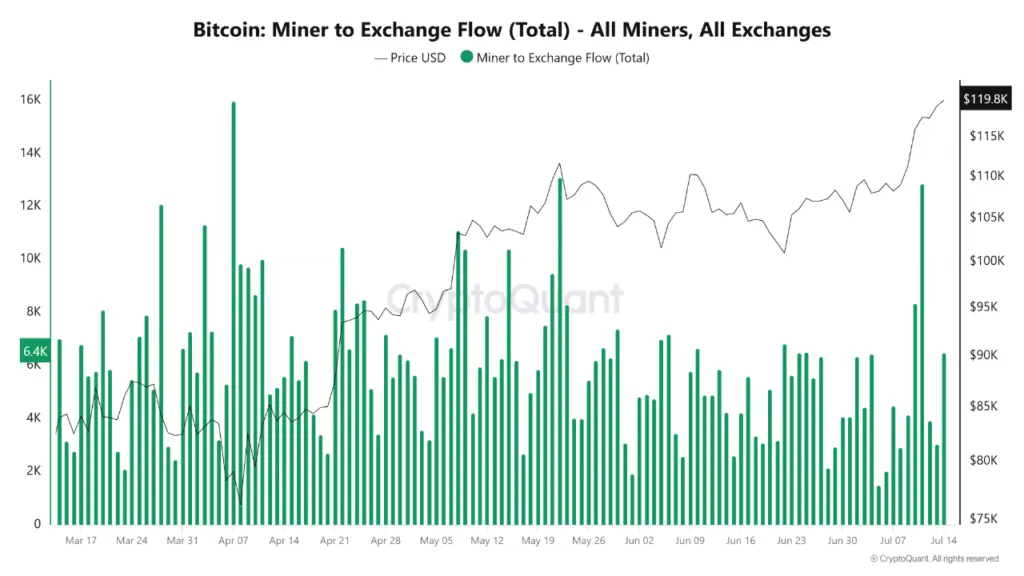

Exchange Inflows Align With MPI Readings

Between July 12 and July 14, when the price of Bitcoin surged to a new all-time high of $123,091, Binance reported a net inflow of about 6,000 BTC.

This influx can be a sign of widespread profit-taking. These movements aren’t necessarily bearish, however.

While not always used for market dumping, some Bitcoin may be set aside for arbitrage, derivative hedging, or over-the-counter transactions.

Will Bitcoin Miners’ Record Earnings?

The MPI index experienced a sharp drop right after it soared above the crucial level of 2.

This has indeed been a recurrent trend. In contrast to protracted selloffs, previous MPI jumps, such as those in late 2024, February 2025, March 2025, and June 2025, were usually followed by either a brief price decline or stabilization.

While some miners may be profiting, the reversal shows they do so selectively and in smaller quantities.

Additionally, the market may absorb these sales without causing significant hemorrhage.

To put it another way, miners might not experience financial strain.

Many might wait for even higher margins because Bitcoin prices are still significantly higher than the average manufacturing cost.

Is Long-Term Trend Intact Despite Frothy Sentiment?

Santiment’s social data showed that when Bitcoin hit $123.1, more than 43 percent of all cryptocurrency conversations focused on it, indicating exuberant retail enthusiasm.

This shows strong mainstream momentum but also suggests a short-term peak, particularly given the peak in “FOMO” emotion.

Macro developments in the meantime shook markets.

Due to risk-off flows in financial markets following US President Donald Trump’s declaration of possible 100% tariffs on Russia, Bitcoin fell below $120,000.

Bitcoin is currently trading at $117,705, down from its intraday high but still up 12% over the previous month, according to CoinMarketCap data.