Bitcoin mining difficulty dropped 5% to 79.5T, the lowest since March, and the drop in mining difficulty should spell relief for the largest mining firms.

On July 5, the difficulty of mining Bitcoin decreased by over 5%, reaching a quarterly low of 79.50 terahashes (79.5T). This was the most significant decrease since March, when the difficulty fell below 80T.

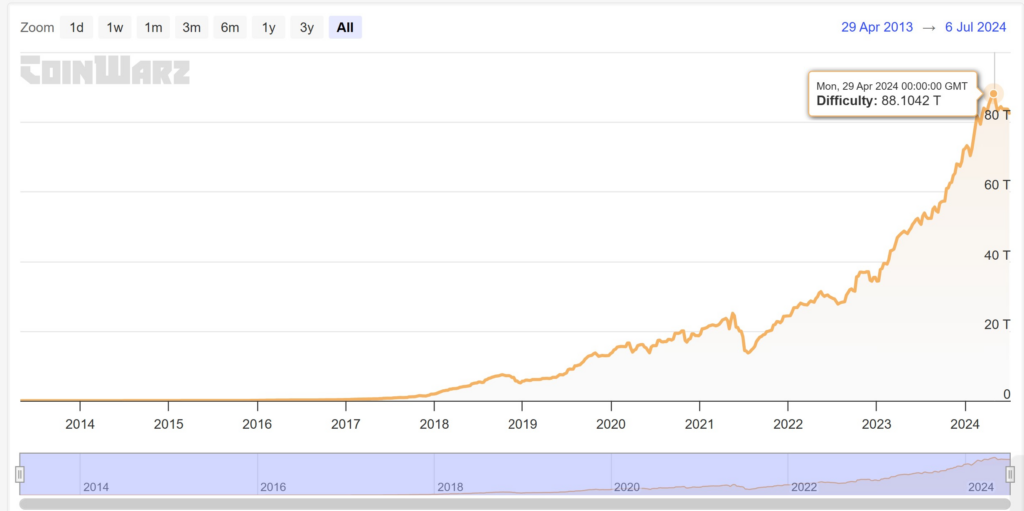

During March and May, the difficulty level attained an all-time high of 88.10T. Subsequently, it began to gradually settle down to its current position as of the publication of this article.

The complexity of Bitcoin mining

Bitcoin mining difficulty is a measurement of hashrate, which is essentially a measure of the number of guesses a mining machine is anticipated to make before it solves the cryptographic puzzle required to unlock one of the remaining bitcoins.

It takes approximately two weeks to update hash rates every 2,016 blocks. Hashrates have generally increased month over month throughout Bitcoin’s existence, with only a few exceptions.

For instance, hash rates were approximately 1.1 gigahashes in 2014. This was sufficiently low to enable the majority of desktop PCs to mine Bitcoin (a rig must be more energy-efficient and potent to be profitable as the hashrate increases).

Hashrates achieved the terahash threshold for the first time in the latter part of 2017, as adoption began to increase. They are currently at 79.5T as of July 6, 2024, and will remain at this level until the next difficulty update.

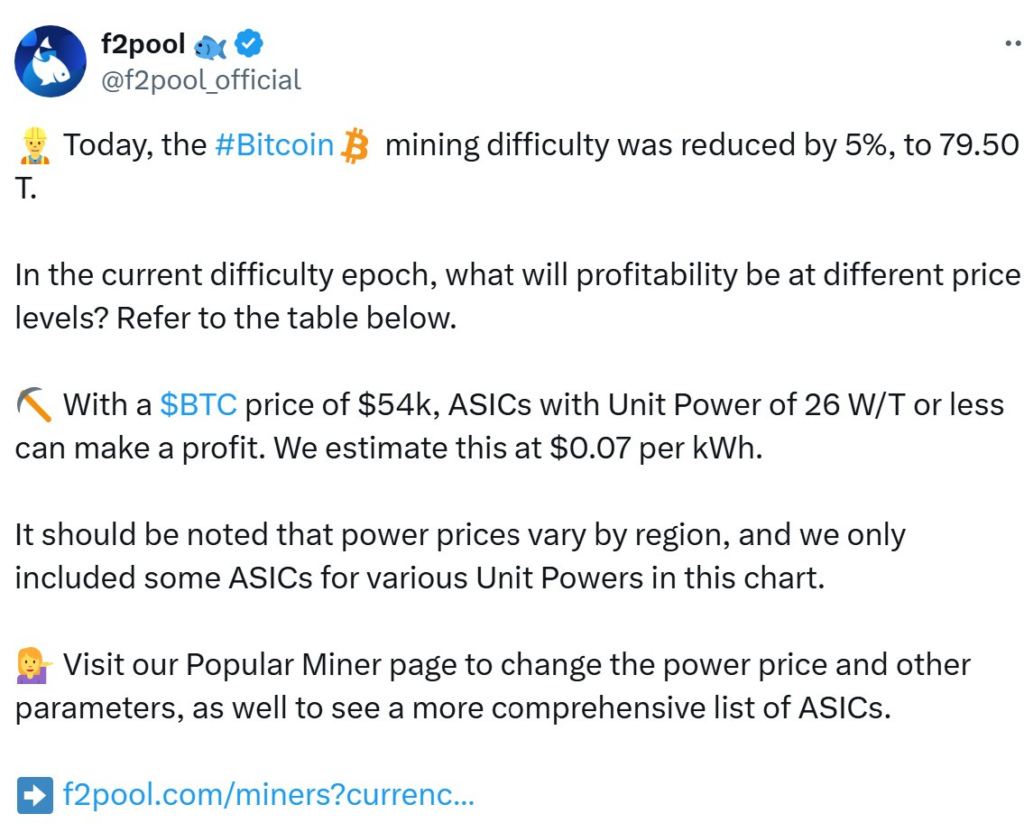

F2Pool, a mining pool, predicts that an ASIC machine with a watts per terahash efficiency rate of 26 or higher (lower) would be profitable if Bitcoin’s price remains above the $54,000 threshold, under the current difficulty measure of 79.5T.

“With a $BTC price of $54k, ASICs with Unit Power of 26 W/T or less can make a profit. We estimate this at $0.07 per kWh.”

If Bitcoin’s price decreases, miners will require more efficient devices to maintain profitability. These conditions should be acceptable for the most significant miners, particularly those in regions where energy subsidies are available for mining facilities if they remain constant.