Bitcoin nears a fresh all-time high above $123K, driven by a strong breakout, post-halving August rally optimism, and anticipation of US CPI data.

In the most recent Bitcoin news, the price of BTC has increased by 3.6% in the past 24 hours, surpassing $122,000. It is on the brink of a new all-time high in anticipation of the US CPI and PPI data publication this week. As per historical trends, market analysts anticipate a robust rally in August and Q4 of this year, as 2025 is the year following the halving. According to macroeconomists, the Trump tariff effect is also expected to fuel inflation in July. Consequently, BTC is establishing itself as a secure refuge in the face of these inflationary market conditions.

Bitcoin Demonstrates Strength Amidst Inflation Concerns Before the US CPI

In the past 24 hours, BTC has formed a robust green candle, resulting in a gain of over 3.5%. It is now anticipating a breach from its all-time high of $123,000. The most recent increase occurred after BTC consolidated below $115,000 over the past week, and investors again surged. Analysts are optimistic about the potential for Bitcoin to reach $130,000 and beyond, as the Golden Cross pattern has reemerged on the chart.

Based on historical trends from previous years, Benjamin Cowen, a prominent crypto analyst, predicted that Bitcoin would conclude the month of August in positive territory. BTC investors will be on the brink of panic as we approach two additional weeks and critical inflationary data.

Crypto analyst Benjamin Cowen has emphasized a recurring post-halving trend in Bitcoin price action. BTC has historically adhered to a consistent pattern in which prices increase in July and August after each halving year, as per Cowen. He also mentioned that there may be a slight decline in the market as we approach September, which will be followed by a new market cycle apex in Q4.

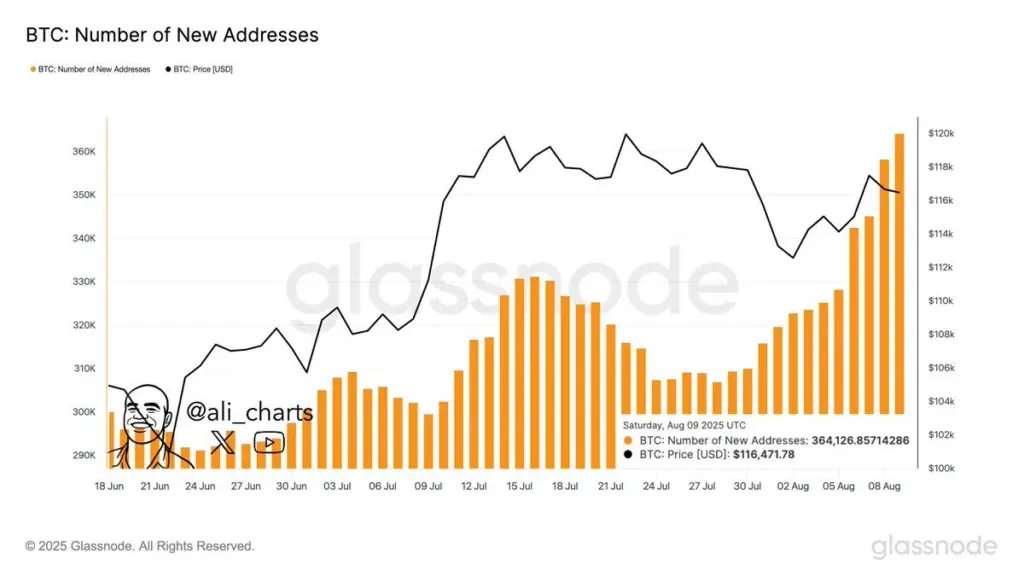

In addition, the on-chain data indicates a strength in the number of new Bitcoin addresses. According to crypto analyst Ali Martinez, the number of new BTC addresses created daily has reached its most significant level in a year (364,126).

US CPI and PPI Data on Radar as Inflationary Pressure Is Likely to Persist

In July, the US Consumer Price Index is anticipated to increase by 0.3%, as per market predictions, indicating that inflationary pressure will likely persist. Consumer prices in various sectors, such as recreational products and household furnishings, are beginning to be affected by the increasing tariffs imposed by the Trump administration. Many companies are attempting to alleviate the tariff burden on price-sensitive customers due to the uncertain labor market and revisions in the US employment data.

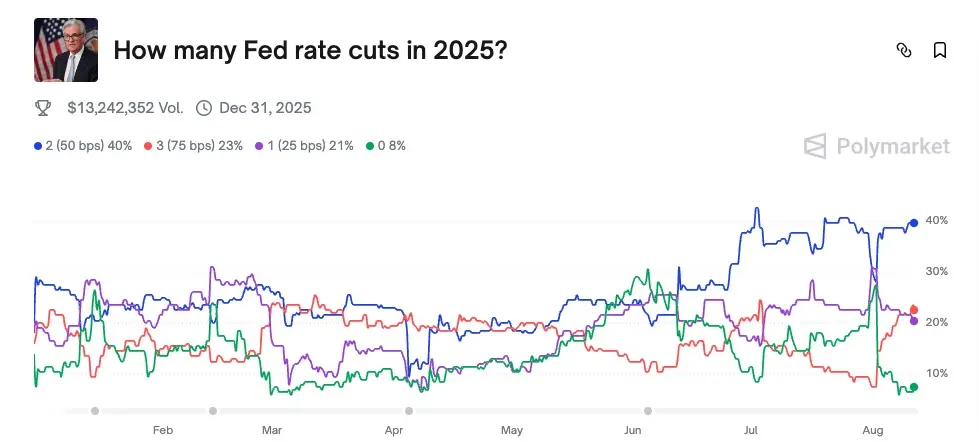

The Federal Reserve’s rate reduction is anticipated to increase during the September FOMC meeting. Based on the Polymarket data, the two rate cuts total 50 basis points and have the maximum weightage at 40%. Nevertheless, the forecast of three rate cuts totaling 75 basis points has increased from 8% to over 23% in the past week, following the revision of the employment data.