With a drop below $67,000, Bitcoin appears to be offering buyers a “flash sale,” but traders caution that the price correction of BTC might not be complete yet.

Following the October 21 Wall Street opening, Bitcoin BTC$67,230 fell below $67,000 due to “expected” pressure from US sellers.

Traders anticipate a further decline in the price of BTC.

Cointelegraph Markets Pro and TradingView data showed daily BTC price losses of 3%.

Following the BTC/USD weekly closing that was the highest in five months, market watchers predicted that consolidation and support retests would now occur.

Famous trader Jelle called the weekly chart “primed” and commented, “Market is selling off slightly today, as expected – and that’s okay.”

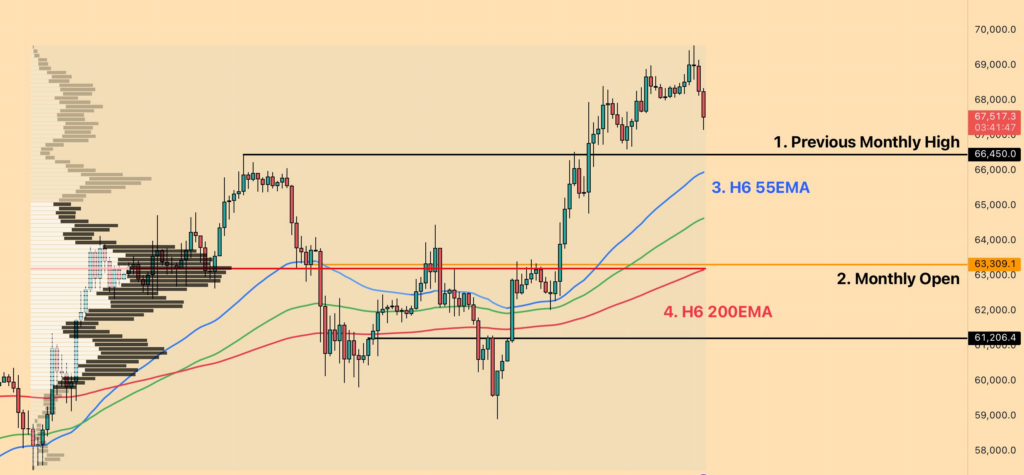

Forecasts for the price of bitcoin included deeper retracements; the well-known X account Emperor speculated that $62,000 might resurface.

The message to followers was, “H6 55EMA and high volume pocket between $66,000-500 should be a good area to watch for support; shorts will take profit here and should.”

Emperor also watched the 200-period exponential moving average (EMA), trading at $63,300 on 6-hour periods.

Trader, analyst, and pundit Josh Rafer stated, “Trends are memes, mostly self-fulfilling prophecy, but the mid-lone and bottom of the trend played significant for bounces for Bitcoin.”

“Watching for a potential re-test before higher.”

Meanwhile, well-known analyst WhalePanda expressed his displeasure with the US response to Bitcoin’s $69,000 onslaught.

“US with yet another outstanding $2k dump. He answered, “Got to wonder where they keep getting the Bitcoin to dump daily.”

For Bitcoin to rise, it must flip $69K.

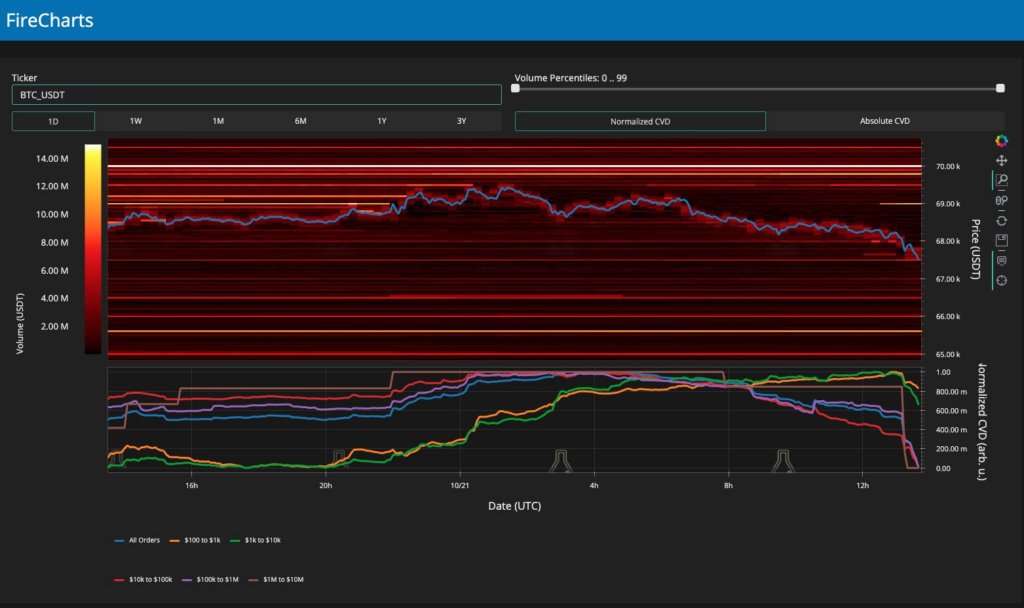

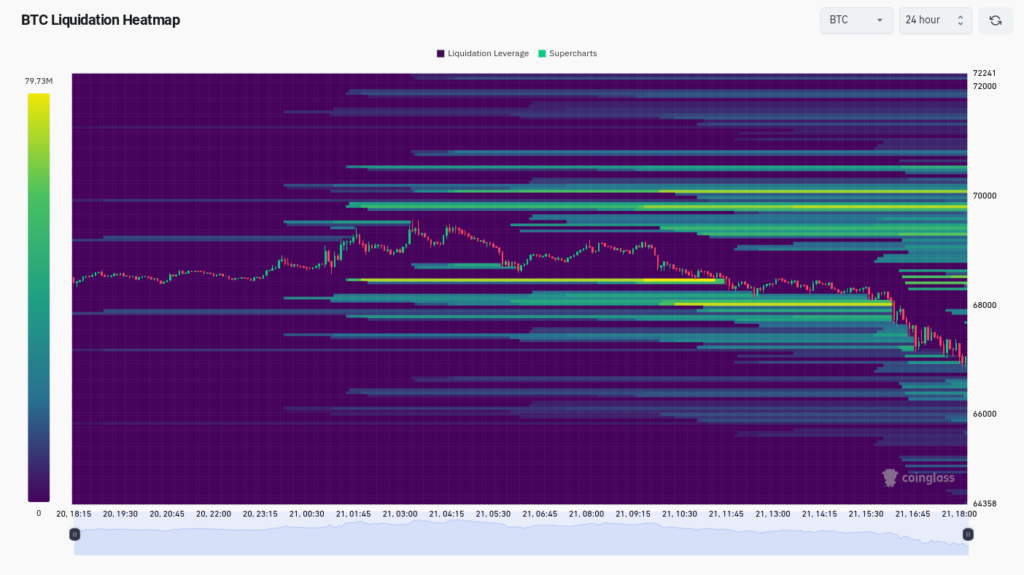

According to the most recent data from the monitoring tool CoinGlass, buyers boosted interest closer to $66,000, consuming bid-side liquidity in BTC/USD.

Bitcoin was defined as “having a flash sale” by trading resource Material Indicators after analyzing liquidity circumstances on Binance, the largest worldwide exchange.

Co-founder Keith Alan emphasized in a different X conversation that total candles must close over $69,000 for bulls to have a chance to test the all-time highs set in March.

He said earlier in the day, “Remember the importance of historical and technical resistance at the 2021 Top, even though there is heavy ask liquidity stacked above $70k.”

“We may see some high wicks, but I don’t expect a sustainable run to ATH territory without full candles printing above $69k.”