Bitcoin falls over 3% to $114,750 as Galaxy Digital sells $1.18B in BTC, sparking $646M in liquidations, with $152M in BTC longs wiped out.

Over the past 24 hours, the price of Bitcoin has decreased by 3%. This follows the recent sale of $1.18 billion in Bitcoin by Galaxy Digital. Consequently, cryptocurrency investors raced to mitigate their losses, erasing hundreds of millions of dollars in leveraged positions.

The price of bitcoin is declining as a result of the Galaxy Digital sell-off

The price of Bitcoin (BTC) has declined by over 3% today, following recent market rallies. This decline results from significant sell-offs by Galaxy Digital, which have significantly impacted the entire cryptocurrency market.

Additionally, automated sell orders were initiated when Bitcoin dropped below its 7-day simple moving average of $118,257 and breached the 23.6% Fibonacci retracement at $118,859, as indicated by data from CoinMarketCap.

The bearish turn was bolstered by momentum indicators, which indicated that further declines were likely, as the RSI remained above oversold territory and the MACD histogram dropped to -166. The psychological support levels of $115,000 and $116,241 are critical.

Galaxy Digital is transitioning its focus to Ethereum-based systems, which indicates a more general institutional trend toward portfolio rebalancing. On CNBC, CEO Mike Novogratz recently lauded Ethereum’s potential over Bitcoin and identified tightening supply and increasing institutional inflows as significant factors in future development.

Despite acknowledging Bitcoin’s status as a dependable and protective asset, his remarks indicate a growing preference for Ethereum’s potential in the evolving cryptocurrency landscape.

Galaxy Digital Dispenses $1.18B BTC To Major Exchanges

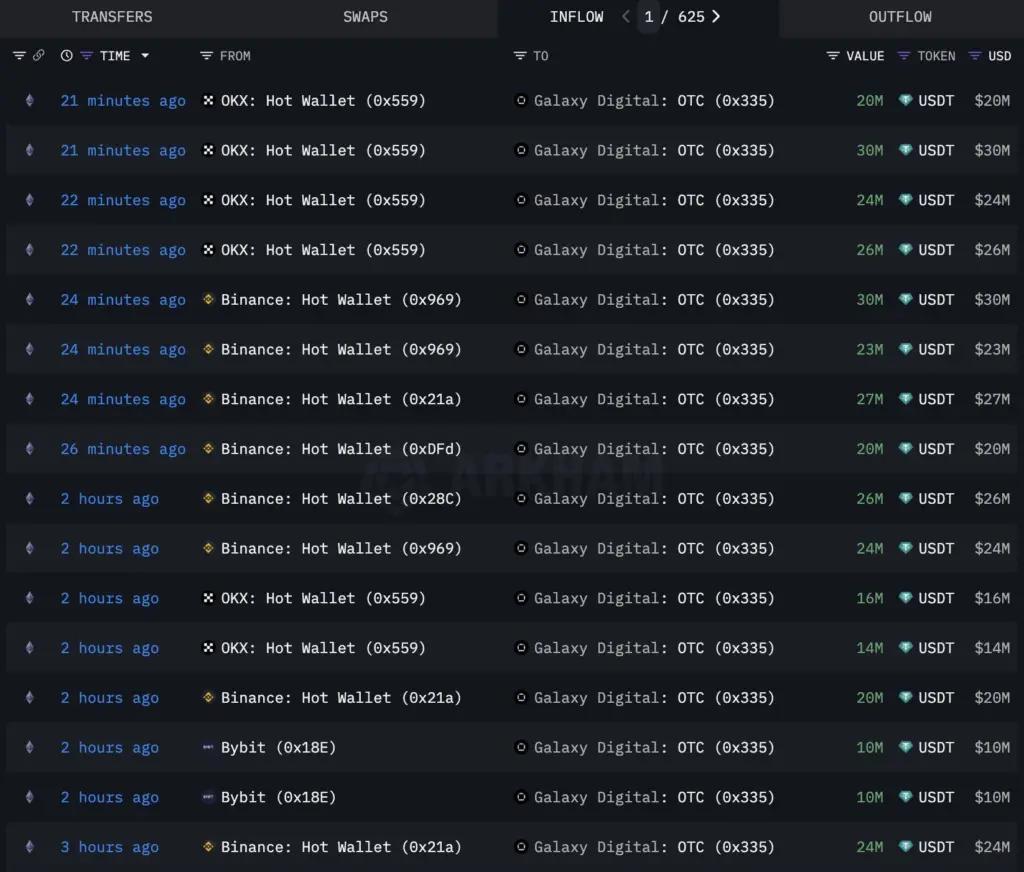

Galaxy Digital deposited over 10,000 BTC, valued at approximately $1.18 billion, to prominent exchanges, such as Binance and OKX, within a brief period, according to on-chain data from LookonChain. This is the most significant dump by Galaxy Digital since it acquired approximately $2 billion in Bitcoin from a Satoshi-era whale just a few weeks ago.

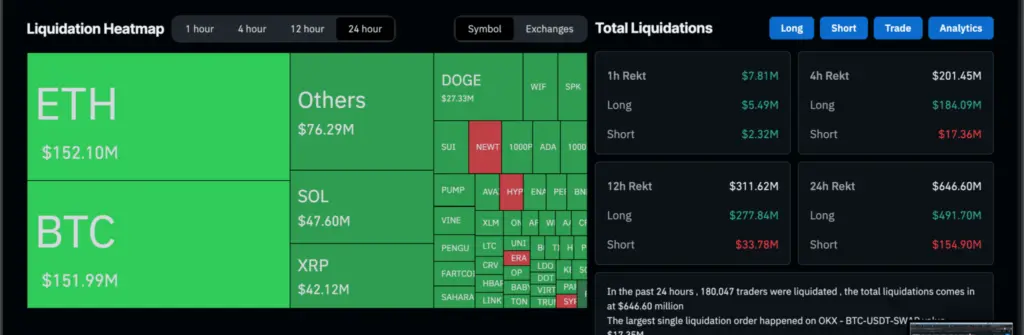

Galaxy Digital withdrew nearly $370 million in USDT from exchanges, verifying that they had sold off most of their BTC, and the BTC price plummeted by over 3% in under eight hours following the dump. In the same period, Coinglass data indicated that the total crypto market liquidations exceeded $646 million within 24 hours, resulting in the loss of approximately $152 million in BTC long positions.

After Galaxy CEO Mike Novogratz indicated that ETH might outperform BTC in the coming months, Autism Capital speculated that Galaxy Digital’s move could be part of a broader portfolio rotation, potentially into Ethereum.

Although Galaxy Digital’s $1.18 billion Bitcoin exit resulted in an immediate decline, some analysts regard the sell-off as a “healthy reset” rather than a long-term adverse reversal. Traders’ attention was diverted to cash and alternative assets, which led to a 3% decrease in Bitcoin’s dominance. Nevertheless, the open interest in derivatives decreased by only 14%, indicating that investors continue to exercise caution.