Bitcoin price eyes new ATH before June ends as it flashes three bullish signals, including a 10-year low in exchange flows and a 6% rebound.

Bitcoin (BTC) is up 6% after a third consecutive day of price action, which has been upward despite the severe weekend sell-off.

This favorable outlook, in conjunction with the fact that exchange volumes have reached a 10-year low, presents an exceedingly optimistic scenario for the cryptocurrency market.

Could this be a sign of an all-time high (ATH) for Bitcoin? We will investigate three potential explanations for the potential for a record high in June.

Bitcoin Price Increased By 6% Following Weekend Crash As Investors Buy On Dips

The BTC price experienced a 4.37% increase on Monday, which reversed the downward trend that had been in place for the previous three days, as indicated by the one-day chart.

This was succeeded by a nearly 1% increase on Tuesday, resulting in a daily close of 16,120.

The price of Bitcoin has increased by 0.47% and is currently trading at $106,618, effectively reversing the 8% decline observed last week.

This information was as of June 25, 2025.

Reason 1: Exchange Volume Reaches 10-Year Low; Is ATH Next?

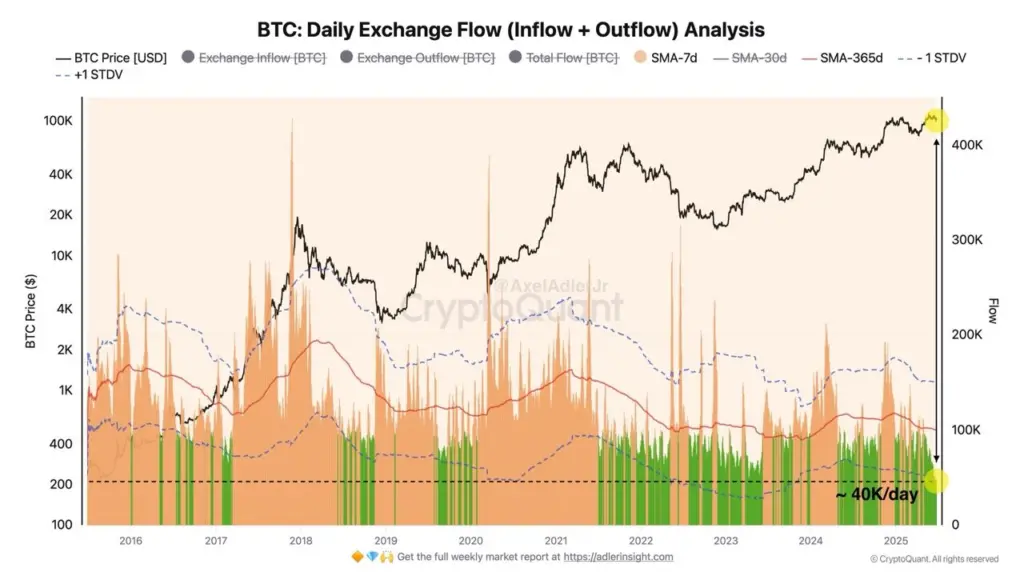

The Daily Exchange Flow has decreased to 40,000 BTC per day, a level that was last observed a decade ago, according to CryptoQuant data.

The sudden decrease in BTC prices on centralized exchanges clearly indicates a liquidity scarcity in the face of increasing institutional interest and spotting Bitcoin ETF flows.

A bottom formation was indicated by a decrease in this metric in 2016 and 2017.

The same phenomenon was observed in late 2018 and early 2019.

In both instances, the Bitcoin price initiated a significant bull run that propelled it to new all-time highs.

Before the bull run resumed in 2022 and 2023, the exchange traffic was low for an extended period, resulting in the BTC price reaching a new all-time high.

BTC exchange reserves have remained low since mid-2024, indicating a similar outlook.

Consequently, there is a high likelihood that the Bitcoin price will resume its bull run and reach new highs if history repeats itself.

Reason 2: Bullish Engulfing Candlestick

An optimistic engulfing candlestick is currently in effect on the weekly Bitcoin price chart.

Investors are monitoring this event for additional affirmation of the recovery, as only four days remain until the weekly close.

Although the daily Bitcoin price chart may appear adverse, the weekly chart presents a different perspective.

The weekly FVG was extended from $97.9K to $100.7K due to the mid-June decline, which supported BTC.

The subsequent rebound indicates potential if the weekly candlestick concludes with a decisive close above $105,633.

This action will validate a bullish, engulfing candlestick and attract sidelined buyers.

Reason 3: Intervention, Pause In Middle East Conflict Of Trump

The Iran-Israel conflict resulted in a decline in risk-on markets, including stocks and cryptocurrencies.

The Iranian parliament’s decision to close the Strait of Hormuz significantly impacted the oil market.

Nevertheless, the markets were temporarily alleviated by the intervention of US President Donald Trump and the mutually agreed cessation.

Although Iran violated the ceasefire, the potential for a prolonged period of peace in the Middle East could catalyze a significant increase in the price of Bitcoin.

Final Thoughts

Bitcoin is only 5.13% away from recapturing its all-time high from the present price.

In conjunction with the bullish Bitcoin price prediction for 2025, the engulfing candlestick possibility, and a decline in exchange reserves to a 10-year low, the odds are skewed in favor of bulls, resulting in an ATH.

Furthermore, the conclusion of the month frequently results in volatility and may serve as an impetus for Bitcoin (BTC) to experience a rally.