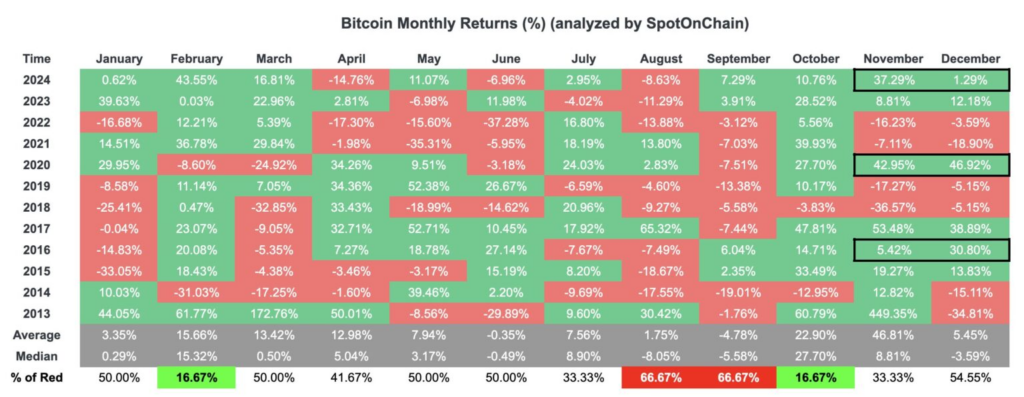

Bitcoin price typically rallies 30-46% in December after elections, potentially driving its price up to $141K.

In November, the Bitcoin price experienced a substantial 37.3% increase in response to Donald Trump’s victory in the November US Presidential elections.

According to historical data, the BTC rally has the potential to extend by an additional 46% in December.

Although BTC is presently hovering around $96,600, this rally has the potential to propel it to $141,000 by the end of the year.

Is It Possible For Bitcoin Price To Increase In December?

Bitcoin anticipates a robust conclusion to the year in December, following a remarkable 37.3% increase in November.

Spot On Chain, a blockchain analytics platform, reported that Bitcoin price has historically increased by an average of 30-46% in December following the elections.

At the time of publication, the price of Bitcoin (BTC) is $96,922, with a market capitalization of $1.918 trillion.

Consequently, the $100,000 threshold appears to be readily achievable if Bitcoin can replicate its previous performance.

Their updated model now anticipates that BTC could reach $115K by the end of December if we contemplate 30% gains from here, as a result of the new FOMO-driven market dynamics.

BTC’s price rally may extend to $141K by December’s conclusion in the event of a 46% surge.

Additionally, BitBoy, a renowned crypto analyst, anticipates that the Bitcoin price will increase to $100,000 within the next 48 hours.

BitBoy’s forecast is predicated on the future perpetual data of Bitcoin.

He observed:

“It’s time guys. The next 48 hours. BTC will hit $100,000. The moment we have waited for. Cherish it. We will only get it once”.

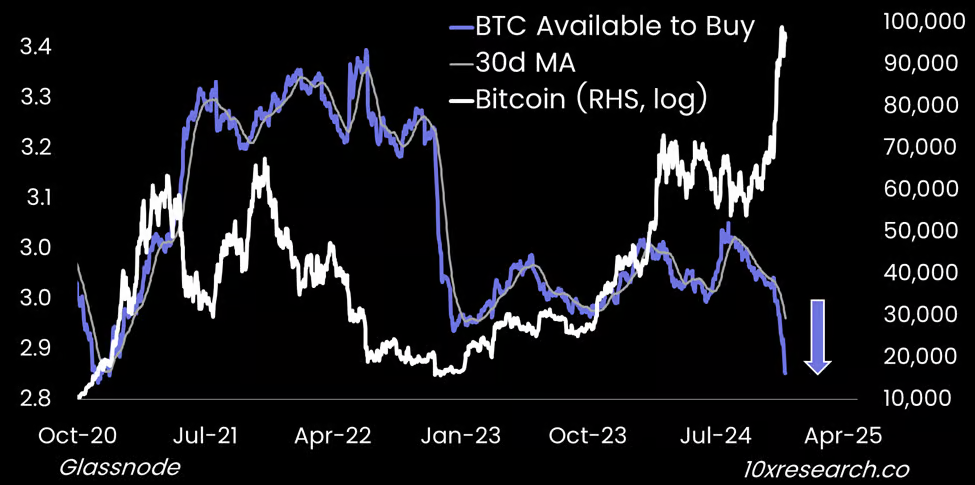

Bitcoin Exchange Reserves Are Experiencing Substantial Decline

In accordance with the data from 10x Research, the Bitcoin supply from the exchanges may be diminishing rapidly.

In contrast to the late summer influx, which temporarily increased exchange inventories, the most recent on-chain data indicates a significant decrease in supply.

Additionally, Bitcoin’s long-term proprietors are resolute in their refusal to release the cryptocurrency into the market. This has the potential to serve as an additional impetus for the Bitcoin price.

Conversely, Bitcoin ETFs have attracted over $31 billion in inflows since their inception, thereby absorbing a substantial amount of market supply.

The BlackRock traditional funds are also pursuing exposure to identify Bitcoin ETFs, as previously reported.

10x Research has reported that the current inventory of BTC is sufficient for only three exchanges: Binance, Coinbase, and Bitfinex. In addition, it included:

“Considering that $30 billion in Bitcoin ETF inflows would only secure 300,000 BTC at current prices, Bitfinex’s reserves could last about one year, while Binance and Coinbase have enough supply”.

This was also corroborated by seasoned Bitcoin analyst Willy Woo, who stated, “If you desire situational awareness of the situation, examine the BTC reserves on exchanges; they are nothing short of a supply shock.”

I am unaware of the purchaser, but short-term speculators are disposing of their coins to a BTC vacuum cleaner.