Bitcoin price rally hits $100K as whales add 20,000 BTC and Tether prints more USDT in 24 hours, signaling potential further gains.

The Bitcoin price is experiencing a robust rebound, regaining the lost ground and reaching $100K levels.

As Tether continues to print additional USDT, the market is inundated with sufficient liquidity, which is why BTC’s upward trajectory remains unwavering.

In addition, the accumulation of BTC whales and on-chain indicators indicates that we have not yet reached the peak.

Bitcoin Price Rally Has Potential To Reach New All-Time High

The BTC price has rebounded from the $96,000 support level in the past 24 hours.

The Bitcoin price was trading at $99,376 a 2.17% increase as of press time, with a market capitalization of $1.97 trillion.

Nevertheless, the daily transaction volumes of BTC have decreased by 33% to $84 billion.

Heavy accumulation of Bitcoin whales has persisted during the most recent Bitcoin price decline, according to on-chain indicators.

According to crypto analyst Ali Martinez, Bitcoin whales have acquired 20,000 BTC valued at $2 billion in the past 24 hours, following the decline to $96,000.

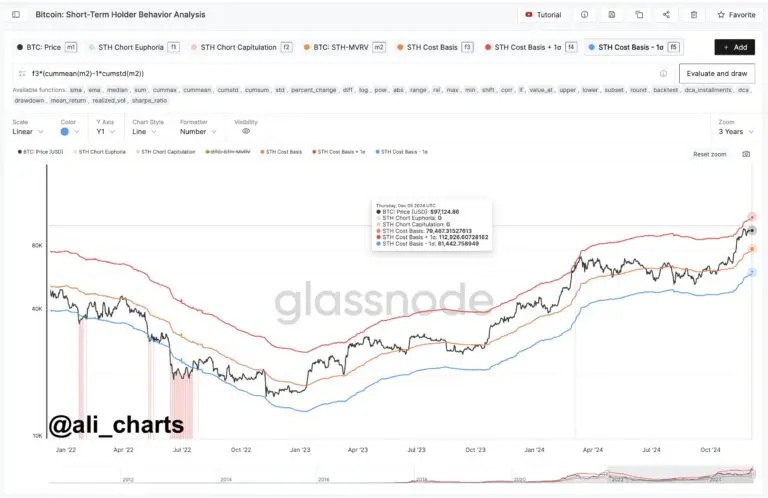

Martinez also emphasized that local Bitcoin price peaks frequently correspond to levels that are approximately one standard deviation above the Short-Term Holder Cost Basis.

At present, the key level is estimated to be $112,926, which could indicate a critical resistance point for the foremost cryptocurrency.

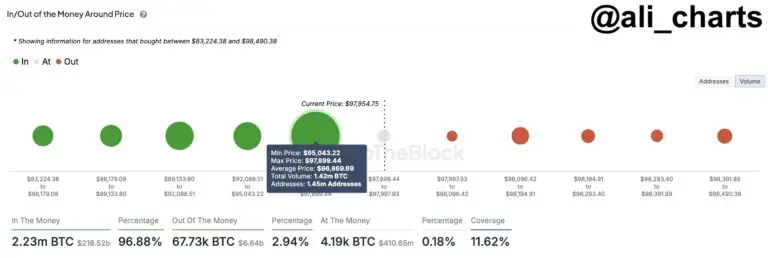

According to Ali Martinez, an on-chain analyst, the most significant support level for Bitcoin is presently $96,870.

The data indicates that approximately 1.45 million addresses collectively acquired 1.42 million BTC at this price point, indicating that it is a critical demand zone.

Martinez posits that Bitcoin’s upward trajectory is likely to continue as long as this level remains stable.

Conversely, spot Bitcoin ETFs have maintained a robust rate of inflows, surpassing Satoshi Nakamoto’s total BTC holdings.

The total inflows on Friday were $376 million, with BlackRock’s IBIT alone contributing over $257 million.

IBIT achieved a significant milestone earlier this week by reaching $50 billion in AUM in less than a year of operation.

Tether’s USDT Printing Has Potential To Generate Additional Momentum

Tether, the stablecoin issuer, has issued an additional $2 billion in USDT on the Ethereum blockchain network, providing a further liquidity boost to Bitcoin and altcoins.

This increases the total USDT minted by Tether across Ethereum and Tron to $19 billion since November 6, with $4 billion issued in the past four days, as reported by Spot On Chain.

The Bitcoin price has surpassed the $100,000 threshold on two separate occasions amid the substantial inflow of new liquidity that has occurred in the past month.

For this reason, market analysts anticipate that this rally will persist. Tether’s dominance in the crypto market is further bolstered by this development.

Furthermore, Tether has been investigating alternative strategies to broaden its market presence.

Last month, Tether revealed the Wallet Development Kit (WDK), a self-custodial, open-source toolkit that is designed to enable developers to create Bitcoin and Tether (USDT) wallets.

The WDK will encourage financial autonomy by facilitating the autonomous management of digital assets by both human users and AI-driven systems.