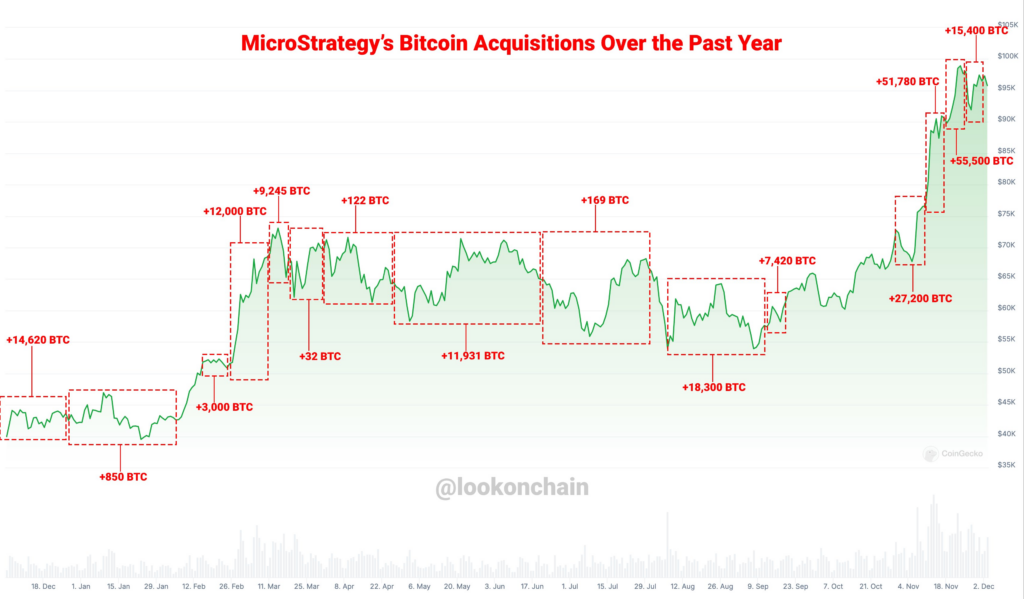

Bitcoin surges as MicroStrategy‘s $1.5B buy fuels optimism; traders eye the $100K milestone with fresh market momentum and bullish sentiment.

The week’s first Wall Street open is accompanied by an odd response from the bitcoin price to MicroStrategy’s most recent confirmation of greater exposure to the cryptocurrency.

At the December 2 Wall Street opening, BTC increased by $96.893 as a new wave of purchases by business analytics firm MicroStrategy stimulated markets.

Bitcoin welcomes the most recent MicroStrategy acquisitions.

During two hourly candles, Cointelegraph Markets Pro and TradingView data monitored Bitcoin price increases of almost $2,000.

Unlike its customary response, BTC/USD surged quickly when MicroStrategy disclosed that it had invested just under $1.5 billion to increase its BTC reserves.

According to a filing issued on December 2 with the US Securities and Exchange, which CEO Michael Saylor later confirmed, the transactions were made during the week ending December 1.

The inventor and CEO of the onchain analytics platform CryptoQuant, Ki Young Ju, offered commentary on the extent of MicroStrategy’s overall Bitcoin purchasing trend.

In a post on X, he wrote, “$MSTR spent $13.5B on 149,900 BTC, with holdings up $21.5B in 30 days.”

“Bitcoin market can’t absorb tens of billions short-term without driving prices up, making returns nearly inevitable. If BTC breaks $100K, the gains could grow even more as it enters price discovery.”

Furthermore, trading company QCP Capital recognized Saylor’s planned December 10 presentation to the board of Microsoft, another attempt to persuade the company to own a Bitcoin Treasury.

On December 10, Microsoft’s shareholders are expected to vote on a proposal to include Bitcoin on its financial sheet. In its most recent broadcast to Telegram channel users, it asked, “Could this be the catalyst that Bitcoin needs to break $100,000 before the year ends?”

“Microsoft’s top shareholders, such as Vanguard, BlackRock, and Fidelity, already have exposure to crypto with investments in MSTR, Coinbase, and other crypto firms. One could argue that they already possess sufficient exposure. On the other hand, if the proposal passes, it would be bullish not only for BTC but also for their other investments.”

An overbought RSI preceded bitcoin price recovery.

After starting to retest support below the $95,000 barrier, the price of Bitcoin was currently around $96,000.

However, traders continued to have a bright future as everyone was focused on the $100,000 milestone.

In his most recent short-term BTC price analysis, well-known trader Roman informed X followers, “Nice corrective upwards consolidation here, resetting RSI & other indicators.”

“We’re also seeing bullish divergences form while building volatility for higher. It’s a matter of time before 100k breaks!”

Roman referred to the relative strength index (RSI) indicator, which nearly fell below the day’s crucial “oversold” mark of 30 on hourly timeframes.