While Bitcoin price analysis identifies new hazards, Gold ignores the strength of the US dollar to outperform the S&P 500 year-to-date returns.

Gold beats both Bitcoin and the US dollar. Therefore, it’s only a “matter of time” before BTC$102,453 copies its all-time high.

The Kobeissi Letter, a trading resource, stated in an X thread on January 28 that the performance of Gold in 2025 is “telling us something.”

Bitcoin raises concerns as gold defies convention.

Gold is a macro asset far from rangebound, even though Bitcoin trades in limbo due to a lack of directional catalysts.

XAU/USD is up around half of the 10% year-to-date increase in BTC/USD, according to data from Cointelegraph Markets Pro and TradingView. The latter increased by 20% in 2024.

Kobeissi notes that the precious metal has moderated its conventional inverse link to the strength of the US dollar and has disregarded volatility shocks like this week’s DeepSeek AI fear.

“Gold prices have risen sharply, even as volatility shook the S&P 500. Even as the US Dollar hit a new 52-week high and the 10-year note yield broke 4.80%, Gold surged,” it wrote.

“Historically speaking, gold should be down sharply. The opposite is happening.”

Bitcoin’s relationship to dollar strength, as measured via the US dollar index (DXY), has long been a topic of discussion.

For market participants, however, the outcome for BTC/USD in the face of rampant gold upside is clear.

“All things aside, Gold will make a new all-time high. It’s a matter of time before Bitcoin follows,” trader, analyst, and entrepreneur Michaël van de Poppe told X followers on January 29.

BTC price needs a key rebound

A popular theory suggests that Bitcoin lags behind Gold by several months before ultimately copying its trajectory.

Not everyone, however, believes that this status quo will continue for long.

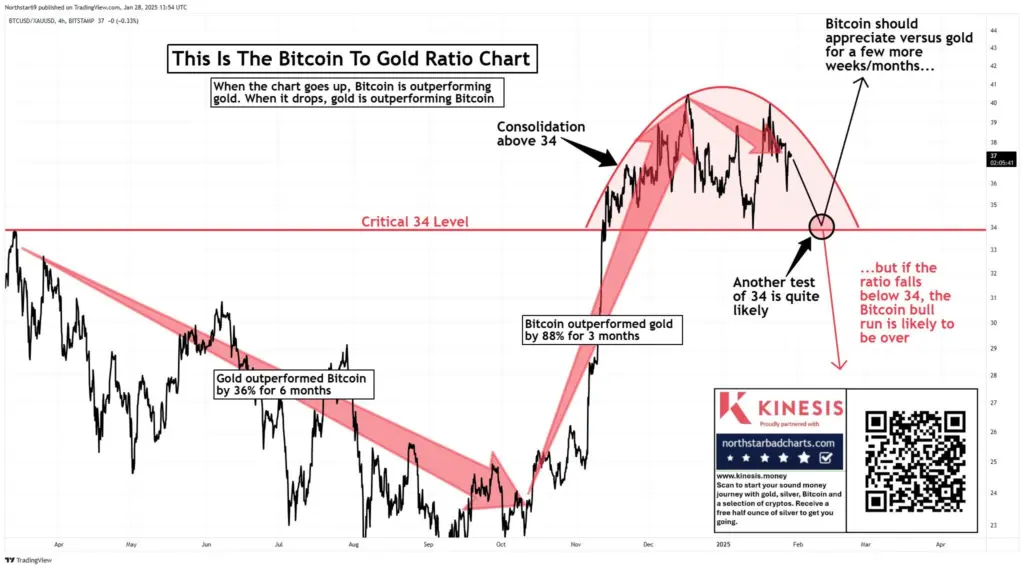

Analyzing the Bitcoin-to-gold ratio, popular X analytics account Northstar warned that a “critical” level was at risk of being violated.

The ratio set new all-time highs of its own in December 2024.

“Bitcoin should break out versus gold after this consolidation here, BUT if the ratio falls below 34, the bull run may end,” one of several recent posts on the topic read.

“No need for any narrative or bias. Just observe the evidence as it unfolds. In this case it will be very clear…one way or the other.”

An accompanying chart showed that, in the best situation, BTC price strength should gain on gold for “a few more weeks/months.”