Bitcoin may be on the cusp of its “main breakout” if RSI indicators resemble the ascent to late 2017’s $20,000 highs

Bitcoin BTC

Popular trader Jelle predicted in a May 24 post on X (previously Twitter) what might transpire as the subsequent “main breakout” in Bitcoin price action.

The price of Bitcoin is “extremely similar to early 2017,” according to one trader.

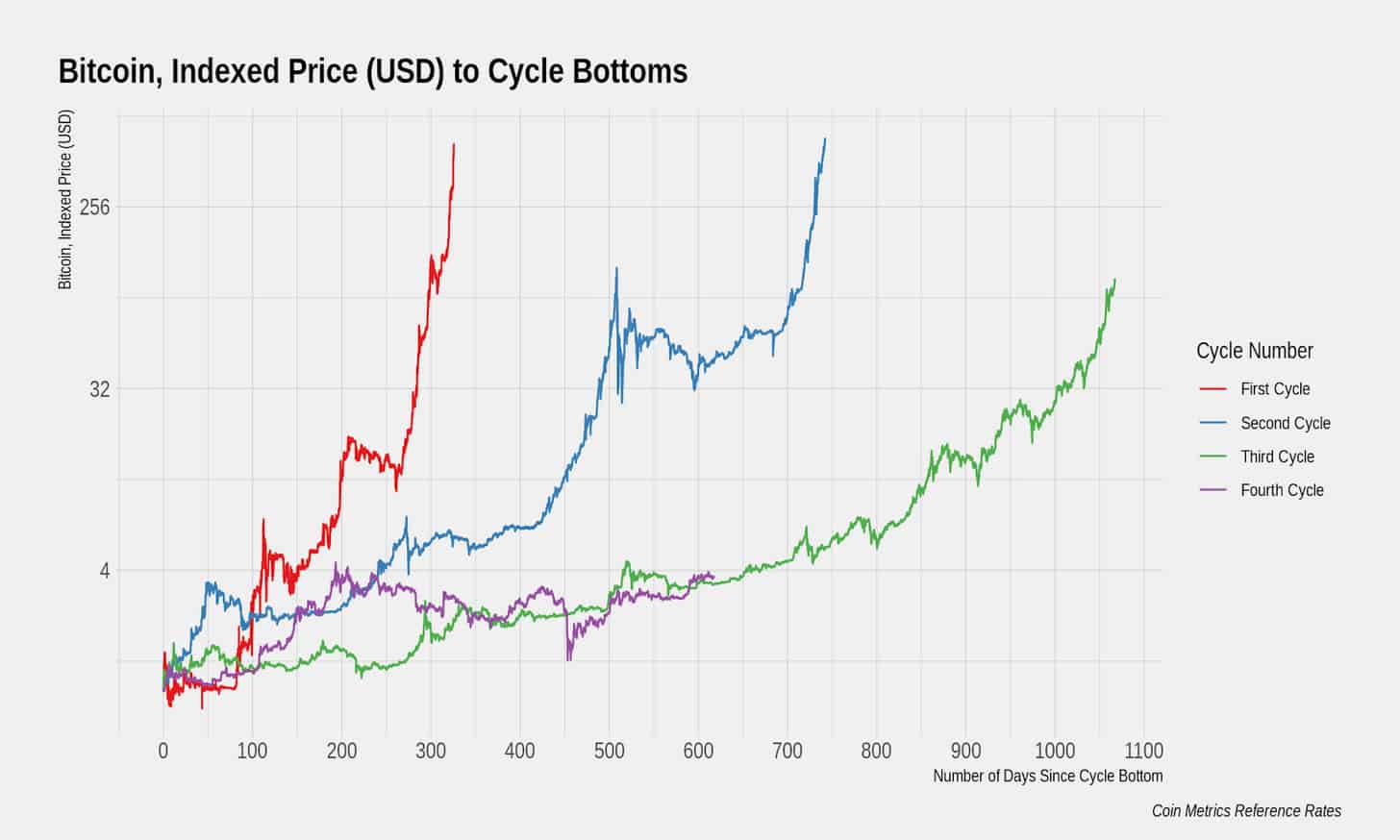

Analysis of Bitcoin frequently identifies parallels between the current bull cycle and its two most recent predecessors (2016) and 2020-21.

Even though 2024 has previously set a new all-time high without a block subsidy halving, an abundance of data indicates that Bitcoin’s most substantial gains remain.

The relative strength index (RSI) is a significant facilitating element for Jelle.

RSI measures the degree to which an asset is overbought or oversold at a given level, and the BTC/USD pair presents an intriguing picture on weekly timeframes.

“The current state of Bitcoin is strikingly similar to the beginning of 2017,” Jelle said.

A companion chart contrasted the performance of the BTC/USD from its ascent to its all-time high of $20,000 in 2017 to its current trajectory since January 2023.

As it did seven years ago, the RSI is declining as the price approaches all-time highs.

“Before the main breakout, there was a bullish divergence and turbulent waters near the previous all-time highs,” Jelle explained.

“Clear $75,000, and this accelerates quickly.”

Bitcoin has historically experienced its most robust upward movement when the RSI is in the “overbought” zone above 70. Such measurements may persist substantially before the Bitcoin price surge becomes untenable.

Could Bitcoin recover to $60,000?

The preliminary sanction of spot Ether ETH

This week, exchange-traded funds (ETFs) in the United States did little to support the price of either coin.

With the BTC/USD pair remaining rangebound, there are demands for a return to $60,000 or even lower. Prominent traders Credible Crypto and Michaël van de Poppe, founder and CEO of trading firm MNTrading, are among those who have predicted this outcome.

“Within the range, Bitcoin is consolidating,” the latter wrote in one of his most recent X postings.

“Probably that consolidation will be taking place for a longer period and I suspect we might see $61-63K even.”

Van de Poppe further stated that around the time of the ETF launch, liquidity was “rotating” from Bitcoin to Ether, but everything was “fine.”