Before Tether created $1.3 billion worth of stablecoins, the price of Bitcoin saw a local low and recovered by more than 21%.

Over the last two days, institutional investors have stopped buying stablecoins, which has caused the price of Bitcoin to fall below a crucial psychological level.

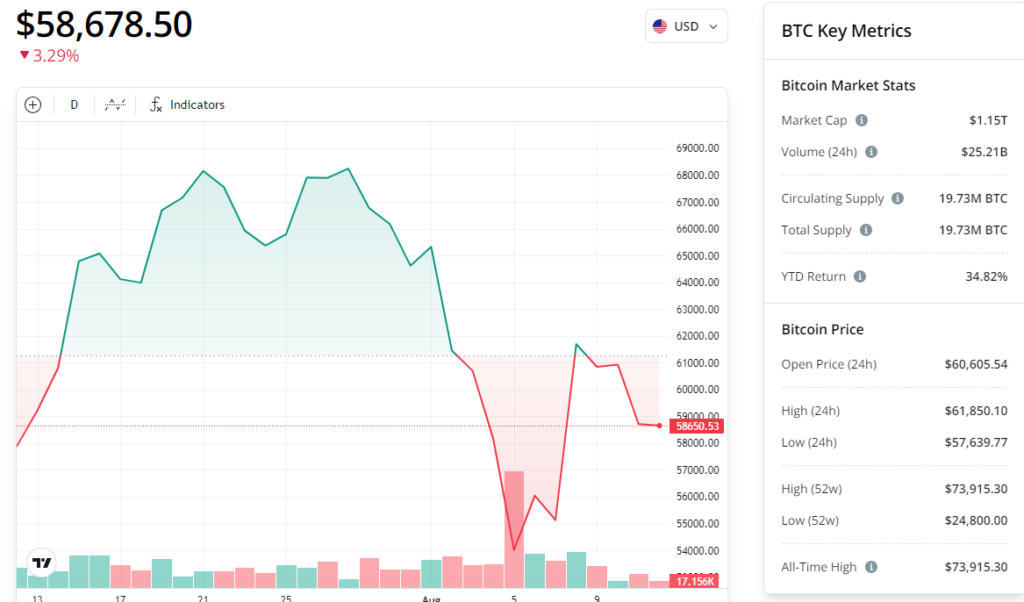

The price of BTC$58,285 dropped 3.9% the previous day, closing at $58,930 as of 08:03 am UTC on August 12, from a weekly high of $62,510.

An August 12 X post from onchain analytics site Lookonchain suggests that the decline below the $60,000 threshold was probably brought on large institutions ending their stablecoin buying frenzy:

“Institutions seem to have temporarily stopped buying, and the price of $BTC dropped 4.5% today! We noticed that institutions stopped receiving $USDT from #TetherTreasury and transferring it to exchanges 2 days ago.”

Since stablecoins are investors’ primary on-ramp to transition from the fiat to the cryptocurrency sector, a lack of institutional stablecoin inflows to crypto exchanges may indicate a lack of buying pressure and investor appetite for the underlying asset.

The $1.3 billion that Tether had previously made represented the local bottom.

Since the market bottomed on August 5 to August 9, Tether has generated almost $1.3 billion in stablecoins. Tether is the issuer of TetherUSDT$1.00, the largest stablecoin in the world.

Several of the most well-known centralized cryptocurrency exchanges, including Kraken, Coinbase, OKX, and Bullish, received $1.3 billion.

On August 5, the price of BTC reached a five-month low of over $49,500. By August 9, it had recovered by more than 21% to reach around $60,000.

The price of Bitcoin could overcome the psychological hurdle of $60,000 if significant institutional stablecoin inflows start up again.

According to an analyst, Bitcoin has to regain $60,000 for upward momentum.

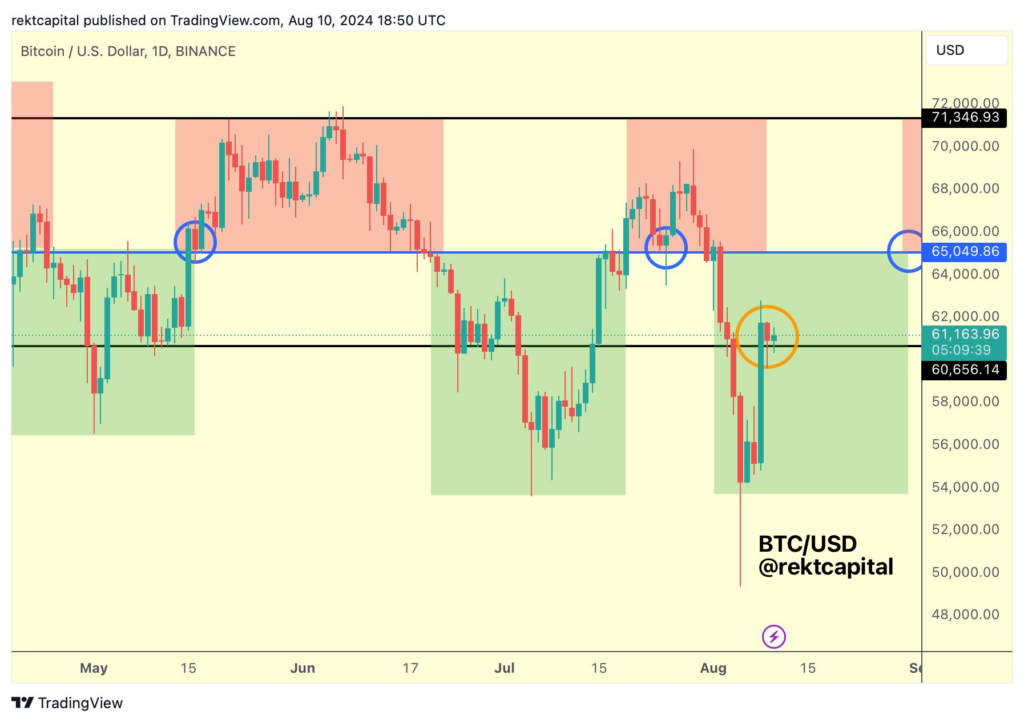

Technical research suggests that the next step up in the price of Bitcoin requires a rebound of $60,600, according to well-known analyst Rekt Capital, who posted on August 10 X:

“Bitcoin is doing all the right things to confirm $60,600 as support so as to position price for a revisit of $65,000+ over time.”

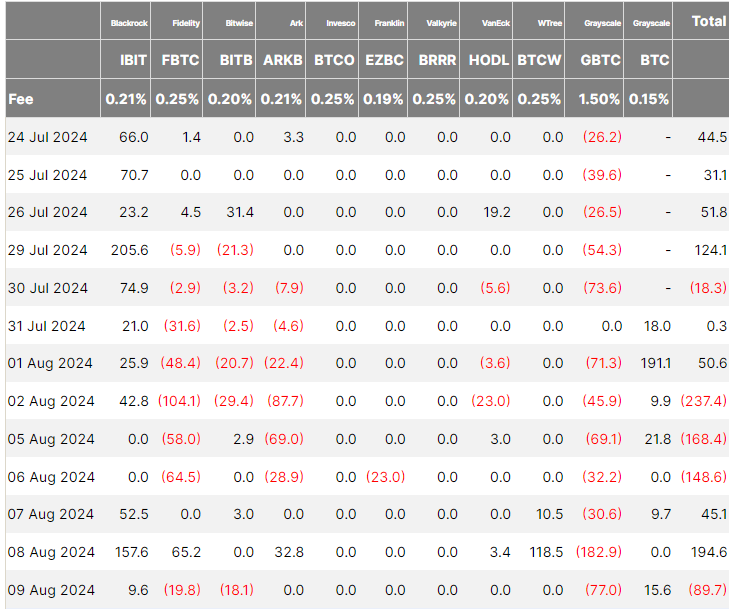

Still, little money is coming into the US-based spot Bitcoin exchange-traded funds (ETFs). According to Farside Investors statistics, the US Bitcoin ETFs experienced net negative outflows of approximately $89 million on August 9.

An increase in the price of a cryptocurrency can be attributed mainly to ETF inflows. Around 75% of fresh investments in Bitcoin came from ETFs by February 15, when the cryptocurrency crossed the $50,000 threshold.