Based on a weekly BTC price chart analysis, it can be concluded that Bitcoin volatility cues have only been so biased in favor of bulls twice.

According to fresh analysis, BTC$63,442 should increase “significantly” since extreme volatility is about to occur.

Head of macro analysis at financial advisory publication Global Macro Investor Julien Bittel hinted at a Bitcoin price of up to $190,000 in a post on X on July 19.

“Compressed” Bollinger Bands spark speculation about a six-figure Bitcoin price.

Should volatility signs materialize as they have in the past, BTC has the potential to soar to all-time highs of six figures.

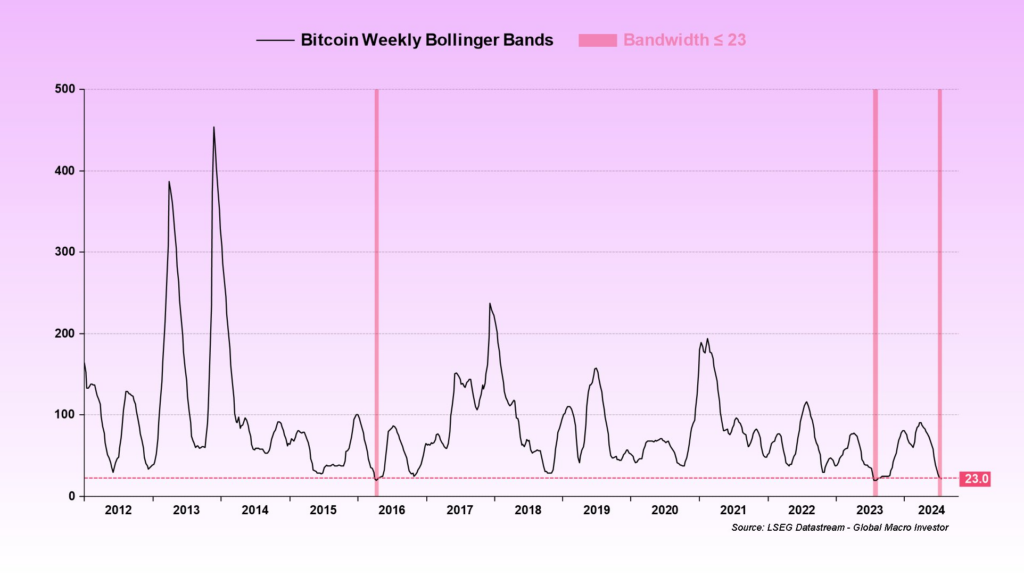

Bittel claims a sharp increase in BTC/USD is necessary due to the Bollinger Bands volatility indicator’s “crazy” status.

He said, “Bollinger Bands are crazy tight by historical standards.”

“Only two other months in history have we seen the weekly Bollinger Bands so compressed: April 2016 and July 2023.”

One of the most critical measures of cryptocurrency volatility is the Bollinger Band, which also provides information on price movements’ strength.

The distance between the upper and lower bands is seldom shorter on weekly timescales. For bulls, the news that usually follows has always been favorable.

Bittel said, “During the previous episodes, BTC prices increased significantly over the next 12 months.”

“A similar move this time around would target Bitcoin within a range of $140,000 to $190,000.”

In this bull market, the Bands have previously indicated a significant upside in the price of Bitcoin. Constriction prevented the run to local highs in late 2023, shortly before the United States spot Bitcoin exchange-traded funds (ETFs) launched.

Similar predictions about what the future might hold for Bitcoin were made by Bittel last month when he advised “patience” in the face of the bull market’s most significant price decline.

History indicates that September Bitcoin’s surge.

According to TradingView and Cointelegraph Markets Pro data, BTC/USD is up 11% over the last week at over $64,000 on July 19.

Only some believe the moment is perfect, even though price measures and trader confidence are rising. The bull market is expected to continue.

In contrast to the accumulating behavior exhibited by institutions and whales, a prominent feature absent from the ordinary bull market landscape is the absence of interest from mainstream retail investors.

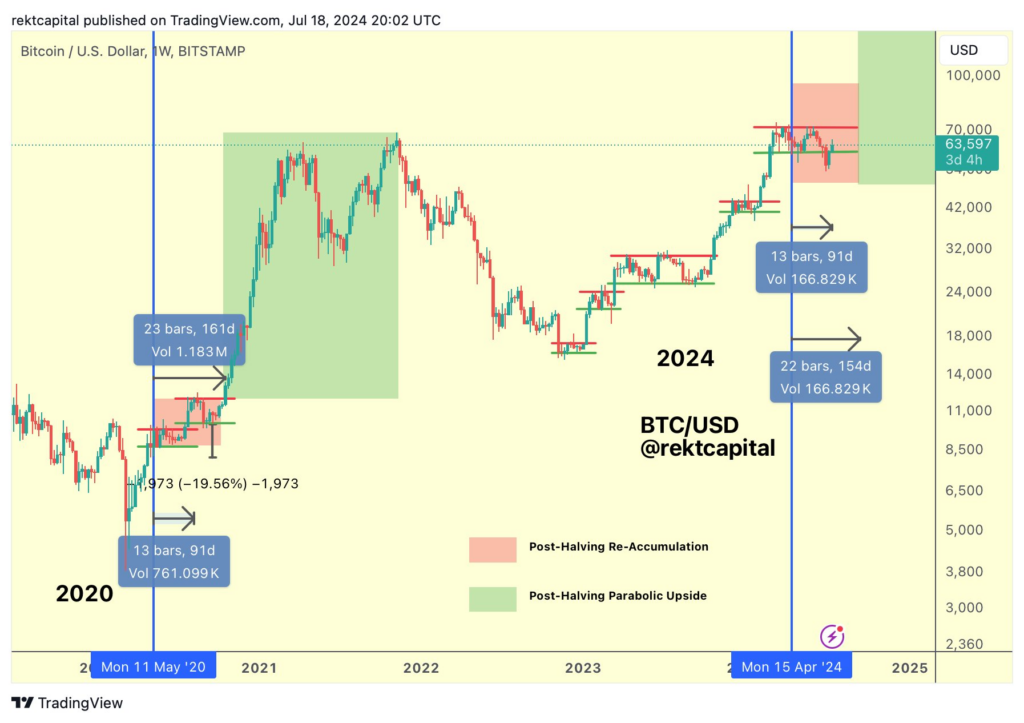

Famous trader Rekt Capital predicted that September would be the make-or-break month for Bitcoin’s resurgence by contrasting optimistic price cycles from the past with the present.

This week, he warned X followers, “If history repeats, a Bitcoin breakout from the Re-Accumulation Range will occur in September 2024.”