CryptoQuant reports Bitcoin’s unrealized losses signal a bottom, but recovery may take months, resembling the 2022 bear market.

A recent analysis cautions that an upside return could take months, putting BTC$57,682 traders facing losses akin to a bear market.

Bitcoin market circumstances are similar to those in late 2022, according to CryptoQuant, an on-chain analytics platform.

Coin profits reflect the post-FTX environment.

For BTC to enter a bull market again, several obstacles must be overcome, and miners and traders are under pressure.

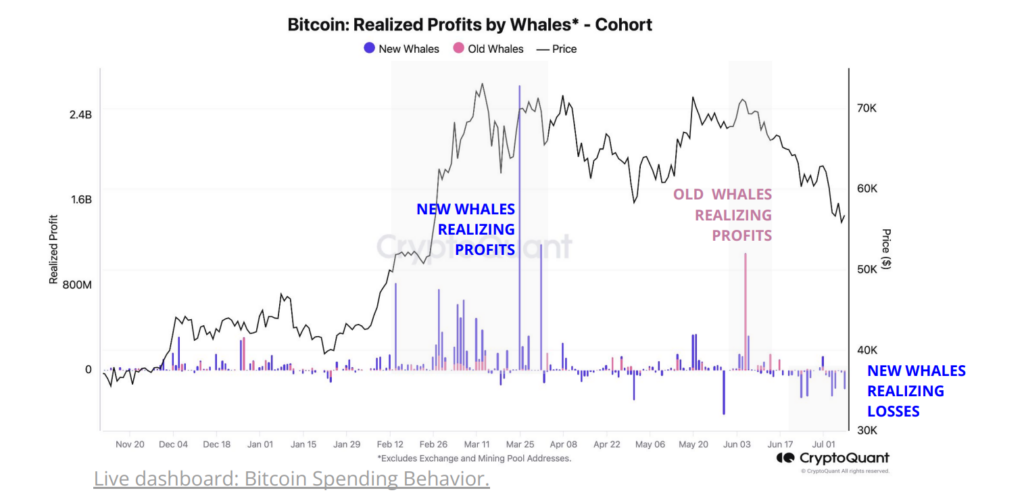

According to CryptoQuant, whales—recent large-volume investors—have distributed $1 billion worth of coins in July alone.

Realizing losses by both large and new investors may be a precursor to the bottom of the Bitcoin price. The statement read that this investor cohort had already made significant returns in February and March when prices reached a height of over $70,000.

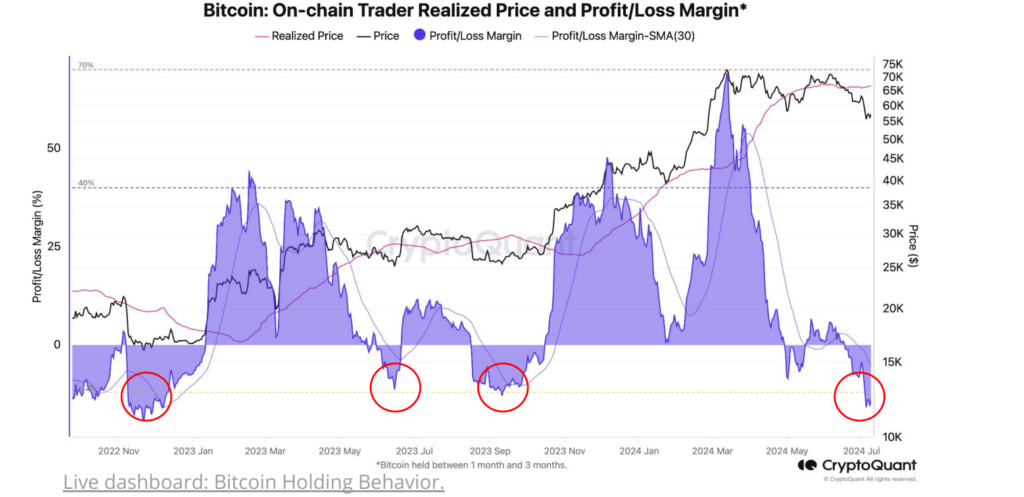

Traders currently have unrealized losses of 17%, the highest since the bottom of the previous Bitcoin bear market in December 2022, which is a stark contrast to the heyday of the bull run just a few months ago.

Similarly, Bitcoin dealers are currently running on negative margins and will only experience losses if they keep selling. The article continued, “Traders’ unrealized margins are currently -17%, the highest negative since just after the FTX exchange collapse in November 2022.

“Prices have typically bottomed-out when trader’s margins touch extremely negative levels as seen currently (red circles).”

The current realized price of traders, or their collective cost basis, was contrasted to unrealized profit margins in an accompanying chart.

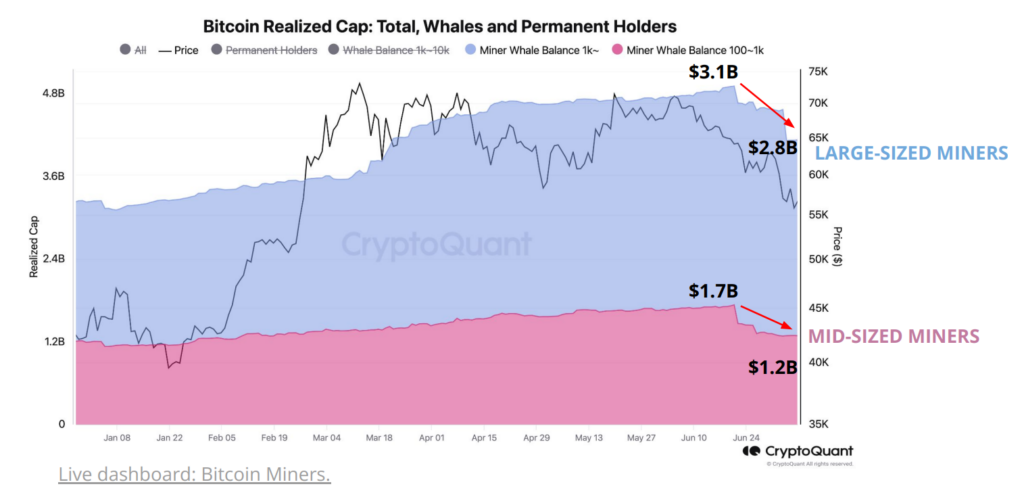

Bitcoin miners continue to boost sales.

CryptoQuant also pointed out that operators are finding it difficult to profit in the wake of April’s block subsidy halving, and miners are still in a state of “capitulation.”

Smaller miners, in particular, have been observed to leave the network due to a low hash fee, which lowers hashrate.

The study verifies, “Since June 20, large-size miners have sold about $300M, while mid-size miners have unloaded about $500M on a cost-basis.”

CEO of CryptoQuant Ki-Young Ju predicted that the cryptocurrency markets might remain “boring for the next 2-3 months” in a post on X, formerly Twitter, on July 9.

He said, ” Remain bullish but steer clear of excessive risk.”