A move toward range highs precedes Donald Trump’s address at the Bitcoin conference, and the behavior of the BTC price is similar to last week’s Deja vu.

Analysis cautions that the recent surge in bitcoin could be “impulsive” as markets prepare for significant news events.

Well-known trader Crypto Ed joined those expressing concern over the most recent BTC in a July 26 X post. BitcoinPrice surge of $67,077 over $67,000.

Bears on Bitcoin could yet make a clear “impulsive” move.

Although the price of Bitcoin has increased by almost 2% since the daily closure on July 25, only some are confident in the short-term strength of the currency.

The recovery for Crypto Ed from the previous day’s local lows of $63,430, consistent with the price behavior after the last week, is unexpected.

“Looks impulsive, bounces stronger than I was expecting yesterday,” he concluded.

“I expected a corrective bounce, followed by another leg lower towards 62k and maybe even lower.”

Nevertheless, the post noted that the market can still grant bulls’ wishes and reject requests for downside liquidity.

Although the intensity of the current bounce suggests that we have already completed leg two and are once again reaching new highs, that scenario is still plausible. Crypto Ed said, “I’ll let PA develop a little more to see if I was wrong on low TF,” and included an Elliott Wave graphic to explain his conclusion.

This included a longer-term goal price for Bitcoin of about $80,000, after which there might be a consolidation of gains that would bring the price back down to levels that are comparable to present ones.

There’s a lot of excitement surrounding Donald Trump’s potential presidential attendance at the Nashville Bitcoin 2024 conference. After openly announcing policy intentions that would benefit the cryptocurrency industry, Trump has come to be associated with a bright outlook for the market.

There have also been rumors that should Trump win, he might establish a US strategic reserve in Bitcoin.

Potential for a $63,500 Bitcoin price retest

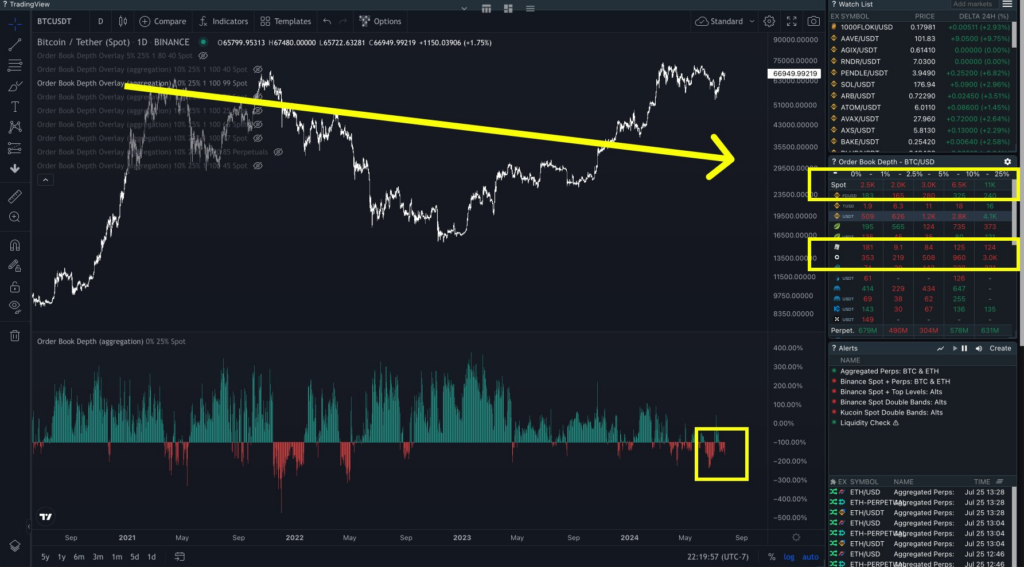

A well-known analyst, Cole Garner, continued his cautious stance by pointing out that order book depth is still biased downward.

“The aggregate spot bitcoin order book remains pessimistic. That day, he prophesied, “Moar sideways.”

According to trading resource Material Indicators, the critical tipping point for bulls is a BTC price target of $63,500 on the downside.

It stated that if the market fell to that point, the most recent uptrend flashing on its proprietary trading indicators would go null.