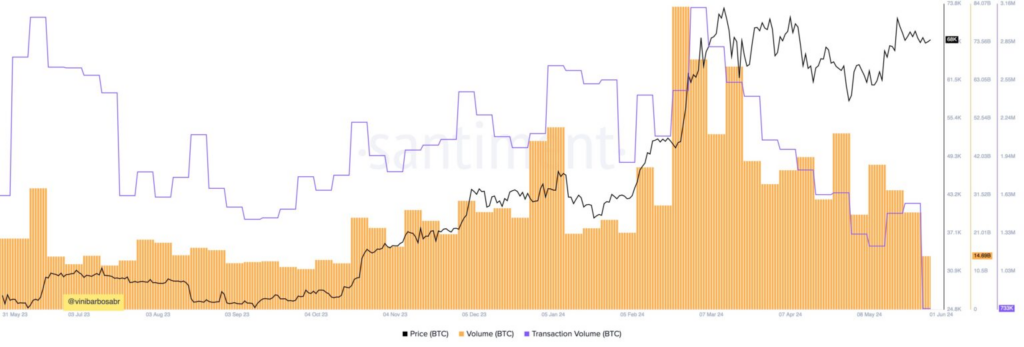

The weekly volume of Bitcoin transactions fell below $14 billion, the lowest since 2023 when the BTC price was below $30,000.

Even though the price of Bitcoin (BTC) has struggled to surpass $70,000 convincingly, altcoins are presently experiencing significant market movement. On-chain indicators indicate a substantial decline in trading interest in Bitcoin, which may portend an impending price decline.

Bitcoin Transactions Volumes See Major Drop

The unprecedented decline in Bitcoin transaction volume signifies a substantial transformation in the market dynamics. Volatility in Bitcoin spot and on-chain transactions has plummeted, with ETFs and derivatives now attracting the majority of attention.

Through these financial instruments, speculative demand is progressively dominating the Bitcoin market.

Notably, Bitcoin’s seven-day trading volume has decreased to less than $14 billion, the lowest level since 2023, when the BTC price was below $30,000.

Furthermore, the chart underscores a substantial decrease in enthusiasm for Bitcoin trading and on-chain transaction volumes, which could be more manageable.

In seven days, the network recorded a mere 722,000 BTC in transactions, which starkly contrasts the 1.79 million BTC that were moved in October 2023, despite the two months passing and the price being the same.

10x Research reports that in addition to Bitcoin, the volumes of the cryptocurrency market have decreased to $50 billion, with funding rates that are only marginally positive, suggesting a lack of interest.

Inflation data and Federal Reserve policy are the two most important factors that could drive Bitcoin to historical highs.

The Bank of Canada has the potential to commence a worldwide cycle of interest rate reductions on June 5, which could establish a precedent for the Federal Reserve. In addition, a decline of approximately 3.3% in the U.S. inflation report on June 12 would be necessary for Bitcoin to appreciate.

Positive Indicators To Watch

Despite the pause in spot trading activity, the Bitcoin derivatives market and interest in Bitcoin ETFs are robust.

In contrast, demand for the authorized Bitcoin spot ETFs has been substantial since their introduction in January 2024. These ETFs have generated a cumulative trading volume of $12 billion over the past week, equivalent to the spot volume of Bitcoin on cryptocurrency exchanges.

This suggests that trading regulated and custodial exchange-traded funds are becoming increasingly favored over Bitcoin.

Bitcoin exchange balances plummeting substantially indicate that billionaires are withdrawing their coins from exchanges in anticipation of price increases. With the withdrawal of 88,000 Bitcoins in the past month, the number of coins remaining on exchanges has dropped to its lowest level since March 2018.

This pattern of foreign currency outflows commenced on May 15, corresponding to the forty-five days since the 13F filing deadline for U.S. registered investors overseeing more than $100 million.