Bitcoin volatility drops below the S&P 500 and Nasdaq for the first time, signaling a rare shift in market dynamics, according to Galaxy Digital.

In April, Bitcoin surprised everyone by achieving double-digit increases with less volatility than significant traditional investments.

Analysts from Galaxy Digital claim that Bitcoin’s In contrast to the S&P 500’s 47.29 and the Nasdaq 100’s 51.26, the realized volatility of BTC$103,578 fell to 43.86 over the last ten trading sessions, which is an unusual “positioning for a digital asset traditionally known for its outsized volatility.”

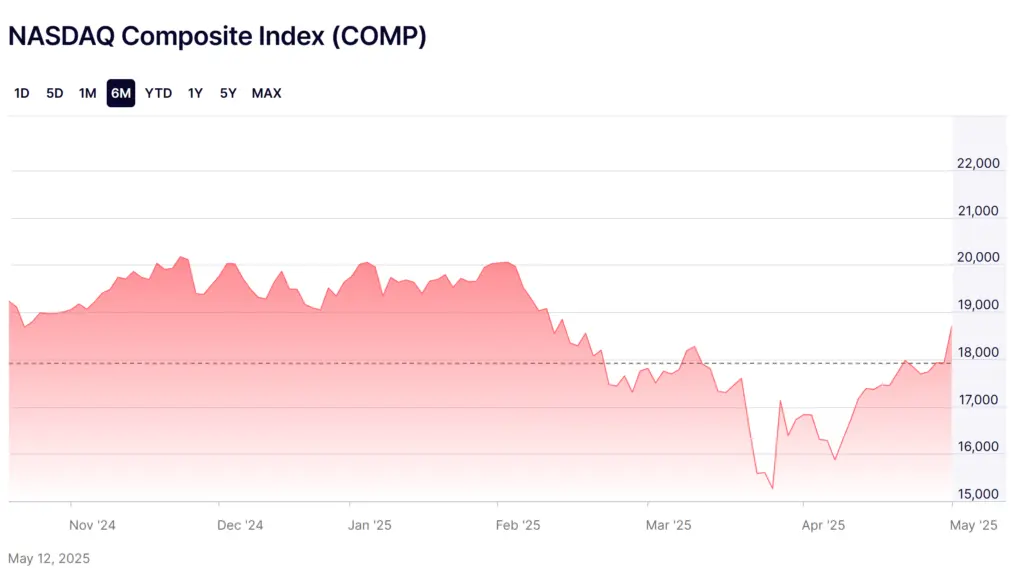

The data point is presented in the context of recent financial instability. Traditional markets have been shaky since US President Donald Trump announced tariffs on April 2.

According to a statement released by Galaxy Digital analysts on May 12, the Nasdaq Composite is flat, the Bloomberg Dollar Index dropped by almost 4%, and even gold, which is usually considered a haven, momentarily reached $3,500 per ounce before retreating to a 5.75% gain.

They did point out that Bitcoin rose 11% during that time, confirming its developing function as a macro hedge in the face of fiscal and geopolitical uncertainties.

The link between Bitcoin and major indexes is declining.

According to the analysts, BTC continues to have strong 30-day correlations with key indexes, ranging from 0.62 with the S&P to 0.64 with the Nasdaq. Its beta has decreased, suggesting that investors may consider it more of a long-term investment than a high-risk one.

Chris Rhine, the head of liquid active strategies at Galaxy, asserts that because Bitcoin is a non-sovereign asset, an investor does not require the full faith or tax basis of a nation to support the integrity of the asset.

According to Galaxy, the current investor behavior is similar to that seen during the US-China trade tensions in 2018 and 2019, when Bitcoin surged in the face of growing international unpredictability.

According to Hank Huang, CEO of Kronos Research, rising ETF inflows and the strategy’s continuous Bitcoin purchases are transforming Bitcoin into a digital gold that is less dependent on stocks.

“Volatility decreases as institutions increase liquidity, making BTC a fundamental component of portfolios,” Huang continued.

Institutions see Bitcoin as a hedge.

According to Galaxy’s OTC trading desk, the market posture is “tactically cautious but structurally constructive,” characterized by low hedging stress and disciplined leverage.

With 95% of its total supply already mined and growing interest from institutions, ETFs, and governments, BTC is gaining recognition as a digital store of value.

“Bitcoin’s supply and demand dynamics are solidifying its place as a mature digital store of value,” said Ian Kolman, co-portfolio manager at Galaxy.

BlackRock’s head of thematics and active ETFs, Jay Jacobs, stated on April 25 that there has been a long-term trend in which nations have been shifting away from dollar-based reserves and toward assets like gold and, more recently, Bitcoin.

He noted that geopolitical fragmentation drives the demand for uncorrelated assets and that people are increasingly viewing BTC and gold as safe-haven investments.