Bitcoin whales buy dips to $95,788, driving a surge as BTC charts signal a potential new all-time high of $100,000 today.

Since there has been an increase in bitcoin whale activity over the past day, there may be upward pressure for the price of BTC to surge to $100,000 today.

Six fresh Bitcoin whales wallets have taken out more than 1,110 Bitcoins from the cryptocurrency exchange Binance in the last few hours.

Bitcoin Whales Gather Dips

According to Lookonchain, a blockchain analytics firm, Bitcoin whales and major investors have been hoarding BTC in recent years as the price of the cryptocurrency has dropped to $97000.

Over the last eight hours, a total of 1,110 BTC, or around $107.7 million, was taken out of the Binance exchange by six newly established wallets.

Despite ongoing market volatility, this action indicates that significant holders of Bitcoin are becoming more confident in the cryptocurrency’s long-term prospects.

Furthermore, 60,000 addresses have bought 22,740 BTC above the current price, according to data from IntoTheBlock.

A strong foundation for a possible upward move has been established by the astounding 344,000 BTC that 458,000 addresses have amassed.

This solid support might act as a spur for the next significant increase in the price of bitcoin.

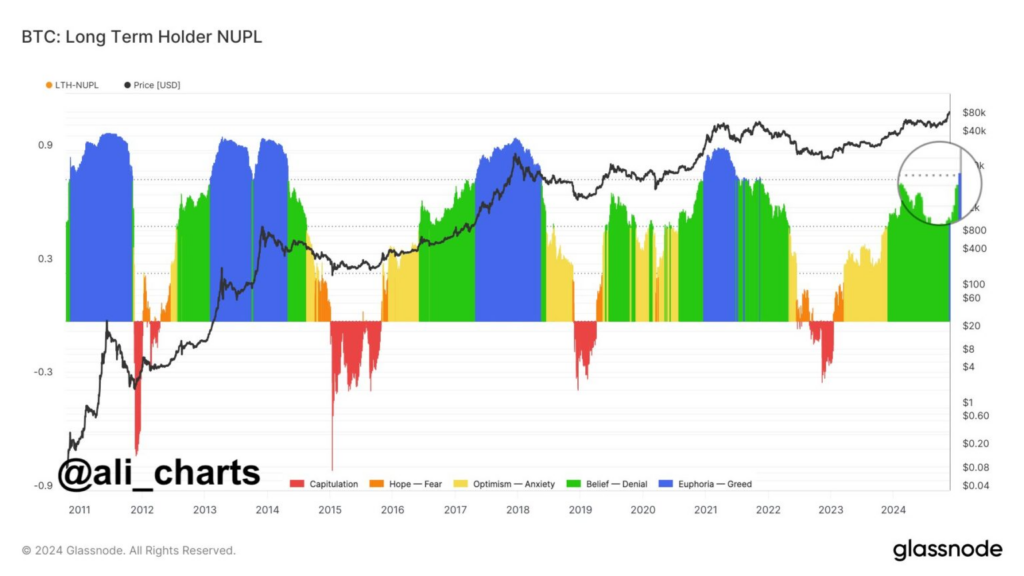

However, long-term holders are displaying signs of “greed,” according to cryptocurrency analyst Ali Martinez. Such activity has historically preceded market peaks and comparable patterns point to an 8–11 month timeframe for Bitcoin’s peak.

According to Martinez, forecasts point to a possible Bitcoin market peak between June and September 2025 if the trend holds.

Will Bitcoin Reach $100K Today?

On the technical chart, the price of Bitcoin is still strong. Bitcoin has recovered from its intraday low of $95,788 once more.

With a market valuation of $1.95 trillion, the price of Bitcoin is up 0.60% at $98,650 as of this writing.

Amid the ongoing Bitcoin whale activity, cryptocurrency researcher Ali Martinez points to a bullish signal for Bitcoin (BTC) when the SuperTrend indicator goes positive on the hourly chart.

This change coincides with a rising Relative Strength Index (RSI) with Bitcoin breaking over a crucial resistance trendline.

According to Martinez, these events might pave the way for a significant price spike, which might signal the eagerly anticipated climb toward $100,000. It might be today, the expert wrote.

Additionally, there has been a sharp increase in cryptocurrency trading activity on centralized exchanges, indicating a very bullish mindset.

According to 10x Research, the present market is experiencing sustained high volumes over several days in a row, in contrast to the March speculative frenzy, which saw a single-day retail trading peak of $16.2 billion in Korea.

This points to a stronger and longer-term trading interest.

Additionally, with over $130 billion in trade volumes last week, MicroStrategy is generating significant activity in the Bitcoin industrial complex.

The company raised $3 billion last week through convertible notes, and market analysts anticipate buying another $3 billion worth of Bitcoin on Monday.

GameFi and Metaverse tokens have led the surge as Bitcoin and the rest of the cryptocurrency market enter a period of consolidation.