Despite poor price action, Bitcoin whales and sharks are steadily accumulating, adding 154,560 BTC in five months, suggesting potential price increases soon.

Despite the poor price action, BTC sharks and whales are steadily accumulating the flagship cryptocurrency. These investment types have boosted their BTC holdings within the past five months. This encourages the Bitcoin ecosystem and may soon impact the cryptocurrency’s price.

Within the last five months, investors in Bitcoin have purchased 154,560 BTC.

In an X (formerly Twitter) post, on-chain analytics provider Santiment disclosed that BTC wallets with at least 10 BTC had added 154,560 more BTC over the previous five months. According to the company, this purchase is noteworthy because it is one of “crypto’s top leading indicators” for optimistic signals for the flagship cryptocurrency.

Santiment added that as these BTC wallets fill up, cryptocurrencies increase in value, and when they sell off their holdings, a protracted down market ensues. Given that these Bitcoin investors are actively growing their holdings, it is possible that Bitcoin and other cryptocurrency tokens could climb shortly.

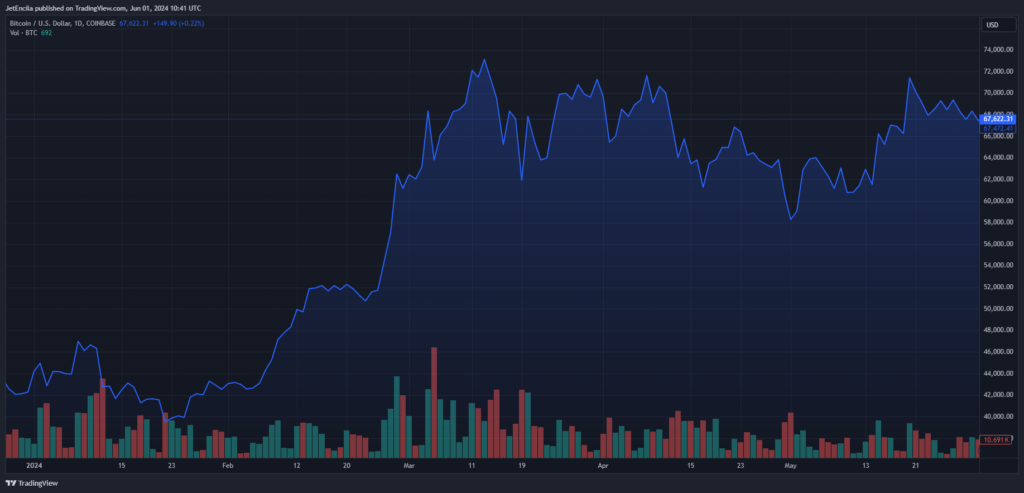

Since their purchases have the potential to cause a substantial increase in the price of BTC, these whales are typically recognized to have a significant effect on the market. As the on-chain analytics tool Glassnode said, BTC has failed to hold above $70,000 since there isn’t enough demand for the flagship cryptocurrency. As such, maintaining this accumulation tendency is imperative.

Therefore, if they can maintain this accumulation pattern, these Bitcoin investors may contribute to increasing the demand for BTC. As this occurs, Bitcoin will eventually achieve a successful breakout above $70,000.

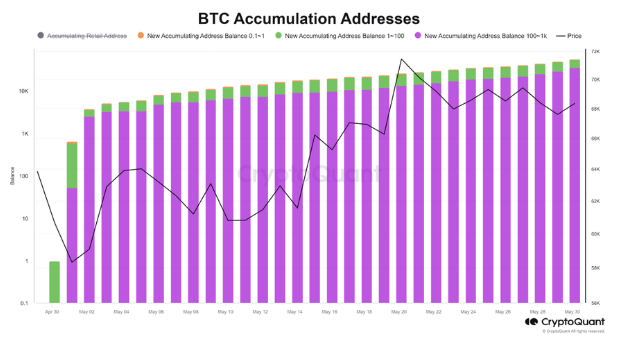

Recently, the on-chain analytics platform CryptoQuant has also given an optimistic prediction for the price of BTC. The platform’s market study revealed a noteworthy rise in the quantity of newly registered BTC accumulation addresses despite the primary cryptocurrency failing to witness a substantial boost in value in the previous month.

Bitcoin Has Not Reached Its Maximum

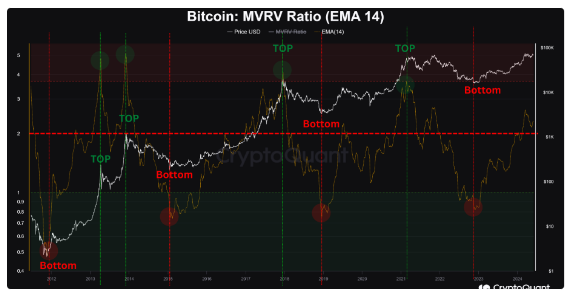

Tarekonchain, a cryptocurrency analyst, stated in a different blog post on the CryptoQuant website that BTC is still far from its peak. The MVRV (market value to realized value) indicator, which the analyst said provides a “highly accurate alert for Bitcoin price tops and bottoms,” was the foundation for his claim.

As per Tarekonchain, the MVRV number below 2 signifies a continuous accumulation zone, implying that the current value of Bitcoin remains low. He said BTC only starts its ascent to a new peak when the MVRV value rises above 2. He disclosed that the MVRV value is at 2.3, meaning that a substantial price increase for Bitcoin is still possible until it approaches its fair value.

The fact that the MVRV indicator hit a value of 3.5 or higher in previous cycles is evidence that the price of the most popular cryptocurrency is still far from peaking in this bull run. According to Tarekonchain, BTC might still reach a new peak during this cycle and even surpass $100,000.