For the second quarter of 2024, cryptocurrency exchange Bitget announced a $700 million capital inflow and increased website traffic.

The exchange highlighted a $700 million capital influx for the quarter by reporting that its BTC, USDT, and ETH holdings increased by at least 70%.

According to the corporation, Q2 saw a 50% rise in traffic from the previous quarter, with 10 million monthly visitors. In addition, the exchange reported 2.9 million additional users and a 10% rise in spot trading market volume above Q1 figures.

The exchange disclosed an increase in funds as well. The corporation reported a minimum 70% gain in its holdings of Bitcoin BTC$58,458, Tether USDT$1.00, and Ether ETH$3,138. Holdings of BTC rose by 73%, while those of USDT and ETH surged by 80% and 153%, respectively. According to Bitget, this corresponds to a roughly $700 million capital inflow.

Bitget collaborations and the new ecosystem fund

Bitget teamed up with three Turkish national athletes in the second quarter of 2024: lkin Aydın, a volleyball player, boxer Samet Gümüş, and wrestler Buse Tosun Çavuşoğlu. This collaboration is a component of the business’s promotion featuring football icon Lionel Messi.

The CEO of Bitget, Gracy Chen, expressed gratitude to the community and stated that they will keep developing for Web3’s future. Chen stated:

“Q2 2024 has been a pivotal period for Bitget. Our collaboration with Turkish athletes along with significant growth in users and website traffic is a part of our global expansion.”

In the second quarter, Bitget and the Singaporean investment firm Foresight Ventures jointly opened a $20 million ecosystem fund. This fund aims to expedite the development of the TON ecosystem and support early-stage projects on The Open Network (TON).

The proof-of-reserve ratios are not altered.

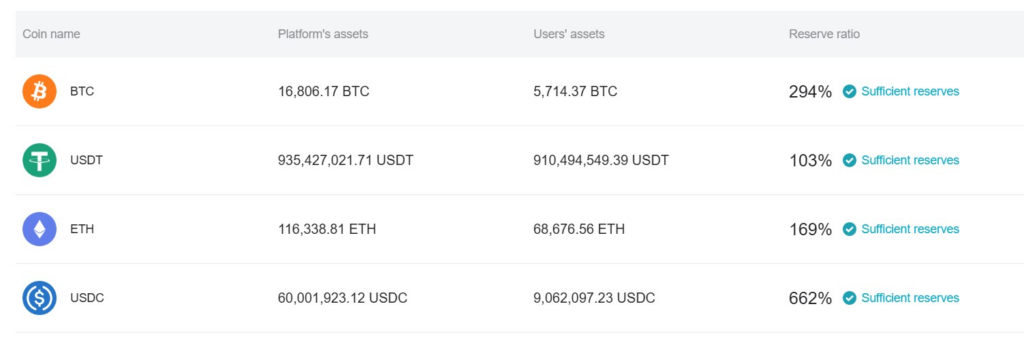

The exchange further stated that its key assets have ratios above 100% in its proof-of-reserves (PoR) report. According to the company’s website, it has more than 100% of cryptocurrencies compared to user funds.

The business also disclosed that the value of its protection fund exceeds $420 million. According to the corporation, this gives its users more security.

To stop deepfake scammers from completing the quarter, the company also teamed up with Sumsub, a Know Your Customer (KYC) verification provider, during the KYC verification procedure at the exchange. The action reacts to the growing number of deepfakes in the cryptocurrency industry.

Researchers from Bitget noted on June 27 that losses resulting from deepfake assaults in the cryptocurrency industry would amount to $25 billion by 2024.