South Korean cryptocurrency exchange Bithumb announced it will scale back its crypto lending services after facing pressure from regulators. The move comes amid concerns from financial authorities regarding the legal uncertainties and potential investor risks associated with the services.

Bithumb, a cryptocurrency exchange, has implemented “substantial reductions” in the scope of its crypto lending services in response to persistent regulatory concerns.

The trading platform has decreased its leverage ratio from x4 to x2, according to the South Korean newspaper Kookmin Ilbo.

It has also reduced its utmost lending cap by 80%, from 1 billion won ($718,298) to a mere 200 million won ($1,436).

The action is a significant reversal for Bithumb, which only introduced the services in July.

Bithumb Crypto Lending Rethink

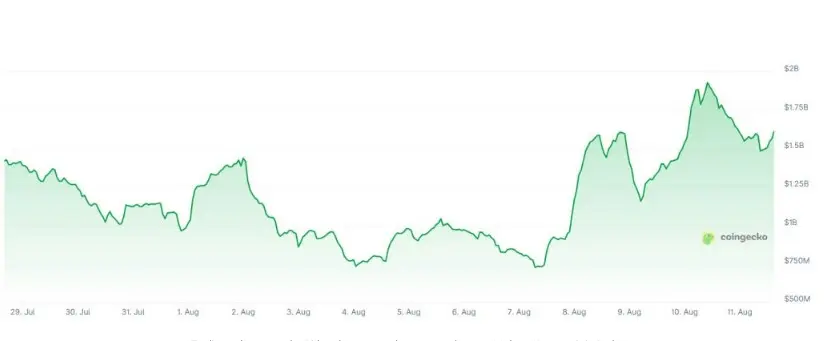

On July 29, Bithumb was also compelled to temporarily suspend crypto lending, citing an “insufficient lending volume.”

The service was reinstituted on August 8. However, a spokesperson for Bithumb was quoted by Kookmin Ilbo as stating:

“After a comprehensive review of the entire service, we have made some adjustments to protect investors and improve the quality of our services.”

The exchange also stated that the new terms would apply to “qualified investors” (those who have accumulated a cumulative trading volume of over 100 billion won over the past three years).

Bithumb did not address regulatory pressure. However, the media outlet concurred that the “measure appears to be in response to criticism from financial authorities, who contend that it is providing excessive leverage in the absence of a clear legal framework.”

Regulators Set to Release Guidelines

The Financial Services Commission (FSC) and Financial Supervisory Service (FSS) convened a hastily organized meeting late last month on behalf of all five fiat-trading crypto exchanges, which resulted in the Bithumb move.

The regulators expressed apprehension regarding the dangers associated with leverage. Additionally, they raised concerns regarding the absence of comprehensive investor protection protocols.

They expressed dissatisfaction with specific services that “provide users with excessive leverage.” The FSC and the FSS concurred that certain platform users are unaware of the concept of crypto lending.

During the service’s outage, Bithumb reportedly reconsidered its operating limits.

Additionally, rival platforms are decreasing their offerings. Upbit has declared that it will exclude Tether (USDT) from its forthcoming crypto lending services.

Kookmin Ilbo further stated that unnamed industry sources anticipate that the FSC and FSS will publish an exhaustive set of guidelines for crypto lending “as early as the end of the month.”

The sources indicated that the regulatory framework would likely incorporate many protocols employed to oversee leveraged investments in the South Korean stock market.

Bithumb initially announced that it would offer lending services for 10 cryptoassets, including Bitcoin (BTC).