BitMine adds 52,475 ETH ($220M) to its treasury, reaching 1,443,923 ETH ($6.61B), reinforcing its lead as top ETH holder.

BitMine, which Tom Lee owns, is again investing in the downturn as Ethereum continues to decline from its 2025 high of approximately $4,500. The most recent acquisition was made just one day after the organization declared itself the second-largest crypto treasury company, primarily due to its over $6.6 billion ETH holdings.

BitMine Increases its Ethereum holdings by $220 million amid Ethereum’s decline

As cited by the on-chain analytics platform Lookonchain, Arkham Intelligence data indicated that BitMine received 52,475 ETH ($220 million) from BitGo’s hot wallet today. Due to this most recent acquisition, the company currently possesses 1.57 million ETH ($6.6 billion).

This is in addition to BitMine’s recent announcement that it has become the second-largest crypto treasury company, surpassing Bitcoin miner MARA Holdings. The company had initiated the decline purchase last week, acquiring $1.7 billion in ETH.

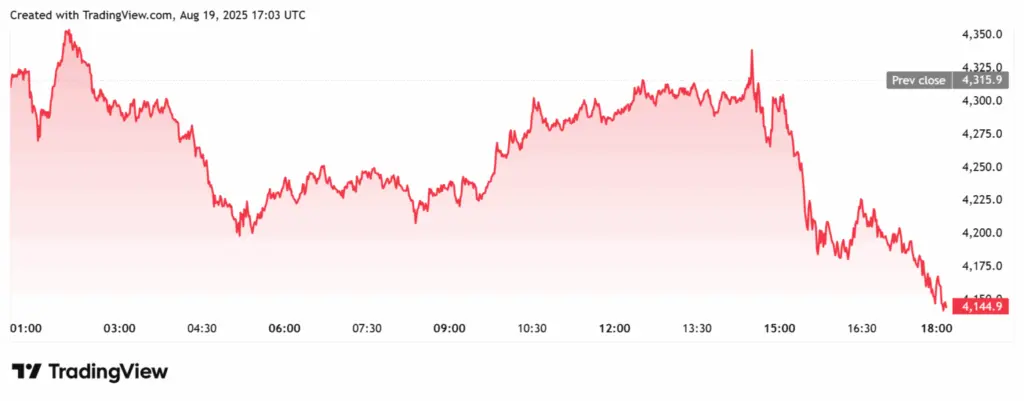

Once more, Tom Lee’s organization is capitalizing on this most recent collapse to accumulate additional ETH at a reduced rate to attain their objective of maintaining 5% of the altcoin’s total supply. The Ethereum price has declined by more than 4% today, according to TradingView data. It is now at risk of retesting the $4,000 psychological level as support.

Tom Lee referenced the Federal Reserve’s Jackson Hole conference in an X post as the cause of the current decline. He alleged that investors are delaying their investments until then in anticipation of the Federal Reserve’s subsequent actions, which will be communicated through Jerome Powell’s speech.

Ethereum and the broader crypto market are also known to be influenced by macro events, such as the Federal Reserve’s decision on monetary policies, even though Tom Lee’s statement was primarily about equities. Consequently, it is probable that market participants, such as crypto ETF investors, also anticipate the Jackson Hole conference.

Additionally, SharpLink Gaming is purchasing additional Ethereum (ETH)

Shaplink Gaming, the second-largest Ethereum treasury corporation, also purchases additional ETH as the accumulation race intensifies. The company disclosed in a press release that it acquired 143,593 ETH at an average price of $4,648 between August 10 and 17.

It currently maintains a total of 740,760 ETH in its treasury. Since implementing its treasury strategy in June, the organization has accrued 1,388 ETH in staking rewards. SharpLink Gaming’s ETH concentration has increased by 94% since June, currently at 3.87.

In the interim, the organization maintains an amount of $84 million that it has not yet allocated to its Ethereum strategy. It could leverage this market collapse to accumulate additional ETH and reduce its average cost price.

According to the Strategic ETH Reserve data, the Ethereum treasury corporations collectively possess 4.10 million ETH ($17.13 billion). This amounts to just over 5% of the altcoin’s total supply.